S. 2313: Flood Insurance Relief Act

The Flood Insurance Relief Act aims to amend the Internal Revenue Code to provide specific tax benefits related to flood insurance premiums. Here are the main points of the bill:

1. Deduction for Flood Insurance Premiums

The bill introduces a new provision allowing individuals to deduct the cost of flood insurance premiums from their taxable income. This deduction is applicable for premiums paid on insurance related to property owned by the taxpayer and is aimed at helping alleviate financial burdens associated with flooding.

2. Eligibility and Limitations

- The deduction is available to individuals whose adjusted gross income (AGI) does not exceed $200,000. For those filing jointly, the limit is set at $400,000.

- Adjusted gross income is determined following specific adjustments as detailed in various sections of the tax code.

3. Definition of Qualified Flood Insurance Premiums

The term "qualified flood insurance premiums" includes:

- Premiums under the National Flood Insurance Act of 1968.

- Payments for private flood insurance as defined in the Flood Disaster Protection Act of 1973.

- Any federal fees associated with flood insurance policies.

- Specific surcharges outlined in the National Flood Insurance Act.

4. Amendments to the Internal Revenue Code

The Act will make several amendments to the existing Internal Revenue Code, specifically to part VII of subchapter B of chapter 1. These amendments include:

- Redesignating existing sections and adding the new section for flood insurance premiums.

- Inserting the deduction for flood insurance premiums into the list of deductions allowed when determining adjusted gross income.

5. Effective Date

The changes introduced by this bill will take effect for taxable years beginning after its enactment.

Relevant Companies

- ALL (Applied Underwriters Inc.) - May experience changes in demand for flood insurance products and related services if the tax deduction affects consumer purchasing behavior.

- MCY (Mercury General Corporation) - As an insurance company, it could be impacted by changes in the market for flood insurance policies due to the new tax deduction.

This is an AI-generated summary of the bill text. There may be mistakes.

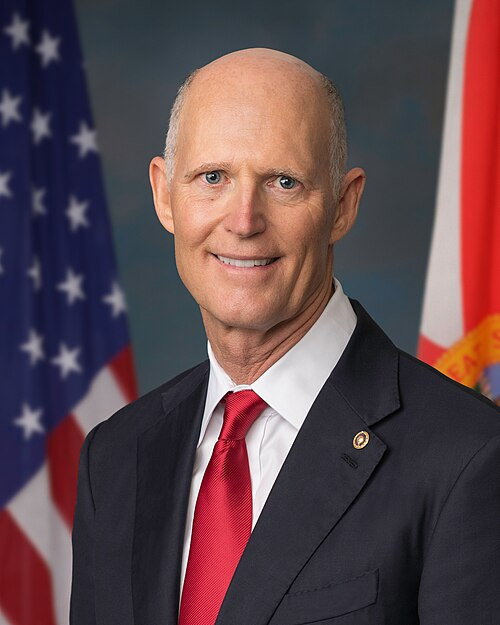

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 16, 2025 | Introduced in Senate |

| Jul. 16, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.