S. 2322: Appraisal Modernization Act

This bill, known as the Appraisal Modernization Act, aims to improve the appraisal process related to mortgage lending by introducing several key measures that enhance transparency and consumer rights. Below is a summary of its main provisions:

Public Appraisal Database

The bill proposes the creation of a public appraisal database that will collect and share residential real estate appraisal data. This database intends to ensure that financial institutions and valuation professionals operate in an efficient and standardized manner for all stakeholders in the housing market, including mortgage loan applicants and borrowers.

- The database will include appraisal data from the Federal National Mortgage Association, Federal Home Loan Mortgage Corporation, and other government agencies, dating back to January 1, 2017.

- Data shared will consist of various identifiers and demographic details related to mortgage applicants, including the race and ethnicity of borrowers.

Searchable Public Database

A publicly accessible online database will be made available, which will contain detailed, searchable appraisal data. This will allow consumers, researchers, and government agencies to review appraisal data more effectively.

- The database is intended to be ready within two years of the enactment of this bill, with quarterly updates afterwards.

Consumer Right to Reconsideration

The bill grants consumers the right to request a reconsideration of an appraisal's value or to request a subsequent appraisal if they believe the initial appraisal is flawed or biased.

- Creditors must have clearly defined procedures for consumers to initiate this process before loan closure or within 60 days of a credit application denial.

- Consumers will be provided with written notice explaining how to request a reconsideration, including a standardized form for submissions.

Review Process for Appraisals

Creditors are required to perform an appraisal review before delivering the appraisal to the consumer. If deficiencies are identified, creditors must order a second appraisal at their expense and document their findings.

Addressing Discrimination in Appraisals

The bill emphasizes the need for creditors to act if they suspect that an appraisal reflects discrimination. They are required to take specific steps in such situations, including ordering a subsequent appraisal and reporting the findings to relevant agencies.

Data Privacy and Security

The Agency overseeing this database will have the authority to modify data releases to protect consumer privacy, ensuring that any public data sharing does not compromise personal information.

Compliance and Implementation Timeline

Following the bill's enactment, the relevant agencies will have specific timelines to implement these provisions, including issuing rules and guidelines for compliance within a year.

Financial Institutions and Stakeholders Involved

The bill makes provisions for how financial institutions and appraisal companies should align their practices with these new requirements, promoting consistency and fairness within the housing and mortgage markets.

Relevant Companies

- FNMA - Federal National Mortgage Association: May be impacted as it will need to comply with the new data-sharing requirements.

- FHLMC - Federal Home Loan Mortgage Corporation: Similar to FNMA, FHLMC will have to adjust its data management practices to align with the new regulations.

- KEY - KeyCorp: As a lender, KeyCorp may have to modify its appraisal processes and systems to accommodate the legislation's requirements.

- USB - U.S. Bancorp: May also need to revise its lending operations, particularly in its appraisal review processes.

This is an AI-generated summary of the bill text. There may be mistakes.

