S. 1979: Rare Earth Magnet Security Act of 2025

This bill, titled the Rare Earth Magnet Security Act of 2025, aims to amend the Internal Revenue Code to provide tax credits for the domestic production of high-performance rare earth magnets. The main points of the bill are outlined below:

Tax Credit for Production

The bill introduces a new tax credit that would incentivize the manufacturing of rare earth magnets in the United States. This credit is calculated based on the amount of rare earth magnets produced and sold by a taxpayer during a taxable year.

- The standard credit is set at **$20 per kilogram** of rare earth magnets manufactured within the U.S.

- If at least **90% of the rare earth materials** used in these magnets are also produced in the U.S., the credit increases to **$30 per kilogram**.

Eligibility for Credit

To be eligible for this credit, the following conditions must be met:

- The magnets must be **manufactured or produced** by the taxpayer and sold to unrelated persons.

- The production must occur as part of the taxpayer's regular trade or business activities.

Component Sourcing Restrictions

The credit includes restrictions on sourcing component materials:

- Components of rare earth magnets cannot be sourced from **non-allied foreign nations**.

- This restriction temporarily does not apply to certain materials (dysprosium, terbium, samarium, and gadolinium) for magnets produced before **January 1, 2027**.

Definitions

The bill provides specific definitions to clarify its terms:

- A **rare earth magnet** is defined as a permanent magnet meeting certain technical specifications.

- **Component rare earth materials** include neodymium, praseodymium, dysprosium, terbium, samarium, gadolinium, and cobalt.

Phased Implementation

The credits are set to phase out for magnets manufactured after **December 31, 2034**. The amounts will decrease over the following years until they reach **0%** after **December 31, 2037**.

Elective Payment Option

Taxpayers will have an option to elect to apply some of the credit as a **payment against their tax** for the taxable year, subject to specific conditions outlined by the Secretary of the Treasury.

Effective Date

The provisions of this act will apply to taxable years beginning after **December 31, 2024**.

Relevant Companies

- MP Materials Corp. (MP) - As a major producer of rare earth materials in North America, MP Materials could potentially benefit from increased tax credits under this bill, incentivizing domestic production procedures.

- NextEra Energy, Inc. (NEE) - While primarily an energy company, NextEra is involved in the transitioning technologies that utilize rare earth magnets, which may see a cost reduction due to incentives offered in this bill.

- Albemarle Corporation (ALB) - A producer of lithium and other advanced materials, Albemarle could see indirect benefits through partnerships or supply chain enhancements related to rare earth magnet production.

This is an AI-generated summary of the bill text. There may be mistakes.

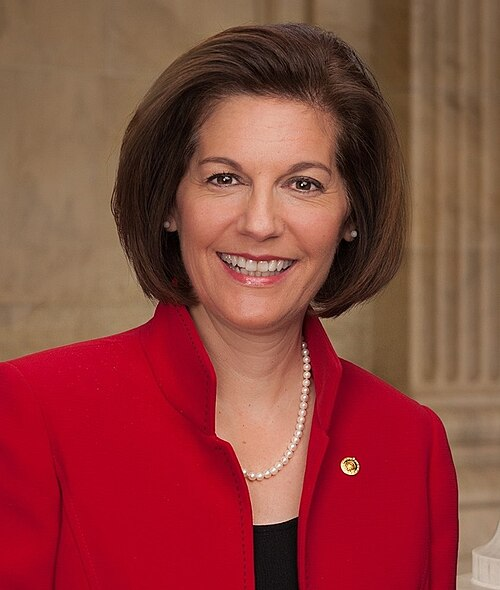

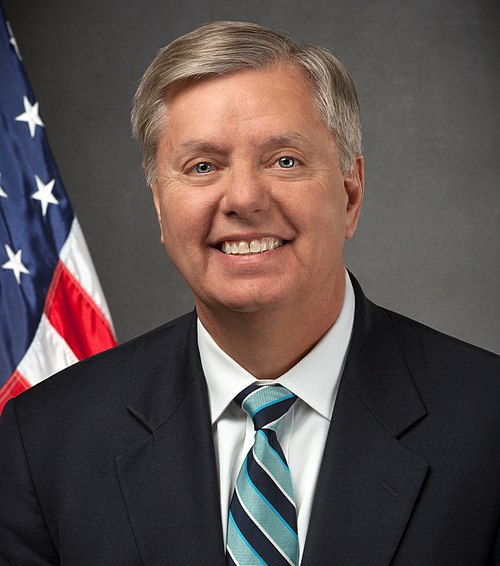

Sponsors

3 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jun. 05, 2025 | Introduced in Senate |

| Jun. 05, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.