S. 2402: First-Time Homebuyer Tax Credit Act of 2025

This bill, titled the First-Time Homebuyer Tax Credit Act of 2025

, aims to provide a tax credit for individuals purchasing their first home in the United States. Here are the main components of the bill explained in simple terms:

First-Time Homebuyer Credit

The bill allows qualifying individuals who are first-time homebuyers of a principal residence to receive a tax credit equal to 10% of the purchase price of the home. This credit can reduce the tax bill for that year.

Credit Limitations

- The maximum amount of the credit is set at $15,000 for most taxpayers.

- For married couples filing separately, the credit is capped at $7,500.

- If multiple non-married individuals buy a home together, the total credit they can claim is still limited to $15,000, and it can be divided among them as they see fit.

Income Phaseouts

The tax credit reduces for individuals whose incomes exceed a certain threshold. If a buyer's modified adjusted gross income is more than 150% of the area's median income, the credit amount decreases gradually, ensuring high-income earners receive less or no credit at all.

Purchase Price Limitations

The credit can also be reduced if the purchase price of the home exceeds 110% of the area's median home price. This means that the government wants to encourage home purchases that are within a reasonable price range for the area.

Inflation Adjustments

For taxable years beginning in 2026 and beyond, the credit limits will increase based on inflation, allowing the maximum amounts to rise to keep up with rising costs.

Eligibility Criteria

To qualify as a first-time homebuyer

, an individual (and their spouse if married) must not have owned a home in the last three years and should not have claimed this credit in previous years.

Exceptions to the Credit

If the homebuyer sells or stops using the residence before the taxable year ends, or if another taxpayer claims a deduction for them for that year, they may not be eligible for the credit. Additionally, they must attach proper documentation when filing taxes to claim the credit.

Reporting Requirements

The bill includes provisions for information reporting to verify eligibility for the credit, which may involve additional documentation requirements for taxpayers claiming the credit.

Recapture of Credit

If a taxpayer who claimed the credit sells the home or it is no longer their principal residence within a set period (four years), the government can require them to repay some of the credit. This repayment amount is calculated based on a percentage of the credit claimed, adjusted for the remaining years in the recapture period.

Election to Transfer Credit

Taxpayers can choose to have their credit applied directly to their mortgage lender instead of taking it themselves. This can help streamline the home-buying process by reducing upfront costs.

Timeline for Implementation

The rules and provisions of this bill would apply to homes purchased after the bill's enactment.

Relevant Companies

- PHM (PulteGroup, Inc.): This homebuilder could see increased sales from first-time buyers utilizing the tax credit to purchase new homes.

- MI (Meritage Homes Corporation): This company could potentially benefit from the increase in first-time home purchases, as the tax credit may encourage more buyers to enter the market.

- LEN (Lennar Corporation): Similar to other homebuilders, Lennar may see a rise in demand for homes as first-time buyers take advantage of the new tax credit.

- TOL (Toll Brothers, Inc.): This luxury homebuilder might benefit from first-time homebuyers looking for new construction due to the credit's support.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