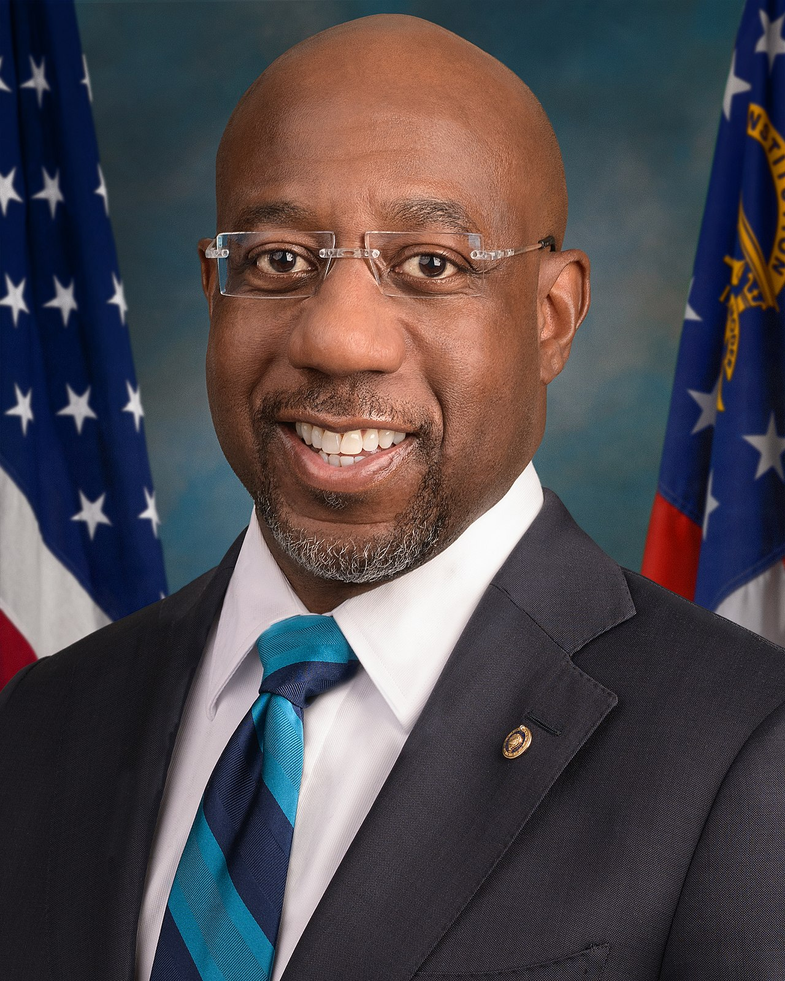

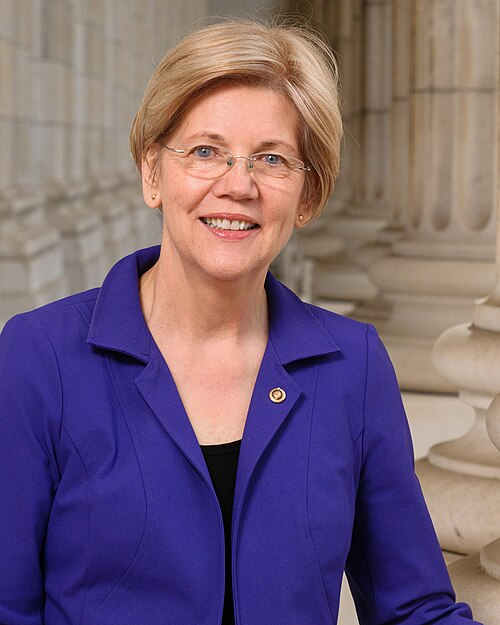

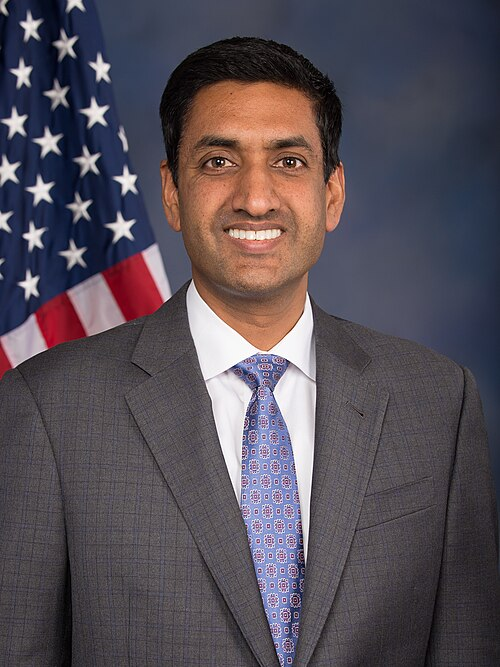

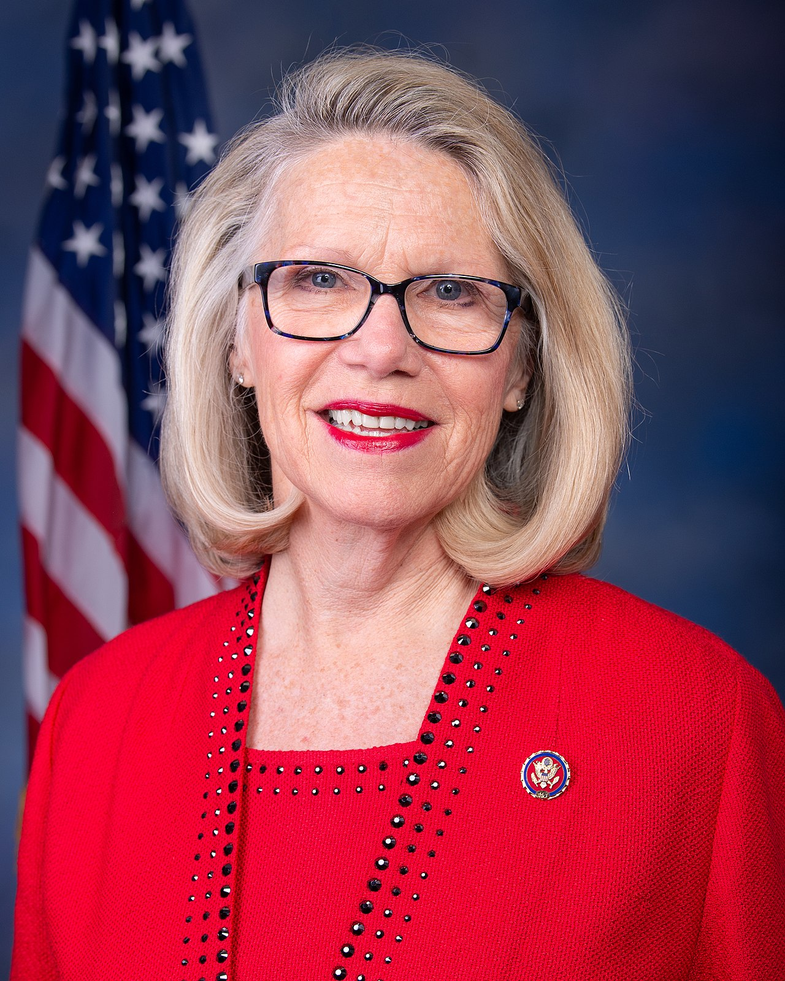

Sponsors

8 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 17, 2025 | Introduced in Senate |

| Jul. 17, 2025 | Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.