S. 2022: Tribal Tax and Investment Reform Act of 2025

The "Tribal Tax and Investment Reform Act of 2025" is designed to create a more equitable federal tax framework for Indian Tribal Governments, aligning their tax treatment more closely with that of State governments. This change is intended to facilitate greater access to capital, support the development of infrastructure within tribal areas, and enhance a range of tax credits and financial benefits available to tribes, thereby reinforcing their sovereignty as governmental entities.

Key Provisions

- Equalization of Federal Tax Treatment: The bill seeks to amend federal tax policies to ensure that Indian Tribal Governments receive similar tax considerations as State governments.

- Access to Capital: By improving tax conditions, the legislation aims to boost capital investment in tribal communities, enabling them to pursue various development projects.

- Infrastructure Funding: The bill is expected to enhance funding opportunities for infrastructure projects in tribal regions, addressing critical needs in these areas.

- Tax Credits Expansion: It expands the availability of tax credits and assistance for qualified community development entities that invest in tribal lands, promoting economic growth and sustainability.

- Definitions and Support: The legislation includes a clear definition of "qualified active tribal community businesses" which will provide clarity for those looking to engage with tribal economies. It also directs the inclusion of tribal-specific data in development area designations.

- Effective Dates and Guidelines: The bill outlines the effective dates for these tax-related amendments and establishes guidance for educational resources that will assist in understanding and utilizing these tax credits effectively.

Intended Outcomes

Through these measures, the Tribal Tax and Investment Reform Act of 2025 aims to empower tribal governments, drive investment into tribal areas, and ultimately enhance economic opportunities for tribal communities. This can lead to improvements in the quality of life, expansion of business ventures, and better public services in these regions.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

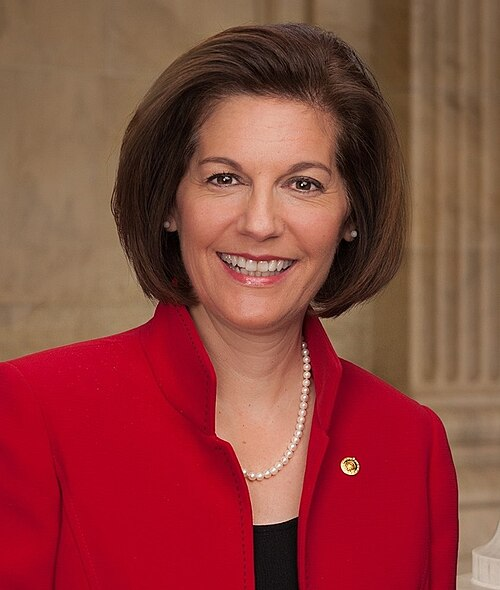

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jun. 11, 2025 | Introduced in Senate |

| Jun. 11, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.