S. 2429: Stop the Scammers Act

The "Stop the Scammers Act" is intended to enhance the resources and capabilities of the Consumer Financial Protection Bureau (CFPB) in order to better serve consumers and protect them from malpractice in financial products and services. Here are its main components:

Whistleblower Incentives and Protection

The bill introduces measures to encourage individuals (whistleblowers) to report violations of consumer financial laws by providing them with financial rewards and protections. Key elements include:

- Definition of Whistleblower: A whistleblower is defined as someone who provides original information that reveals a violation of federal consumer financial laws.

- Awards for Whistleblowers: Whistleblowers could receive between 10% and 30% of the civil money penalties collected in actions resulting from their information. If the penalties are below $1 million, a minimum award can be set at $50,000.

- Discretion in Award Amounts: The CFPB will have discretion in determining specific award amounts based on the significance of the information, assistance provided, and other relevant factors.

- Confidentiality Protection: The identity of whistleblowers will generally be kept confidential to encourage reporting without fear of retaliation.

- Requirements for Claims: Whistleblowers must meet specific requirements to be eligible for awards, including not having been involved in the misconduct they report.

Consumer Financial Civil Penalty Fund

The bill amends the existing Consumer Financial Civil Penalty Fund to allocate resources for the awards granted to whistleblowers, supporting the enforcement actions taken by the CFPB.

Funding Cap Increases

The legislation increases the funding cap for the CFPB from 6.5% to 12%. This is intended to ensure the Bureau has adequate resources to perform its functions and respond to consumer needs effectively.

Reporting and Accountability

The CFPB will be required to report annually to Congress detailing the whistleblower awards granted and the types of cases involved. This aims to promote transparency and accountability regarding the support provided to whistleblowers.

Rulemaking Authority

The CFPB is granted the authority to create rules and regulations necessary to implement the provisions of this bill effectively. This will help ensure that the processes regarding whistleblower claims and protections are clear and enforceable.

Protection from Retaliation

The bill reinforces protections for whistleblowers against retaliation. Whistleblower rights and remedies are maintained, and agreements that may limit these rights (such as predispute arbitration agreements) cannot overrule the provisions of this act.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

