S. 2178: Equal Dignity for Married Taxpayers Act of 2025

This bill, titled the Equal Dignity for Married Taxpayers Act of 2025, aims to amend the Internal Revenue Code to ensure that all provisions related to tax laws apply to legally married same-sex couples in the same way as they do to married opposite-sex couples. The main provisions of the bill include the following adjustments:

Clarification of Terminology

The bill proposes to change various terms within the Internal Revenue Code, replacing gender-specific language with gender-neutral language to ensure inclusivity. For example:

- Replace "husband and wife" with "married couple" or "spouses".

- Change references to "his spouse" to "the individual's spouse".

Affected Tax Provisions

The bill affects numerous sections of the current tax code by making these changes:

- Amends sections regarding taxable income, deductions, and tax credits to reflect that all provisions apply equally to all married couples.

- Updates rules on joint returns, allowing for "married couple" terminology instead of "husband and wife".

- Addresses issues surrounding community property laws, confirming that income and property owned by married couples, regardless of gender, will be treated uniformly.

Impact on Filing Status

The bill allows married couples to file joint tax returns, enabling them to benefit from shared tax deductions and credits. It also clarifies that if one spouse passes away, the surviving spouse can still file taxes as a married couple for that year.

Conforming Amendments

Additionally, the bill requires conforming amendments across various sections of the Internal Revenue Code to ensure consistency in language and application. This includes the elimination of references that specify spousal roles based on gender and replacing them with inclusive terms.

Implementation and Compliance

The bill emphasizes that all legally married couples, regardless of sexual orientation, will be treated equally under tax law, which may result in easier navigation of tax-related issues and compliance across the board.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

