S. 2384: American Investment Accountability Act

This bill, titled the American Investment Accountability Act, aims to monitor and report on U.S. investments in entities connected to foreign adversaries. Here’s a detailed summary of its main provisions:

Definitions

Key terms are defined in the bill, including:

- Country of concern: This refers to nations that are considered foreign adversaries, such as China, Russia, Iran, North Korea, Cuba, and Venezuela.

- Covered United States business: An U.S.-based corporation or partnership or a foreign company where at least 25% is owned by U.S. citizens, excluding small businesses.

- Covered entity: This includes organizations headquartered in, organized under the laws of, or controlled by a country of concern.

- Direct and portfolio investments: These terms refer to the investment types as defined in existing legislation.

Reporting Requirements

The bill mandates regular reports from various government officials regarding investments:

- Secretary of Commerce: Required to report on the value of direct investments made by U.S. persons in countries of concern and covered entities. This report will be issued within one year of the bill's enactment and every 90 days afterward.

- Secretary of the Treasury: Must report on portfolio investments by U.S. persons in the same categories mentioned above, with the same reporting frequency.

- Securities and Exchange Commission (SEC): Tasked with providing information about U.S. businesses' operations and investments related to covered entities and countries of concern at similar intervals.

Monitor Specific Activities

The SEC's report will cover specific activities such as:

- Spin-offs and joint ventures with covered entities.

- Mergers and acquisitions involving covered entities.

- Investment transactions exceeding certain financial thresholds.

Investment Clarity and Tracking

The Secretary of Commerce and Secretary of the Treasury are required to break down investment data by sector and the U.S. state from where the investment originated, helping to provide a clearer picture of U.S. financial ties to these foreign entities.

Purpose of the Bill

The primary intention behind the American Investment Accountability Act is to ensure transparency and accountability regarding U.S. investments in foreign adversaries. By mandating these reports, the bill seeks to provide Congress with detailed insights into where U.S. funds are directed internationally, specifically focusing on potential risks and impacts associated with investing in entities abroad, especially those controlled by nations deemed as adversarial to the U.S.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

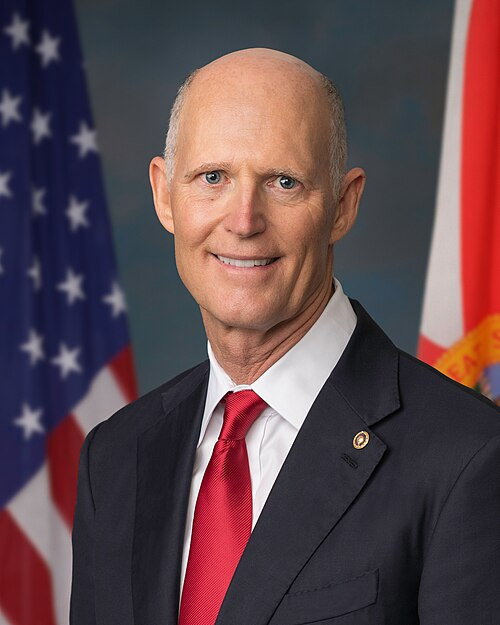

Sponsors

1 sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 22, 2025 | Introduced in Senate |

| Jul. 22, 2025 | Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.