S. 2321: Price Gouging Prevention Act of 2025

This bill, titled the Price Gouging Prevention Act of 2025, aims to combat price gouging in the United States. It establishes legal standards regarding excessive pricing of goods and services, particularly during emergencies or unusual market disruptions. Below is a summary of the key provisions and objectives of the bill.

Key Provisions

The bill includes various provisions addressing definitions, enforcement, and the mechanisms for preventing price gouging during exceptional market shocks.

Definitions

- Commission: Refers to the Federal Trade Commission (FTC).

- Exceptional Market Shock: This term defines significant market disruptions due to reasons such as natural disasters, wars, public health emergencies, or national emergencies that affect supply and demand for essential goods or services.

- Good or Service: Any item or service offered in commerce.

Prohibition of Price Gouging

The bill prohibits selling or offering a good or service at a "grossly excessive price," which it will define further. Key aspects include:

- Any entity that sells goods or services must refrain from drastically increasing prices regardless of its position in the supply chain.

- Small businesses (those earning less than $100,000,000 in gross revenue) may defend themselves against accusations of price gouging if they can prove the price increase is directly related to unavoidable increased costs.

Presumptive Violations

The bill establishes a presumption that a business is violating the price gouging prohibition if it raises prices significantly during an exceptional market shock unless it can prove the price increase is due to factors beyond its control.

Enforcement

The Federal Trade Commission will have expanded authority to enforce the provisions of this act. Actions they can take include:

- Issuing civil penalties for violations, which may vary based on whether the entity has "unfair leverage" in the market.

- Bringing civil actions to stop further violations and seek damages for affected consumers.

State Enforcement

State attorneys general are also given the authority to enforce these regulations. They can bring civil actions if they believe price gouging is occurring, in addition to their rights to act under state law.

Disclosure in SEC Filings

Companies classified as "covered issuers" during periods of exceptional market shocks must include specific disclosures in their filings. This includes reporting on:

- Changes in sales volume and average sales price.

- Gross margins and the share of revenue increases related to changes in costs or sales volumes.

- Explanations of pricing strategies and any significant changes that occurred during the covered quarter.

Funding

To implement the bill's provisions, it appropriates $1 billion to the Federal Trade Commission for fiscal year 2025 to aid in its enforcement activities.

Implementation Timeline

The Securities and Exchange Commission (SEC) is required to issue final regulations within 180 days of the bill's enactment to operationalize the disclosure requirements.