45 bill sponsors

-

TrackRon Wyden

Sponsor

-

TrackAngela Alsobrooks

Co-Sponsor

-

TrackTammy Baldwin

Co-Sponsor

-

TrackMichael F. Bennet

Co-Sponsor

-

TrackRichard Blumenthal

Co-Sponsor

-

TrackLisa Blunt Rochester

Co-Sponsor

-

TrackCory A. Booker

Co-Sponsor

-

TrackMaria Cantwell

Co-Sponsor

-

TrackSusan M. Collins

Co-Sponsor

-

TrackChristopher A. Coons

Co-Sponsor

-

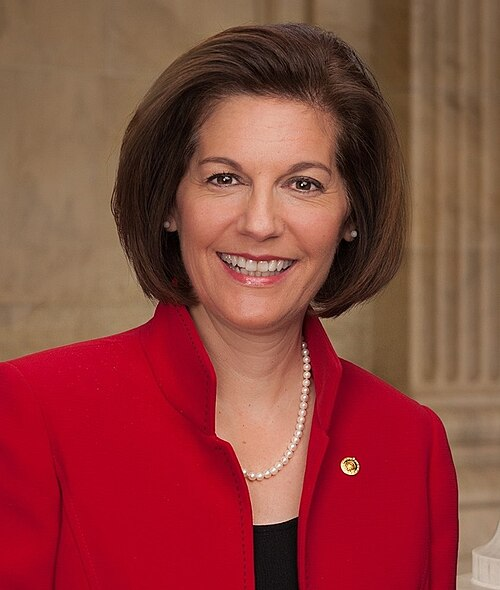

TrackCatherine Cortez Masto

Co-Sponsor

-

TrackTammy Duckworth

Co-Sponsor

-

TrackRichard J. Durbin

Co-Sponsor

-

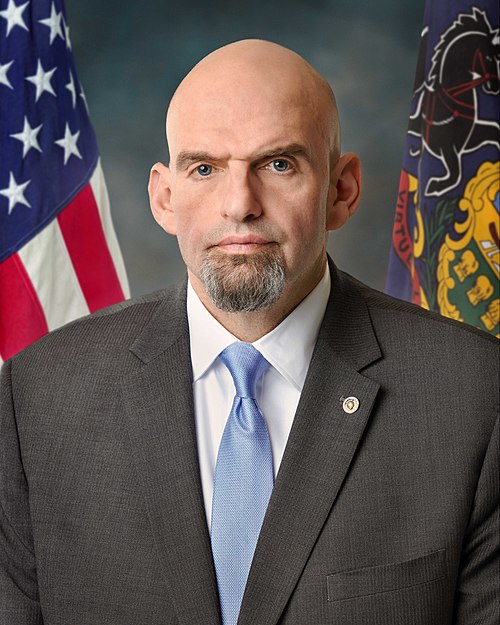

TrackJohn Fetterman

Co-Sponsor

-

TrackKirsten E. Gillibrand

Co-Sponsor

-

TrackMartin Heinrich

Co-Sponsor

-

TrackJohn W. Hickenlooper

Co-Sponsor

-

TrackMazie K. Hirono

Co-Sponsor

-

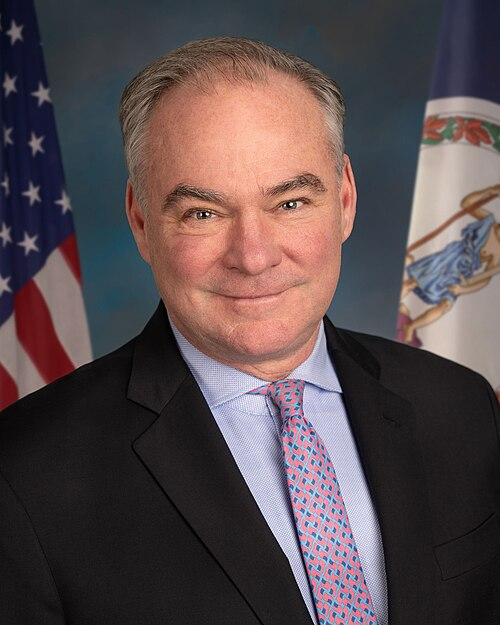

TrackTim Kaine

Co-Sponsor

-

TrackMark Kelly

Co-Sponsor

-

TrackAndy Kim

Co-Sponsor

-

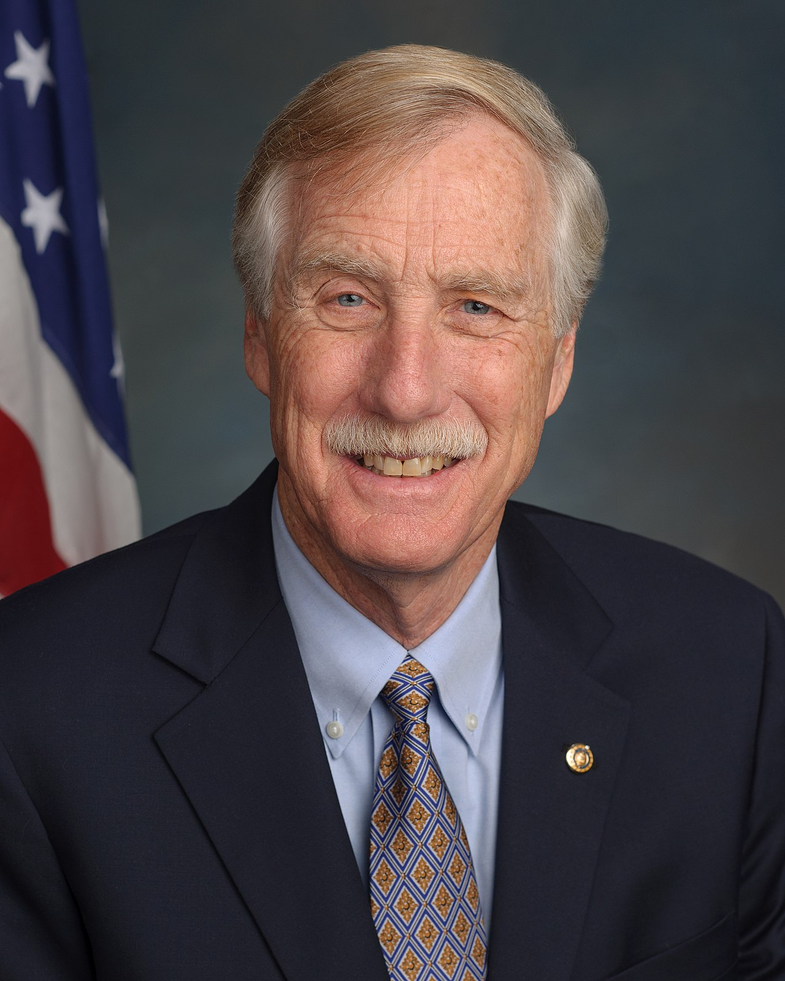

TrackAngus S. King Jr.

Co-Sponsor

-

TrackAmy Klobuchar

Co-Sponsor

-

TrackBen Ray Lujan

Co-Sponsor

-

TrackEdward J. Markey

Co-Sponsor

-

TrackJeff Merkley

Co-Sponsor

-

TrackChristopher Murphy

Co-Sponsor

-

TrackPatty Murray

Co-Sponsor

-

TrackJon Ossoff

Co-Sponsor

-

TrackAlex Padilla

Co-Sponsor

-

TrackGary C. Peters

Co-Sponsor

-

TrackJack Reed

Co-Sponsor

-

TrackJacky Rosen

Co-Sponsor

-

TrackBernard Sanders

Co-Sponsor

-

TrackBrian Schatz

Co-Sponsor

-

TrackAdam B. Schiff

Co-Sponsor

-

TrackCharles E. Schumer

Co-Sponsor

-

TrackJeanne Shaheen

Co-Sponsor

-

TrackElissa Slotkin

Co-Sponsor

-

TrackTina Smith

Co-Sponsor

-

TrackChris Van Hollen

Co-Sponsor

-

TrackMark R. Warner

Co-Sponsor

-

TrackElizabeth Warren

Co-Sponsor

-

TrackPeter Welch

Co-Sponsor

-

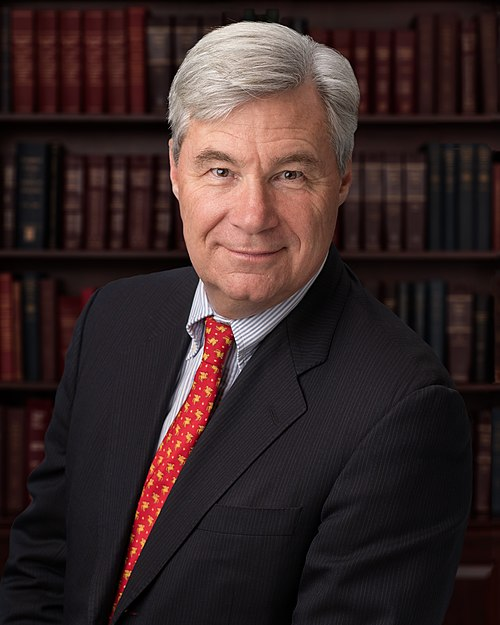

TrackSheldon Whitehouse

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Jun. 26, 2025 | Introduced in Senate |

| Jun. 26, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.