S. 2362: Ending Lending to China Act of 2025

This bill, titled the "Ending Lending to China Act of 2025," primarily aims to stop the provision of financial assistance to the People's Republic of China (PRC) from multilateral development banks. Here is a detailed breakdown of the bill's provisions:

Short Title

The bill is formally referenced as the "Ending Lending to China Act of 2025."

Findings

The bill includes several findings that highlight the economic status of China and its role in global lending:

- The PRC is the second largest economy in the world and a significant global lender.

- As of April 2025, China had foreign exchange reserves exceeding $3 trillion.

- The World Bank considers China to be an upper-middle-income country.

- In 2021, China's government announced the eradication of extreme poverty within its borders.

- China leverages state resources to support financial institutions like the Asian Infrastructure Investment Bank and the New Development Bank.

- China is identified as the world's largest official creditor.

- Countries can borrow from multilateral development banks until they can independently manage long-term development.

- The World Bank reviews and graduates countries out of eligibility after they surpass a certain income threshold.

- China crossed this threshold in 2016.

- Since 2016, the International Bank for Reconstruction and Development has approved nearly $13 billion in loans to China.

- In 2024, the Asian Development Bank also provided loans and assistance exceeding $900 million to China.

Statement of Policy

The bill states that it is the official policy of the United States to oppose any new lending to China from these multilateral development banks. This opposition arises from China's successful attainment of income levels that qualify it to no longer receive assistance from these institutions.

Opposition to Lending

The Secretary of the Treasury is directed to instruct the U.S. Executive Director at each multilateral development bank to:

- Oppose any loan or financial assistance to China from these banks.

- End lending and assistance to any countries that have surpassed the designated income level for eligibility.

Reporting Requirements

Within one year of the bill's enactment and annually thereafter, the Secretary of the Treasury must submit a report to designated congressional committees that includes:

- An assessment of China's borrowing status from each multilateral development bank.

- A description of China's voting power and representation at these banks.

- A list of countries that have surpassed the income threshold at each bank.

- A list of countries that have graduated from assistance eligibility.

- A comprehensive outline of U.S. efforts to graduate countries from assistance once they exceed eligibility criteria.

Definitions

The bill clarifies that:

- "Appropriate congressional committees" refers to specific Senate and House committees related to Foreign Affairs and Financial Services.

- "Multilateral development banks" are defined according to existing legislation, specifically referencing U.S. laws governing international financial institutions.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