25 bill sponsors

-

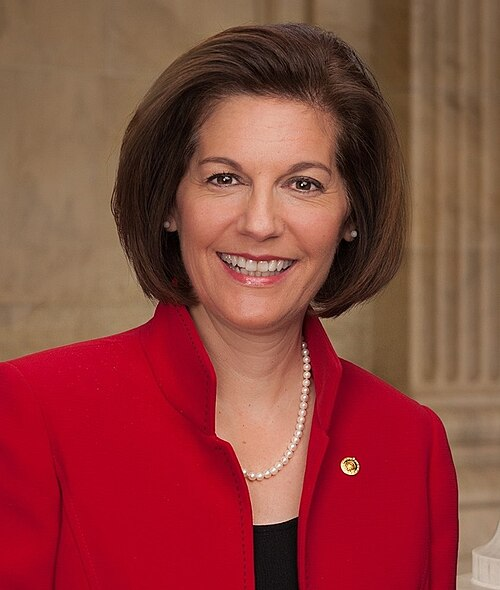

TrackCatherine Cortez Masto

Sponsor

-

TrackAngela Alsobrooks

Co-Sponsor

-

TrackRichard Blumenthal

Co-Sponsor

-

TrackLisa Blunt Rochester

Co-Sponsor

-

TrackCory A. Booker

Co-Sponsor

-

TrackRichard J. Durbin

Co-Sponsor

-

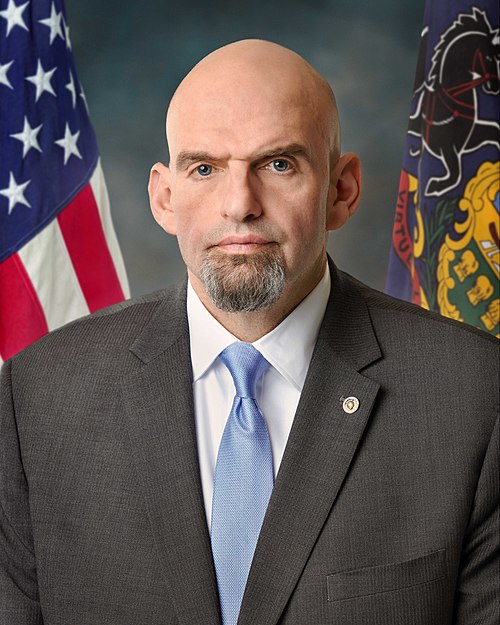

TrackJohn Fetterman

Co-Sponsor

-

TrackRuben Gallego

Co-Sponsor

-

TrackKirsten E. Gillibrand

Co-Sponsor

-

TrackJohn W. Hickenlooper

Co-Sponsor

-

TrackAndy Kim

Co-Sponsor

-

TrackAmy Klobuchar

Co-Sponsor

-

TrackBen Ray Lujan

Co-Sponsor

-

TrackJeff Merkley

Co-Sponsor

-

TrackJack Reed

Co-Sponsor

-

TrackJacky Rosen

Co-Sponsor

-

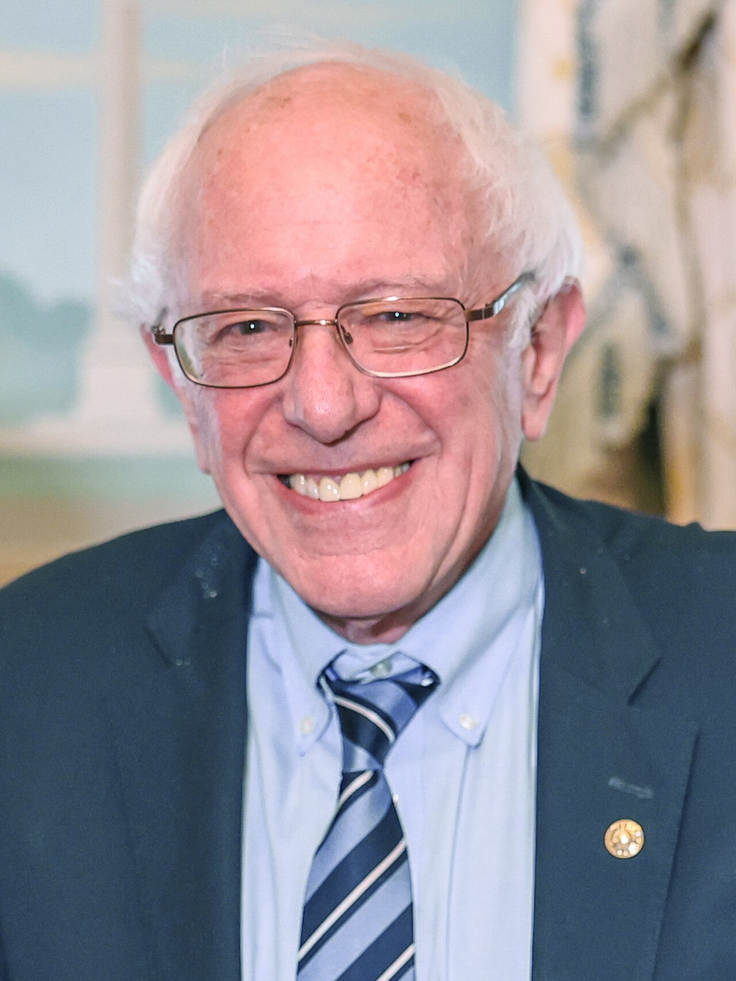

TrackBernard Sanders

Co-Sponsor

-

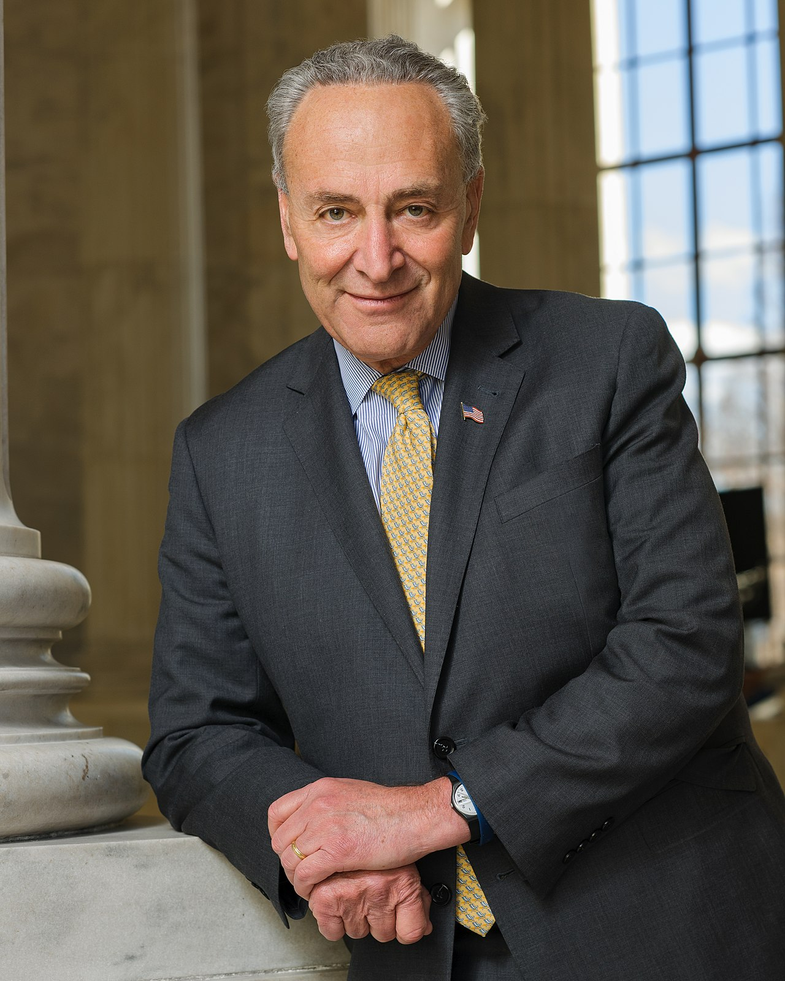

TrackCharles E. Schumer

Co-Sponsor

-

TrackTina Smith

Co-Sponsor

-

TrackChris Van Hollen

Co-Sponsor

-

TrackMark R. Warner

Co-Sponsor

-

TrackRaphael G. Warnock

Co-Sponsor

-

TrackElizabeth Warren

Co-Sponsor

-

TrackPeter Welch

Co-Sponsor

-

TrackSheldon Whitehouse

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 24, 2025 | Introduced in Senate |

| Jul. 24, 2025 | Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.