S. 2419: Business of Insurance Regulatory Reform Act of 2025

The Business of Insurance Regulatory Reform Act of 2025 aims to amend the Consumer Financial Protection Act of 2010, focusing on the relationship between the Bureau of Consumer Financial Protection (BCFP) and entities regulated by state insurance regulators. The key points include:

Clarification of Authority

The bill seeks to clarify the authority of the BCFP concerning persons or entities that are regulated by state insurance regulators. The amendment includes the following provisions:

- The term "Description of activities" in the existing law is changed to "Exceptions." This indicates a shift in focus about what activities are regulated.

- The BCFP will have limited enforcement authority over entities engaged in insurance-related activities. If these entities are offering consumer financial products or services, the BCFP cannot enforce regulations on them, provided they are operating within the framework of insurance.

- If a regulated entity is subject to any consumer law—or those laws transferred under specific subtitles—the BCFP's authority to enforce such laws will be narrowly constructed in terms of how it relates to their insurance business.

Support for State Regulators

The bill emphasizes that the enforcement of relevant regulations should favor state insurance regulators' authority. This means that the rights and powers of state regulators are reinforced in the context of overseeing insurance businesses.

Overall Impact

In essence, this legislation aims to reduce federal oversight of insurance companies regarding consumer financial products and services, enhancing the role of state regulators in enforcing insurance-related laws.

Relevant Companies

- AXP (American Express Company) - As a financial services company that provides credit cards and other financial products, it may be affected if they engage in activities related to insurance through partnerships or offerings.

- PRU (Prudential Financial, Inc.) - As a major insurer, Prudential's operations may be directly impacted by changes in regulatory enforcement concerning consumer financial products linked to insurance.

- ZNGA (Zynga Inc.) - Though primarily known for social gaming, any future ventures into financial services or insurance through gaming platforms could intersect with this regulatory framework.

This is an AI-generated summary of the bill text. There may be mistakes.

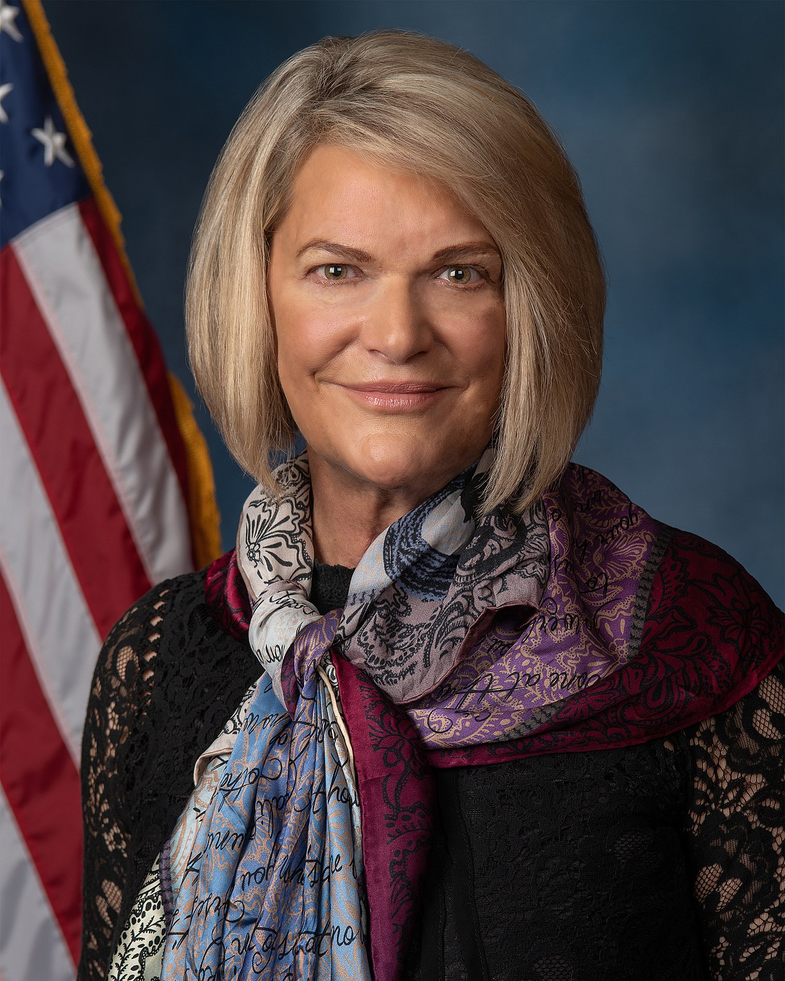

Sponsors

6 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 23, 2025 | Introduced in Senate |

| Jul. 23, 2025 | Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.