S. 2441: Build Now Act of 2025

This legislation, known as the Build Now Act of 2025, aims to modify how community development block grants are allocated to urban areas based on the growth rates of housing units within those areas. Here's a breakdown of its primary components:

Definitions

The bill introduces the following key terms:

- Covered Recipient: A metropolitan city or urban county that receives federal funds.

- Eligible Recipient: A covered recipient that meets specific criteria regarding housing rent, home value, vacancy rates, and disaster declarations.

- Housing Growth Improvement Rate: A measure of the growth in housing units in a jurisdiction compared to its previous growth rate.

- Extremely High-Growth Recipient: An eligible recipient with a housing growth improvement rate of 4% or more.

Adjustments to Allocation of Funds

The bill outlines a system for adjusting the allocation of community development block grant funds based on housing growth improvement rates:

- If an eligible recipient's growth rate is at or above the median for similar recipients, or if it is an extremely high-growth recipient, it will receive extra funding.

- If an eligible recipient's growth rate is below the median, its funding will be reduced by 10%.

Calculation of Housing Units

To determine the number of housing units in a jurisdiction, the Secretary of Housing and Urban Development will:

- Use census data and address files as required.

- Make calculations at the block level based on the most current jurisdiction boundaries.

Annual Reporting

Before allocating funds each year, the Secretary is required to publish a report that includes:

- The housing growth improvement rates for all eligible recipients.

- A list of recipients that received additional funds or had their funding decreased.

Notification and Implementation

The Secretary must notify eligible recipients of their growth rates within 60 days of the bill's enactment and provide guidance on best practices for increasing housing supply. The new allocation adjustments will take effect starting the second full fiscal year after the bill is enacted, continuing through fiscal year 2042.

Relevant Companies

- DHI (D.R. Horton Inc.): As one of the largest homebuilders in the U.S., changes in government funding for housing development could affect DHI's business operations and growth opportunities.

- TOL (Toll Brothers Inc.): This luxury homebuilder may see an impact on market demand and project viability in areas influenced by the funding adjustments from the bill.

- PHM (PulteGroup Inc.): Shifts in community development block grant allocations could influence PulteGroup's project pipelines and regional operations.

This is an AI-generated summary of the bill text. There may be mistakes.

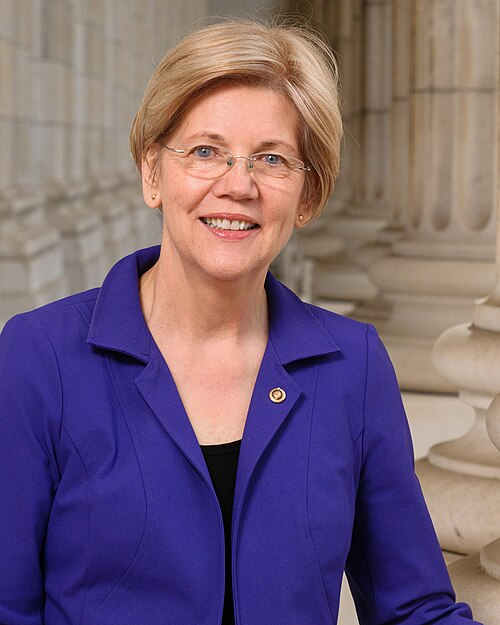

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 24, 2025 | Introduced in Senate |

| Jul. 24, 2025 | Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.