16 bill sponsors

-

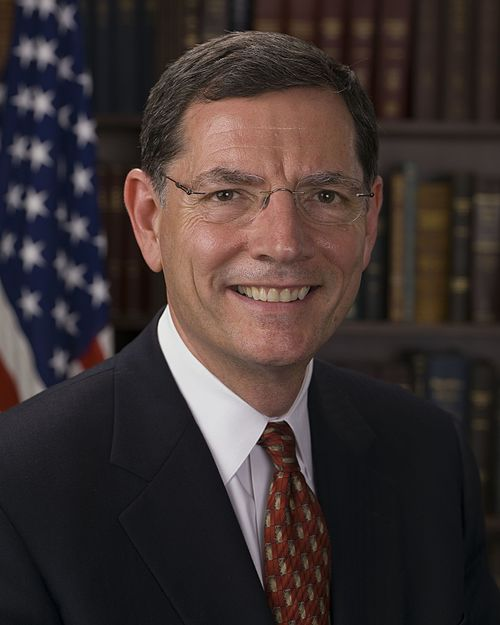

TrackJohn Barrasso

Sponsor

-

TrackMarsha Blackburn

Co-Sponsor

-

TrackTed Budd

Co-Sponsor

-

TrackShelley Moore Capito

Co-Sponsor

-

TrackTed Cruz

Co-Sponsor

-

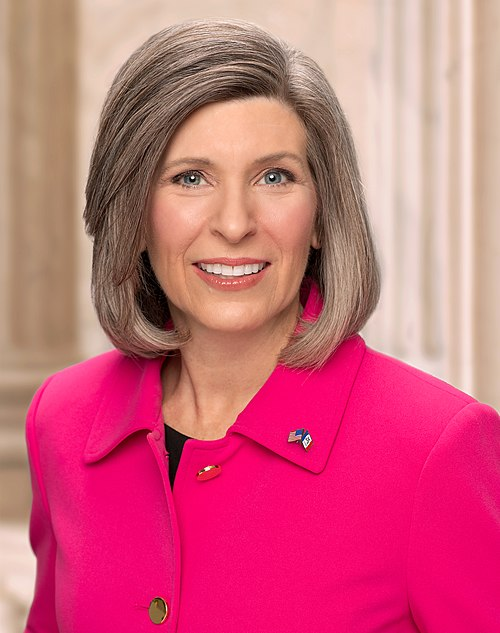

TrackJoni Ernst

Co-Sponsor

-

TrackDeb Fischer

Co-Sponsor

-

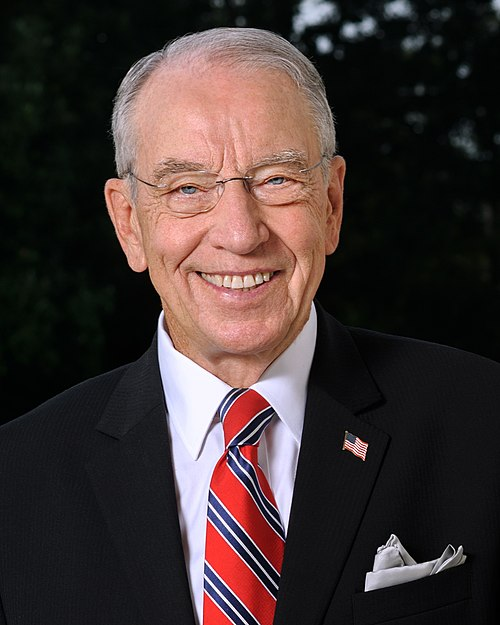

TrackChuck Grassley

Co-Sponsor

-

TrackJosh Hawley

Co-Sponsor

-

TrackMike Lee

Co-Sponsor

-

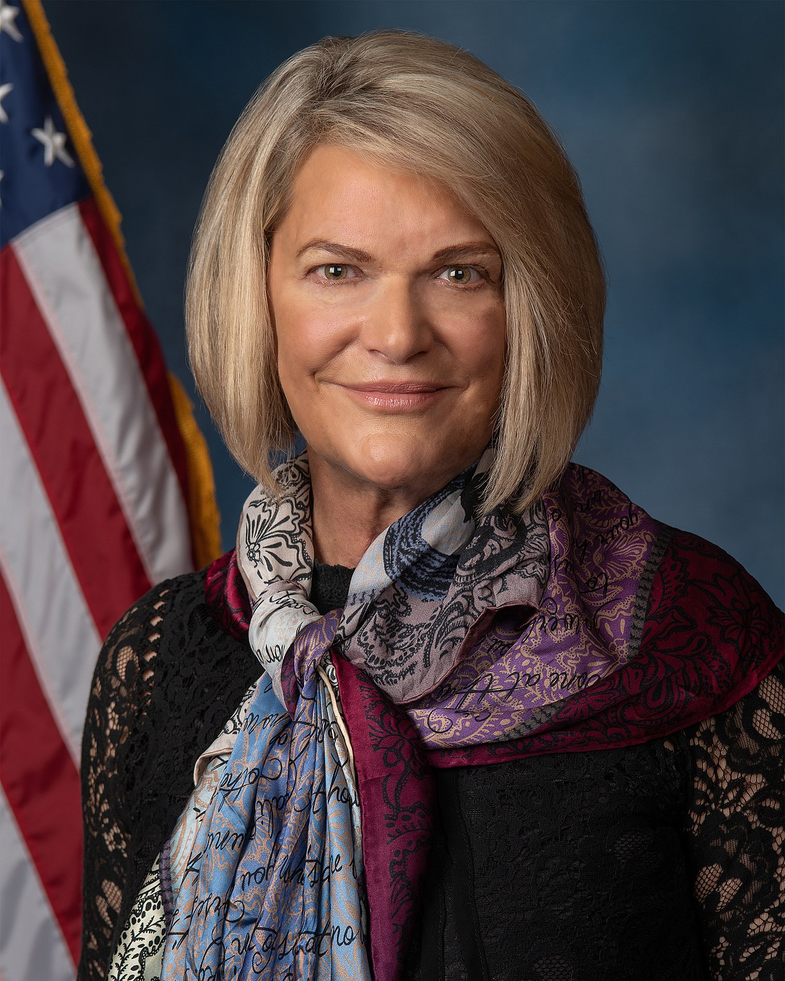

TrackCynthia M. Lummis

Co-Sponsor

-

TrackRoger Marshall

Co-Sponsor

-

TrackPete Ricketts

Co-Sponsor

-

TrackEric Schmitt

Co-Sponsor

-

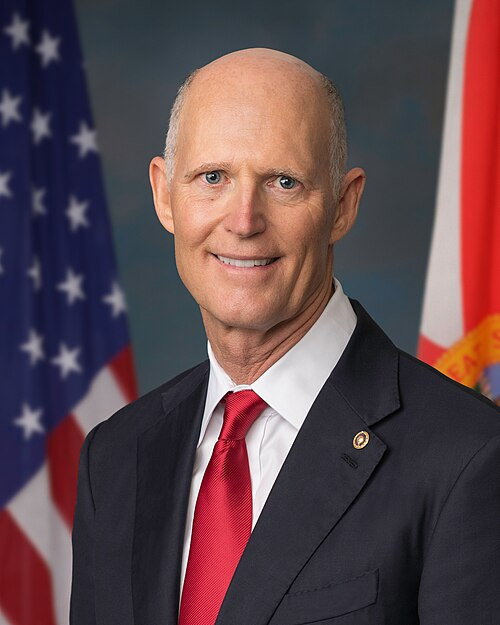

TrackRick Scott

Co-Sponsor

-

TrackThom Tillis

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 21, 2025 | Introduced in Senate |

| Jul. 21, 2025 | Read twice and referred to the Committee on Foreign Relations. (text: CR S4506-4507: 2) |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.