S. 1991: Delivering On Government Efficiency in Spending Act

This bill, known as the Delivering On Government Efficiency in Spending Act, aims to enhance the accountability and transparency of federal payments by establishing mandatory reporting and verification requirements. Below are the key provisions and effects of the bill:

Mandatory Reporting and Verification

The bill introduces a new requirement for federal agencies to report and verify information related to each payment they authorize. This includes:

- A brief description of the payment's purpose.

- The specific account from which the payment will be disbursed.

- The type of activity associated with the payment.

Each agency must provide this information to the Secretary of the Treasury for inclusion in the Treasury's disbursement system.

Periodic Evaluation of Information

Agencies are required to evaluate the accuracy of the reported payment information at least once a fiscal year. They must also provide written confirmation regarding the accuracy of this information to the disbursing official.

Public Reporting

Within 30 days of certifying a payment, the Director of the Office of Management and Budget must ensure that the collected data is made publicly available on the official federal spending transparency website.

Exemptions for Sensitive Operations

The bill allows for exemptions from these reporting requirements if the information disclosure could adversely impact sensitive operations, particularly those related to national security or law enforcement.

Data Access for Program Integrity

The bill also expands access to the National Directory of New Hires for the Secretary of the Treasury. This is intended to aid in identifying and preventing improper payments. Additionally, it allows the Secretary to verify bank account details before making payments to ensure accuracy and reduce fraud.

Use of Consumer Reports and Tax Information

The bill permits certain redisclosures of consumer report information and IRS tax information to assist in preventing improper payments. This includes access to taxpayer information that will help verify the eligibility and compliance of payment recipients.

Social Security Information Disclosure

The bill requires the Social Security Administration to provide personal information to the Treasury Department, which will be used to enhance the capabilities of the Do Not Pay working system. This system is designed to identify and recover improper or fraudulent payments.

Implementation and Guidance

The Secretary of the Treasury is authorized to issue regulations and guidance to facilitate the implementation of the bill's provisions.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

