S. 2207: To amend the Internal Revenue Code of 1986 to reform the treatment of digital assets.

This bill aims to amend the Internal Revenue Code to reshape how digital assets are defined and treated for tax purposes. Here’s a breakdown of the key components of the legislation:

Definition of Digital Assets

The bill introduces a formal definition for "digital asset" as any digital representation of value recorded on a secured distributed ledger technology. It specifies that this includes actively traded digital assets (those easily available for trading on exchanges) but excludes certain financial assets unless specified otherwise by the Secretary of the Treasury.

Tax Treatment of Digital Assets

The bill introduces provisions regarding the sale, exchange, or disposition of digital assets:

- Minor gains or losses from these transactions, specifically involving personal purchases, may not be included in gross income unless they involve cash or other digital assets, subject to a threshold of $300.

- Taxpayers must keep accurate records to differentiate between transactions that qualify for this exclusion and those that do not.

- If total gains exceed $5,000 for the taxable year, no further exclusion for minor transactions would apply.

Digital Asset Lending and Tax Implications

The bill clarifies that income from digital asset lending should still be included in gross income, with adjustments to reflect the return of the lent assets. The legislation updates references in tax laws related to the lending of digital assets, thereby reflecting their specific nature in the market.

Wash Sale Rules for Digital Assets

It modifies the existing wash sale rules, which currently disallow loss deductions on certain sales of stocks, to now include digital assets. This means that if you sell a digital asset at a loss and then buy a similar asset back within a stipulated timeframe, the loss deduction could be disallowed.

Mark-to-Market Election

The bill allows dealers and traders in digital assets to elect a mark-to-market accounting method. This means they can recognize gains or losses based on market value at the end of the year, similar to how securities are treated.

Mining and Staking Income Deferral

Under this legislation, individuals who engage in mining or staking digital assets will defer income recognition until they sell or otherwise dispose of the generated assets. This also categorizes such income as ordinary income for tax purposes.

Charitable Contributions of Digital Assets

The bill expands on the charitable contribution rules by allowing for donations of qualified appreciated digital assets, which are defined as actively traded and considered capital gain property. Amendments ensure that similar treatment is given as for other appreciated property when contributed to charities.

Effective Dates and Regulations

The provisions of this bill are to be effective for transactions occurring after December 31, 2025. A series of regulatory guidelines will also be established by the Secretary of the Treasury to implement and clarify these tax treatment changes.

Relevant Companies

- COIN (Coinbase): As a major cryptocurrency exchange, Coinbase will be directly impacted as users may benefit from the tax changes related to minor transaction exclusions and lending practices.

- GBTC (Grayscale Bitcoin Trust): This investment trust may see changes in its operations and tax strategy related to digital assets due to the amendments in how income from these assets is treated.

This is an AI-generated summary of the bill text. There may be mistakes.

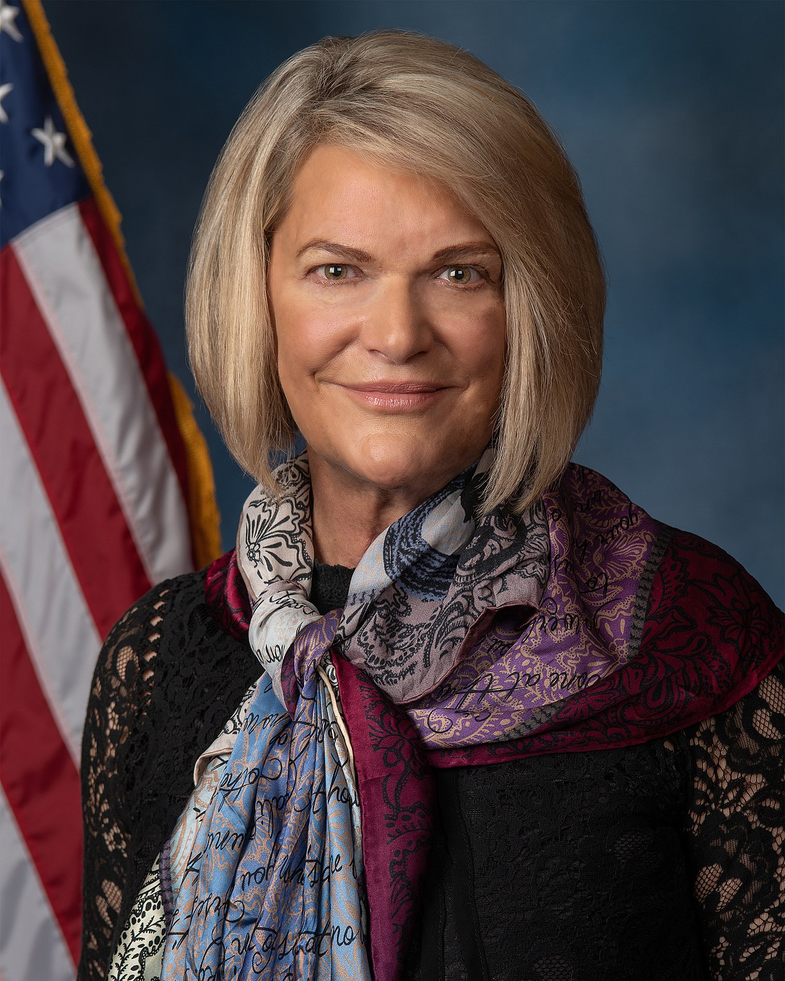

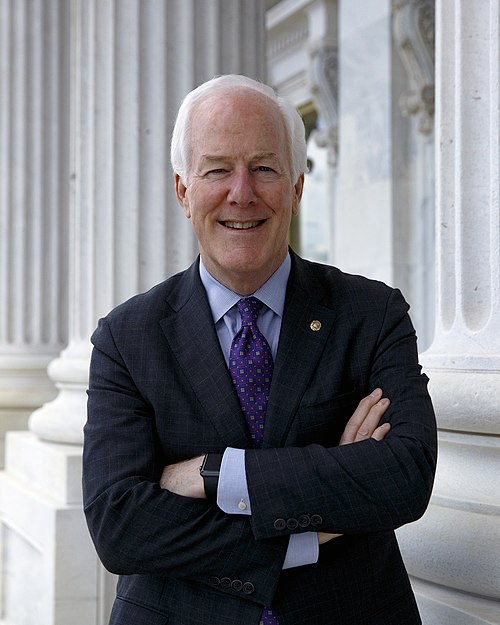

Sponsors

4 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jun. 30, 2025 | Introduced in Senate |

| Jun. 30, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.