S. 2107: Protecting Our Students and Taxpayers Act of 2025

This bill, titled the "Protecting Our Students and Taxpayers Act of 2025," aims to amend the Higher Education Act of 1965, focusing specifically on proprietary institutions of higher education, which are schools operated for profit. Its primary goal is to enhance the protection of students and taxpayers by ensuring that these institutions do not rely excessively on federal education funds.

Key Provisions

- 85/15 Rule: The bill elaborates on the existing "85/15 rule." To qualify as a proprietary institution, at least 15% of the institution's revenue must come from sources other than federal education assistance funds. This is to ensure that these schools are not entirely dependent on government funding.

- Revenue Definitions: The bill provides detailed definitions regarding what constitutes revenue. This includes income from tuition, fees, and services necessary for student education, but excludes federal funds unless they are used to pay for institutional costs directly.

- Non-Federal Revenue Requirement: It mandates that institutions must utilize specific accounting methods to calculate their revenues and maintain compliance with the revenue rule.

- Eligibility Restrictions: If a proprietary institution fails to meet the revenue requirements for a fiscal year, it will be ineligible for federal assistance for at least two years. It can regain eligibility by demonstrating compliance with financial requirements over that period.

- Accountability Measures: The bill requires the Secretary of Education to report to Congress on the revenue sources of proprietary institutions, which will help in monitoring their compliance with the new revenue rules.

- Repeal of Certain Requirements: The bill also repeals some existing requirements under the Higher Education Act that are deemed outdated or unnecessary regarding institutional accountability.

Implementation Timeline

The amendments proposed by this Act will take effect starting on the second full award year after the bill is enacted, giving institutions time to adjust their financial practices accordingly.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

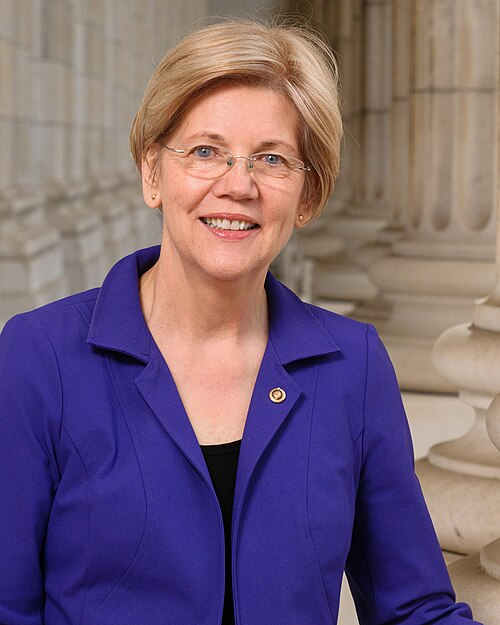

Sponsors

8 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jun. 18, 2025 | Introduced in Senate |

| Jun. 18, 2025 | Read twice and referred to the Committee on Health, Education, Labor, and Pensions. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.