16 bill sponsors

-

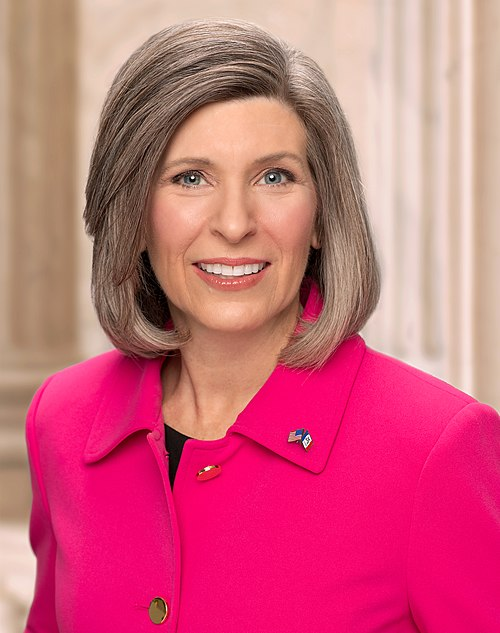

TrackJoni Ernst

Sponsor

-

TrackKatie Boyd Britt

Co-Sponsor

-

TrackTed Budd

Co-Sponsor

-

TrackKevin Cramer

Co-Sponsor

-

TrackSteve Daines

Co-Sponsor

-

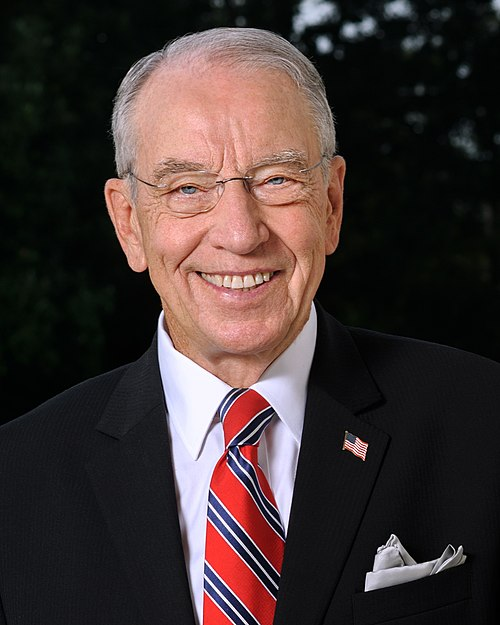

TrackChuck Grassley

Co-Sponsor

-

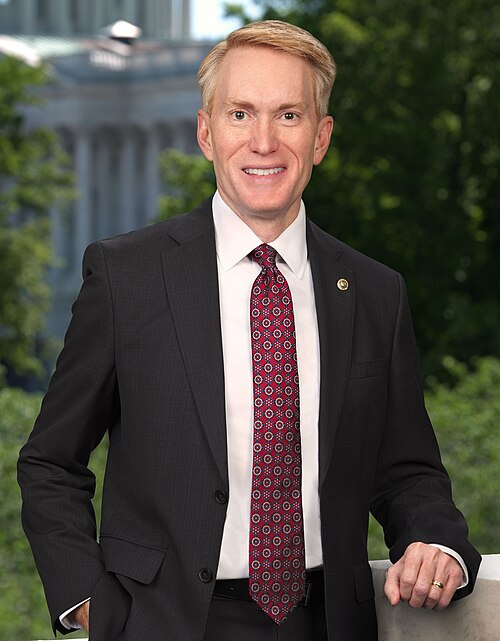

TrackJames Lankford

Co-Sponsor

-

TrackMike Lee

Co-Sponsor

-

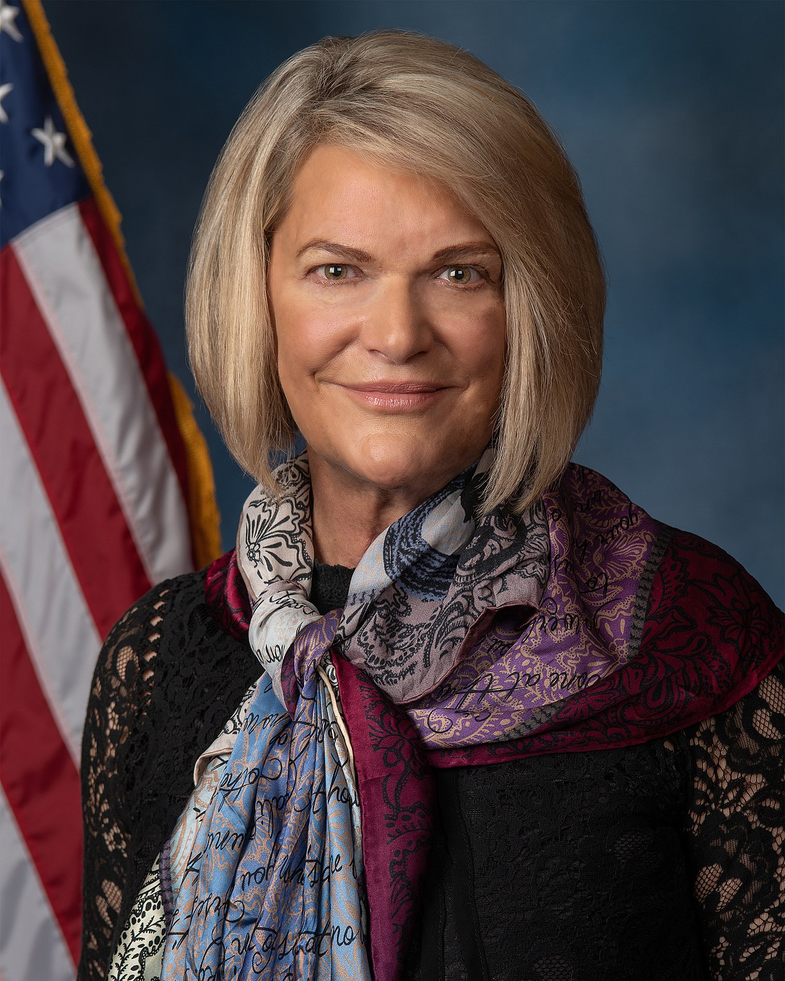

TrackCynthia M. Lummis

Co-Sponsor

-

TrackRoger Marshall

Co-Sponsor

-

TrackDavid McCormick

Co-Sponsor

-

TrackMarkwayne Mullin

Co-Sponsor

-

TrackJames E. Risch

Co-Sponsor

-

TrackRick Scott

Co-Sponsor

-

TrackTim Sheehy

Co-Sponsor

-

TrackTommy Tuberville

Co-Sponsor

Actions

3 actions

| Date | Action |

|---|---|

| Dec. 10, 2025 | Committee on Small Business and Entrepreneurship. Hearings held. |

| Jun. 09, 2025 | Introduced in Senate |

| Jun. 09, 2025 | Read twice and referred to the Committee on Homeland Security and Governmental Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.