S. 2471: 21st Century Mortgage Act of 2025

This bill, known as the 21st Century Mortgage Act of 2025, proposes updates to how mortgage lenders assess risk when borrowers possess digital assets. Specifically, it targets government-sponsored enterprises (GSEs) like the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac). The key points of the bill are outlined below:

Consideration of Digital Assets

- Definition of Digital Assets: The bill defines digital assets as any digital representation of value recorded on a secure distributed ledger, excluding assets that are unique or do not represent ownership in a fungible manner.

- Qualified Custodial Arrangements: It specifies that digital assets must be held under a qualified custodial arrangement, meaning they are managed by a regulated third party or a group of custodians that meet certain legal requirements.

Assessment of Digital Assets in Mortgage Risk

- Inclusion in Reserves: When evaluating risk for single-family mortgage loans, GSEs must allow borrowers to count their holdings in digital assets, as long as these assets are under a qualified custodial arrangement. This can be done without needing to convert the digital assets into U.S. dollars.

- Adjustments for Risk Mitigation: The bill mandates that when assessing digital assets, GSEs must adjust their evaluations for factors such as market volatility, liquidity, and the concentration of digital assets within the overall reserves.

- Periodic Review: The GSEs are required to regularly review and update the methodologies used to assess the risks associated with digital assets.

Approval Process

- Methodology Submission: Any significant changes to the methodologies for assessing digital assets will need to be submitted to the GSEs' boards for approval. Once approved, these changes will also be reviewed by the Director of the Federal Housing Finance Agency.

This bill aims to modernize mortgage risk assessments by incorporating digital assets, reflecting their growing significance in the financial landscape.

Relevant Companies

- FNMA (Federal National Mortgage Association) - As a major GSE, Fannie Mae will need to adapt its mortgage risk assessment practices to include digital assets.

- FMCC (Federal Home Loan Mortgage Corporation) - Freddie Mac will similarly be affected by this legislation, impacting how it evaluates borrowers with digital assets.

This is an AI-generated summary of the bill text. There may be mistakes.

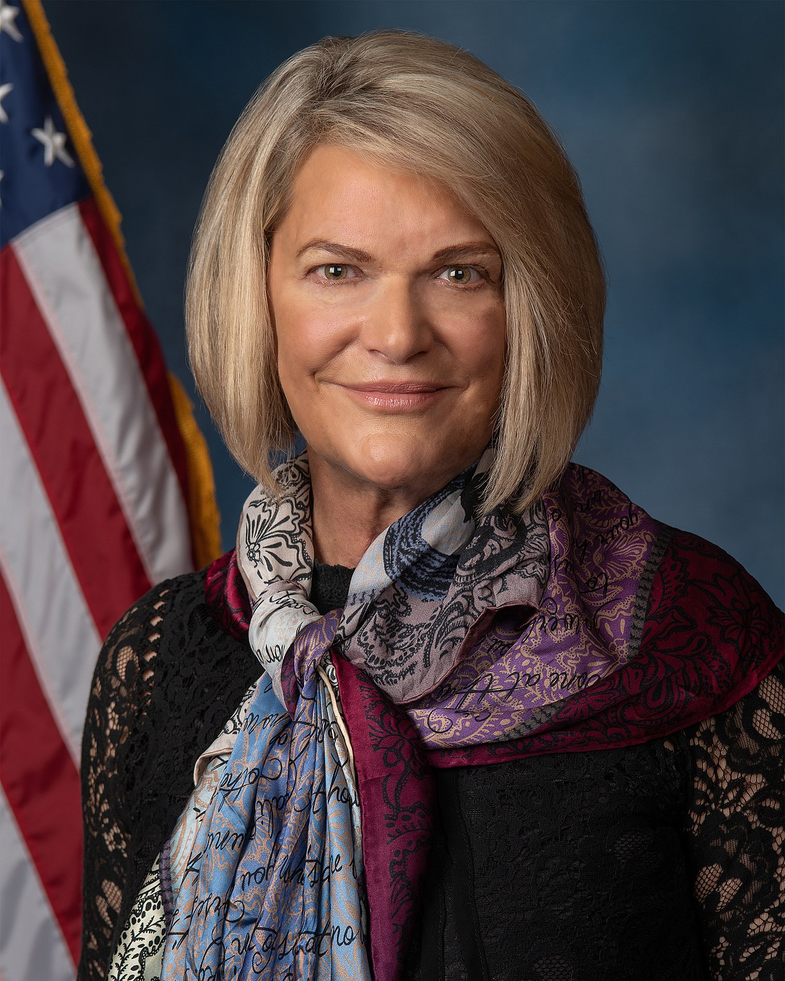

Sponsors

1 sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 28, 2025 | Introduced in Senate |

| Jul. 28, 2025 | Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.