Relevant Companies

None found.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

10 bill sponsors

-

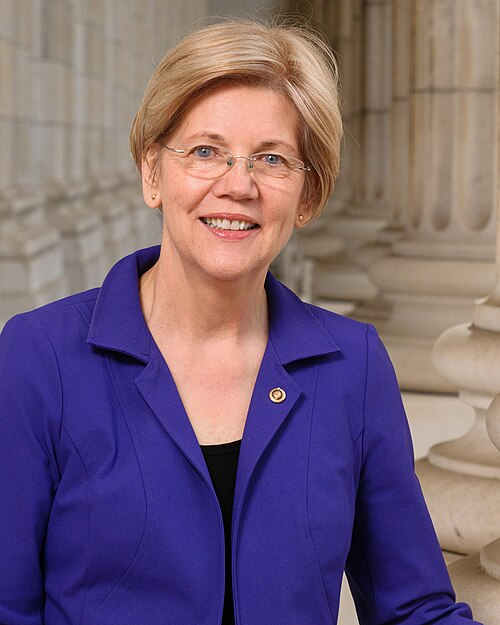

TrackElizabeth Warren

Sponsor

-

TrackTammy Baldwin

Co-Sponsor

-

TrackRichard Blumenthal

Co-Sponsor

-

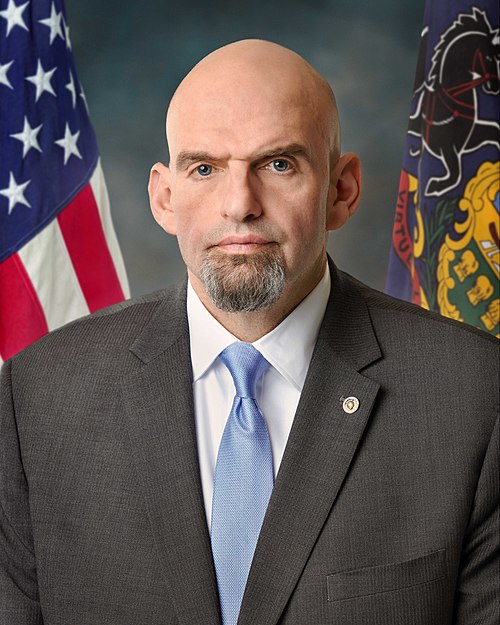

TrackJohn Fetterman

Co-Sponsor

-

TrackAndy Kim

Co-Sponsor

-

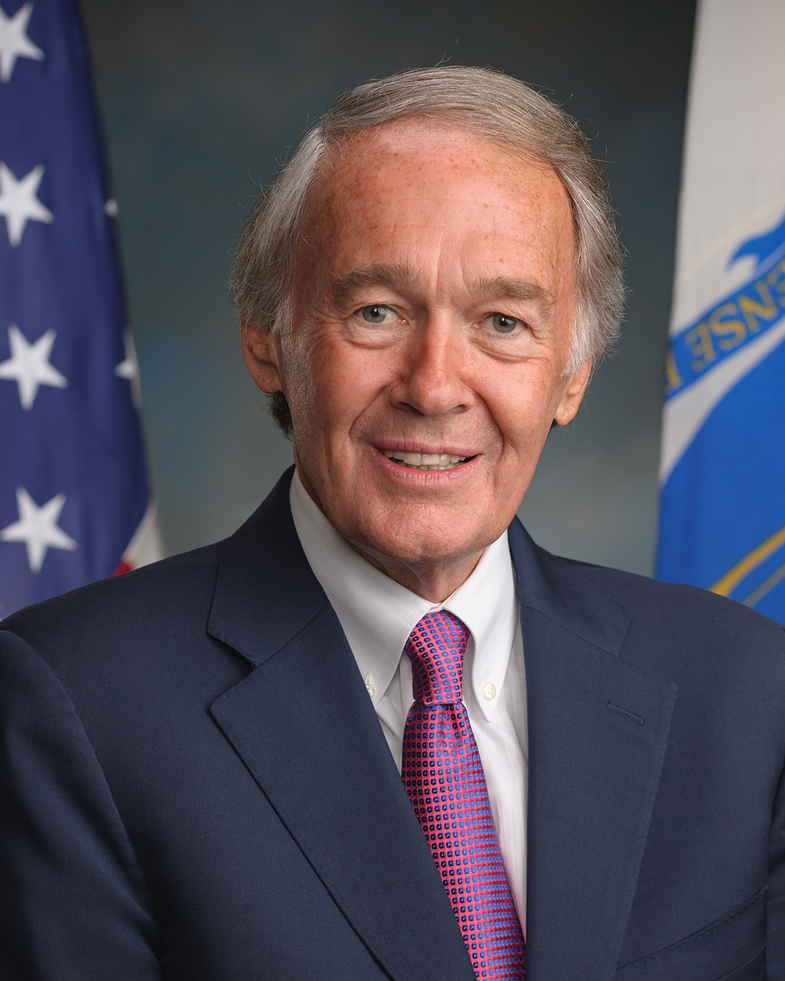

TrackEdward J. Markey

Co-Sponsor

-

TrackJeff Merkley

Co-Sponsor

-

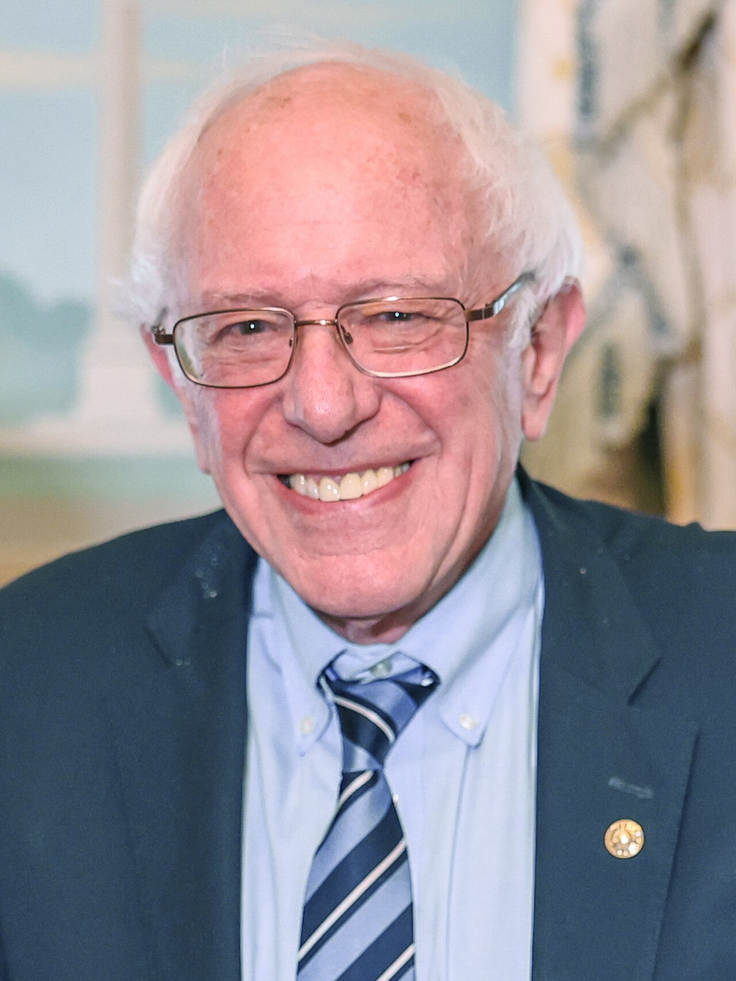

TrackBernard Sanders

Co-Sponsor

-

TrackElissa Slotkin

Co-Sponsor

-

TrackSheldon Whitehouse

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 17, 2025 | Introduced in Senate |

| Jul. 17, 2025 | Read twice and referred to the Committee on Commerce, Science, and Transportation. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.