S. 2418: Helping with Equal Access to Leave and Investing in Needs for Grieving Mothers and Fathers Act

This bill, titled the Helping with Equal Access to Leave and Investing in Needs for Grieving Mothers and Fathers Act, proposes amendments to the Family and Medical Leave Act (FMLA) of 1993 and the civil service leave provisions to provide specific protections and benefits regarding the loss of an unborn child.

Key Provisions

1. Definition of Spontaneous Loss of an Unborn Child

The bill defines "spontaneous loss of an unborn child" as the loss of a child in the womb that is unplanned and does not result from a purposeful act.

2. Leave Entitlement

Under the amended FMLA:

- Employees will be entitled to take leave for the spontaneous loss of their unborn child or the unborn child of their spouse.

- This leave is considered an additional reason for which an employee may take protected leave under the FMLA.

3. Intermittent or Reduced Leave

The bill allows for leave to be taken intermittently or on a reduced schedule if medically necessary, ensuring flexibility for grieving parents.

4. Paid Leave Substitution

It specifies that employees can use paid leave concurrently with the unpaid leave they are entitled to for the loss of an unborn child.

5. Notice Requirements

Employees must provide reasonable notice to their employers regarding their intent to take leave due to this loss.

6. Certification for Leave

Employers may require certification from a healthcare provider to support the leave request, detailing the circumstances of the loss.

Civil Service Changes

The bill extends similar provisions to federal civil service employees, ensuring they also have access to leave for the spontaneous loss of an unborn child under the same terms as private employees.

Tax Credit for Stillbirth

Moreover, the bill introduces a refundable personal credit for individuals who have experienced a stillbirth. Key points include:

- An eligible individual can claim a credit against their taxes if they have suffered a stillbirth during the taxable year.

- The credit amount is linked to the existing child tax credit amount.

- Eligibility requires a certificate of birth resulting in stillbirth issued under applicable state law.

- Defines stillbirth as the spontaneous death of a child prior to complete delivery.

Effective Date

The changes proposed by this bill would take effect for taxable years starting after the date of enactment.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

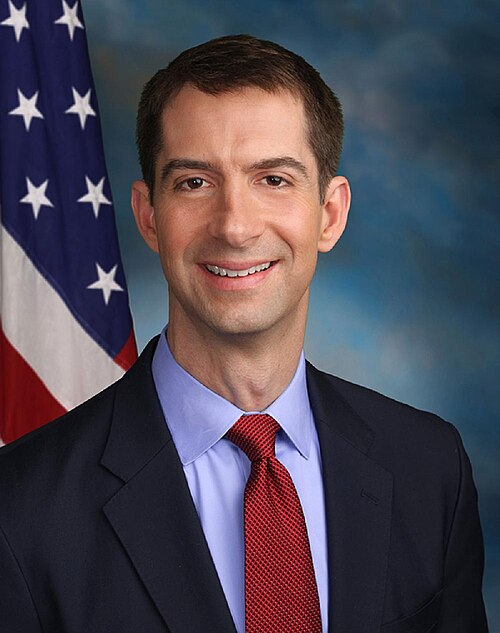

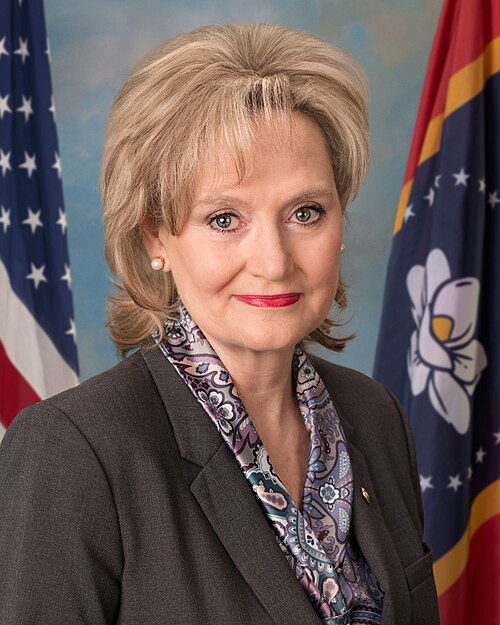

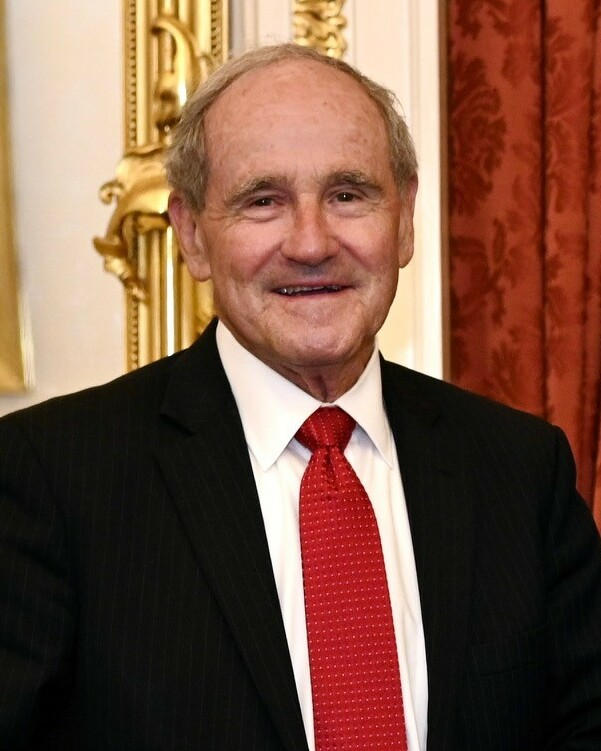

Sponsors

5 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 23, 2025 | Introduced in Senate |

| Jul. 23, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.