S. 2129: Survivors Assistance for Fear-free and Easy Tax Filing Act of 2025

This bill is titled the "Survivors Assistance for Fear-free and Easy Tax Filing Act of 2025" (or "SAFE Tax Filing Act of 2025") and aims to amend the Internal Revenue Code to assist certain individuals in their tax filing process if they are survivors of domestic abuse or spousal abandonment.

Key Provisions

- Treatment of Abused or Abandoned Spouses: The bill allows married individuals who are survivors of domestic abuse or spousal abandonment to file their taxes as if they were unmarried or as heads of households. This applies if they are living apart from their spouse as of the last day of the taxable year, are survivors of domestic abuse or abandonment, and indicate this status on their tax return.

- Definition of Domestic Abuse: Domestic abuse is defined in broad terms, including physical, psychological, sexual, emotional, or economic abuse. Factors such as efforts to control, isolate, or intimidate the survivor are also considered.

- Spousal Abandonment Definition: An individual may qualify as a survivor of spousal abandonment if they cannot locate their spouse after reasonable efforts to do so.

- Election Process: The option to file as unmarried will only be available for the tax year in which the election is made by the individual.

- Impact on Spouse’s Filing: The bill clarifies that the status change for the survivor does not affect the marital status of their spouse for tax purposes.

- Due Diligence for Tax Preparers: Tax return preparers must be aware of the eligibility conditions under this bill and ensure they properly assist clients who may qualify to file as unmarried.

- Effective Date: The provisions of this bill would apply to taxable years ending after the date it is enacted.

Overall Goals

The primary goal of this legislation is to provide more accessible and less stressful tax filing options for individuals who have experienced significant personal trauma due to domestic abuse or abandonment, facilitating their financial independence and stability.

Relevant Companies

None found.This is an AI-generated summary of the bill text. There may be mistakes.

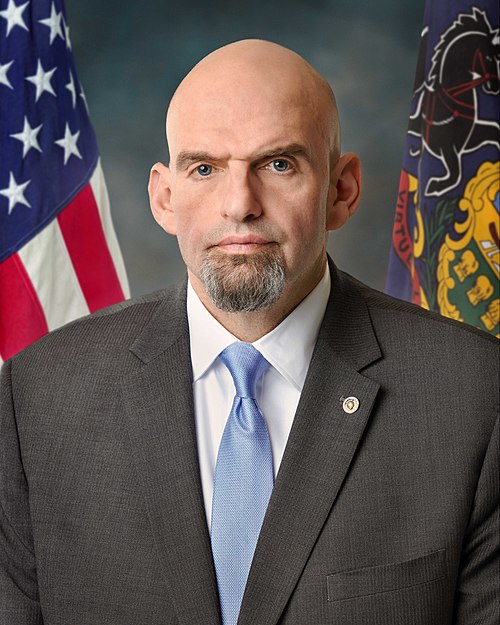

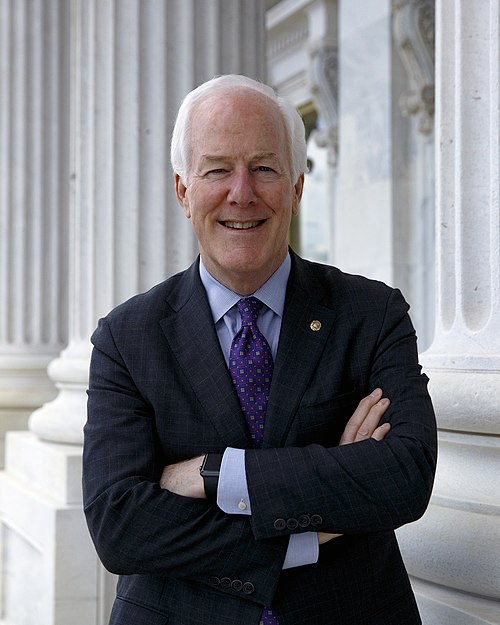

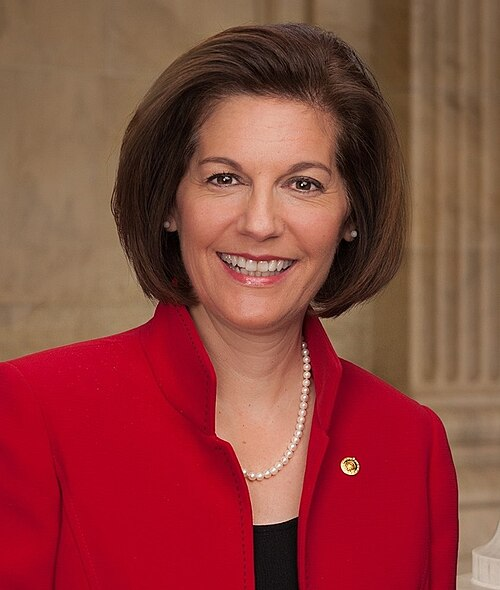

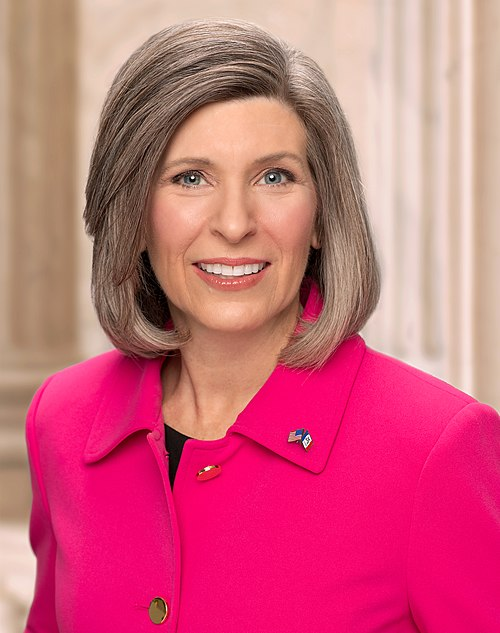

Sponsors

4 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jun. 18, 2025 | Introduced in Senate |

| Jun. 18, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.