S. 2143: Curbing Officials' Income and Nondisclosure (COIN) Act

This bill, titled the Curbing Officials' Income and Nondisclosure (COIN) Act, seeks to amend existing laws to prevent financial exploitation by public officials and to improve transparency regarding their financial interests, particularly concerning digital assets. Below is a summary of the main provisions of the bill.

Prohibited Financial Transactions

The bill defines several financial transactions that public officials and their immediate family members are prohibited from engaging in. These include:

- Issuing, sponsoring, or endorsing securities that are digital assets, such as cryptocurrencies or tokens.

- Trading or investing in financial interests related to digital assets.

This prohibition applies not only during the time of service of a public official but also during specific timeframes before and after their tenure, specifically:

- The 180 days before their service starts.

- The two years after their service ends.

Civil and Criminal Penalties

Violating the prohibitions outlined can result in civil actions brought by the Attorney General, with penalties that may include:

- A fine of up to $25,000 per violation.

- A percentage of the monetary value of the transaction, or any profits gained from the prohibited conduct.

Criminal penalties may include imprisonment and fines, particularly for violations that result in substantial losses to others or for acts of insider trading. There is also specific mention of bribery linked to these prohibited transactions, which carries severe penalties.

Ethics Requirements for Cryptocurrencies

The bill requires public officials to disclose any cryptocurrencies, tokens, or digital assets exceeding $1,000 in fair market value they hold. This is intended to promote transparency regarding their financial interests in these assets.

Public Official Certification Requirement

Payment stablecoin issuers must certify that no public official profits from their issuance. This involves:

- Submitting initial and ongoing certifications to relevant Federal regulators.

- Making these certifications publicly available.

Government Accountability Office (GAO) Report

The bill mandates that, within 360 days of its enactment, the Comptroller General of the United States must submit a report to Congress. This report will contain recommendations for updating ethics laws and enforcement procedures related to digital assets.

Relevant Companies

- COIN - Coinbase Global, Inc. is significantly affected as it deals primarily in cryptocurrencies and could face increased scrutiny and regulatory challenges under this bill.

- GBTC - Grayscale Bitcoin Trust may need to adjust its operational compliance and governance structures in response to potential regulatory changes affecting public financial disclosures related to cryptocurrency investments.

- ETHE - Grayscale Ethereum Trust could encounter similar impacts and adjustments as it manages digital assets under the new disclosure requirements mandated by this bill.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

11 bill sponsors

-

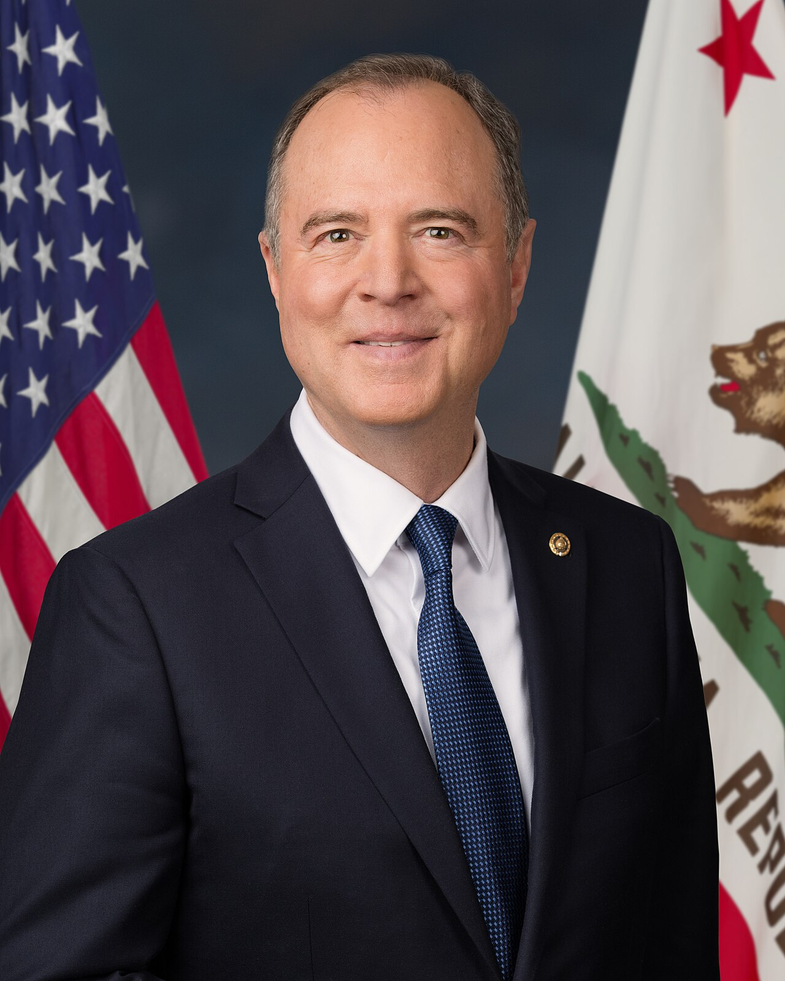

TrackAdam B. Schiff

Sponsor

-

TrackAngela Alsobrooks

Co-Sponsor

-

TrackRichard Blumenthal

Co-Sponsor

-

TrackLisa Blunt Rochester

Co-Sponsor

-

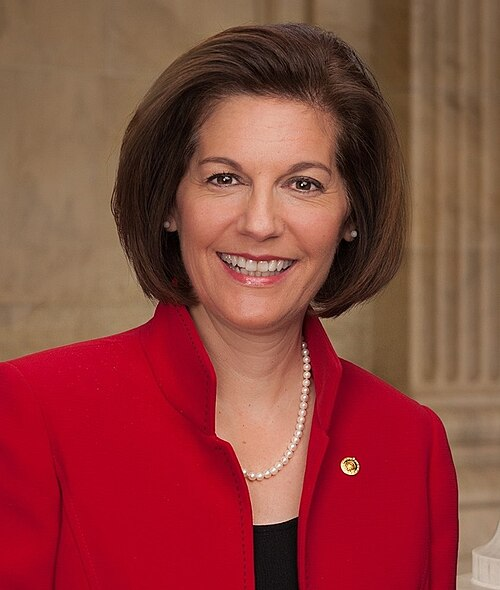

TrackCatherine Cortez Masto

Co-Sponsor

-

TrackRuben Gallego

Co-Sponsor

-

TrackKirsten E. Gillibrand

Co-Sponsor

-

TrackMark Kelly

Co-Sponsor

-

TrackAndy Kim

Co-Sponsor

-

TrackBen Ray Lujan

Co-Sponsor

-

TrackElissa Slotkin

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Jun. 23, 2025 | Introduced in Senate |

| Jun. 23, 2025 | Read twice and referred to the Committee on Homeland Security and Governmental Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.