14 bill sponsors

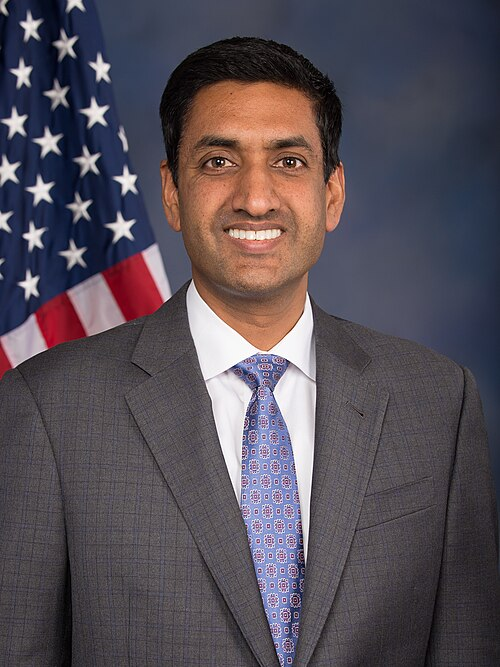

-

TrackSheldon Whitehouse

Sponsor

-

TrackAngela Alsobrooks

Co-Sponsor

-

TrackTammy Baldwin

Co-Sponsor

-

TrackRichard Blumenthal

Co-Sponsor

-

TrackLisa Blunt Rochester

Co-Sponsor

-

TrackRuben Gallego

Co-Sponsor

-

TrackMartin Heinrich

Co-Sponsor

-

TrackAndy Kim

Co-Sponsor

-

TrackBen Ray Lujan

Co-Sponsor

-

TrackJack Reed

Co-Sponsor

-

TrackJacky Rosen

Co-Sponsor

-

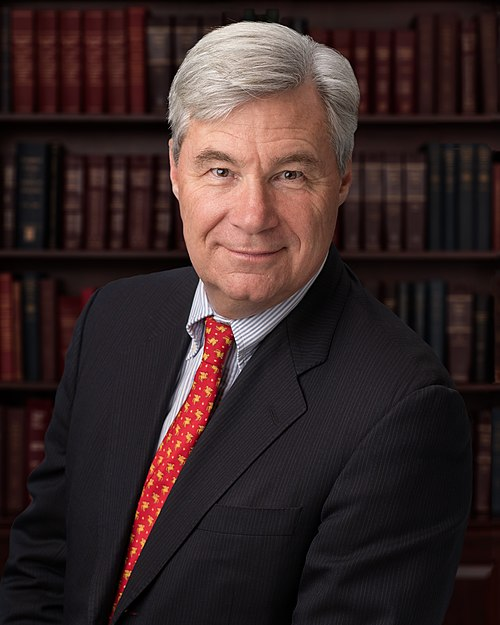

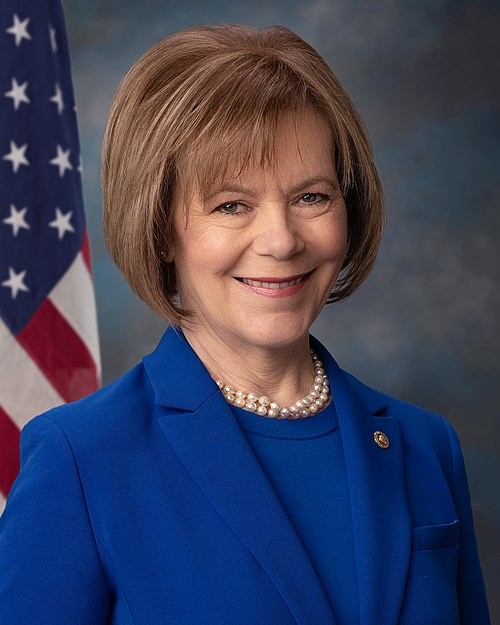

TrackTina Smith

Co-Sponsor

-

TrackChris Van Hollen

Co-Sponsor

-

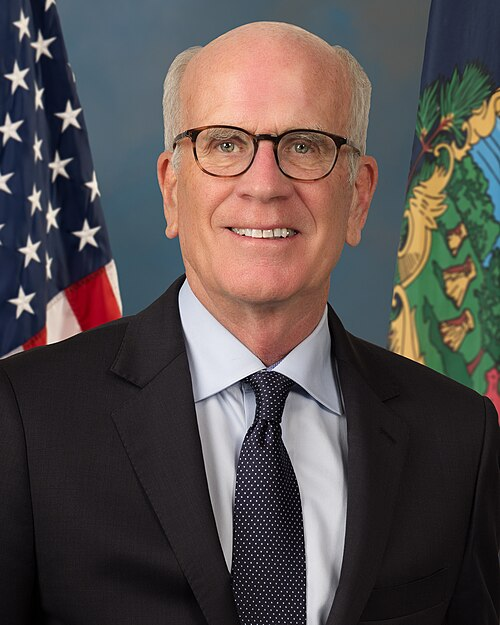

TrackPeter Welch

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 23, 2025 | Introduced in Senate |

| Jul. 23, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.