S. 2447: Repealing the Trump Sick Tax Act

This bill, titled the "Repealing the Trump Sick Tax Act," aims to reverse certain changes made to healthcare laws that affect Medicaid and Medicare drug pricing. The main components of the bill include:

Repeal of Medicaid Cost Sharing Changes

The bill seeks to repeal a specific section of a previous law that altered the cost-sharing requirements for Medicaid. This means that the regulations governing how much Medicaid beneficiaries pay for their care would revert to their prior state, as if the changes made by the previous law had never happened. In particular, this would restore the rules that were previously in effect regarding out-of-pocket costs for Medicaid services.

Rescission of Appropriated Funds

The bill also includes a provision to rescind the funds that were allocated under the changes mentioned above. This means that any money that was set aside for the new cost sharing requirements would be returned, effectively negating the financial adjustments made to support those changes.

Repeal of Orphan Drug Exclusion Changes

In addition to the Medicaid provisions, the bill aims to undo changes that were made regarding orphan drugs under the Medicare Drug Price Negotiation Program. Orphan drugs are medications developed specifically to treat rare diseases. The measure, if enacted, would ensure that these drugs are no longer excluded from the price negotiation process that Medicare has in place for pharmaceuticals. Consequently, this would allow these drugs to possibly be included in negotiations to lower costs for beneficiaries.

Implications

The overall intention of the bill is to restore previous healthcare cost-sharing standards and to enable Medicare to negotiate prices for orphan drugs, potentially affecting affordability and access for beneficiaries enrolled in both Medicaid and Medicare.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

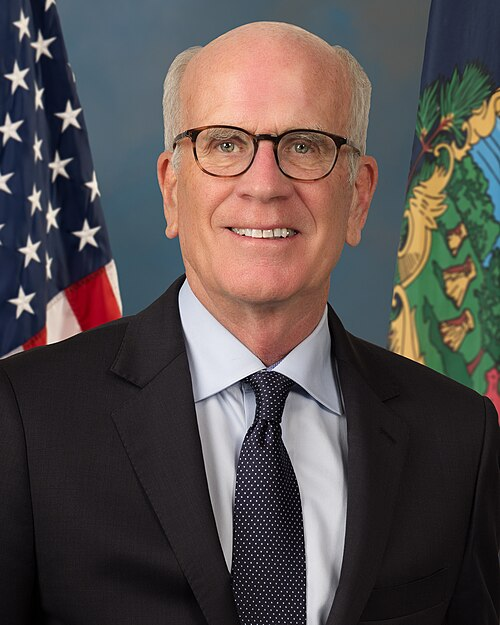

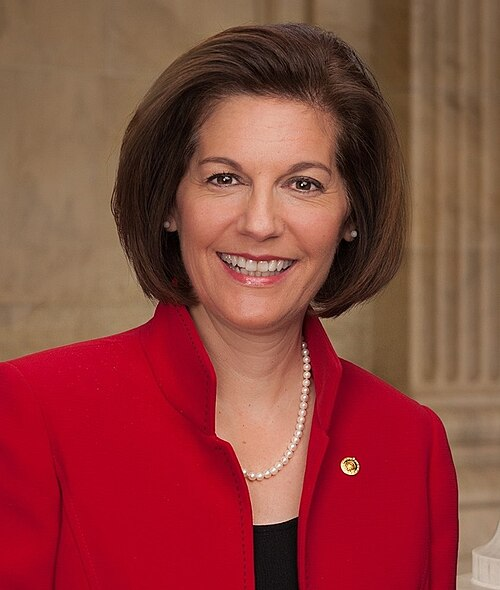

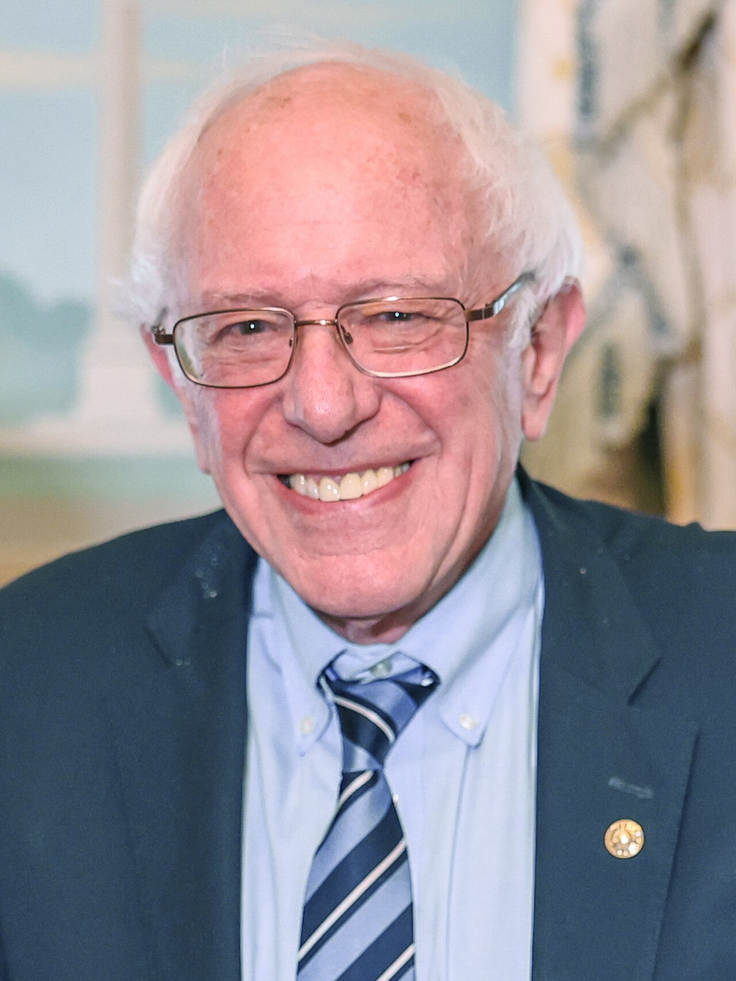

Sponsors

8 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 24, 2025 | Introduced in Senate |

| Jul. 24, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.