S. 2100: Modernizing Agricultural and Manufacturing Bonds Act

This bill, titled the Modernizing Agricultural and Manufacturing Bonds Act, aims to introduce several modifications to the rules governing certain tax-exempt bonds used for financing in agriculture and manufacturing. Below is a summary of its main provisions:

Modifications to Qualified Small Issue Bonds

The bill proposes changes to the definition of “manufacturing facilities” that can qualify for small issue manufacturing bonds. Key modifications include:

- Expanding the definition to include not just tangible personal property but also the production of intangible property.

- Allowing for functionally related facilities that are located on the same site as the manufacturing facility, as long as their costs do not exceed 25% of the net proceeds of the bond issue.

- Increasing the maximum amount of bonds that can be issued from $10 million to $30 million.

- Raising the limit on total capital expenditures related to these bonds, and adjusting these limits for inflation in future years.

Exceptions for Private Activity Bonds for First-Time Farmers

The bill seeks to help first-time farmers by further expanding exceptions to the regulations surrounding private activity bonds. Key measures include:

- Raising the maximum dollar limitation for these bonds from $450,000 to $1 million.

- Removing the separate lower limit on amounts used for purchasing used farm equipment.

- Adjusting the dollar amount for small issue bonds to be consistent with the higher limits for first-time farmers.

- Changing the determination of "substantial farmland," shifting from using median farm size to average farm size for eligibility.

Inflation Adjustments

The bill introduces provisions for future adjustments based on inflation for the limits established in both sections regarding the increase in bond amounts. This is intended to maintain the relevancy of the thresholds over time.

Effective Dates

Most amendments proposed by the bill would apply to bonds issued after the date of enactment, with particular adjustments for specific provisions that would be effective for those issued after defined deadlines (e.g., some after December 31, 2025).

Relevant Companies

None found.

This is an AI-generated summary of the bill text. There may be mistakes.

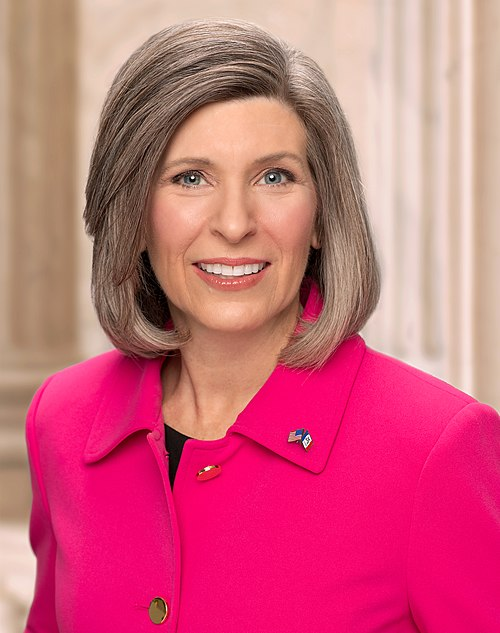

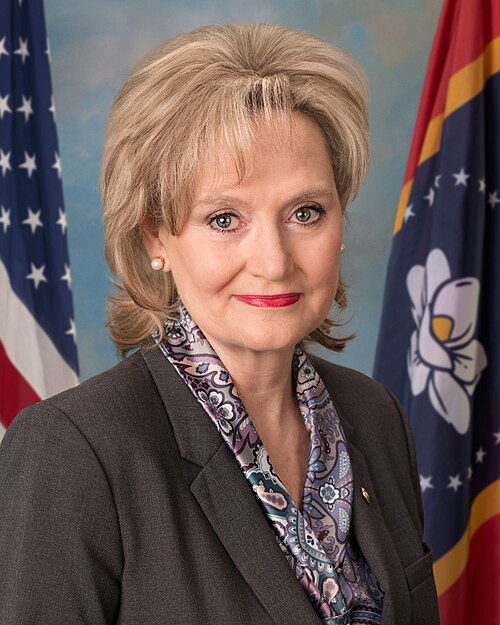

Sponsors

3 bill sponsors

Actions

3 actions

| Date | Action |

|---|---|

| Jan. 14, 2026 | Committee on Small Business and Entrepreneurship. Hearings held. |

| Jun. 17, 2025 | Introduced in Senate |

| Jun. 17, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.