S. 1918: Access Technology Affordability Act of 2025

The Access Technology Affordability Act of 2025 proposes changes to the Internal Revenue Code to create a refundable tax credit intended to help blind individuals purchase necessary access technology. Here’s a breakdown of the key components of the bill:

Tax Credit for Access Technology

The bill introduces a tax credit for individuals who purchase qualified access technology for blind individuals who are themselves the taxpayers, their spouses, or their dependents. This aims to reduce the financial burden of acquiring technology that can assist in accessing information that is visually represented.

Definition of Qualified Access Technology

The term “qualified access technology” is defined in the bill as hardware, software, or other information technology that primarily serves to convert or adapt visual information into formats that can be used by blind individuals. This encompasses a range of products designed to aid those who are visually impaired.

Credit Amount and Limitations

- The credit will cover amounts paid or incurred by the taxpayer, which are not reimbursed by insurance or other means.

- The maximum credit amount is $2,000 for any qualified blind individual within a three-year period.

- The bill includes a provision to adjust the credit amount for inflation starting from taxable years following 2026, ensuring that the $2,000 limit will increase with cost-of-living adjustments.

Provisions Against Double Benefits

No credit will be allowed for expenses if the taxpayer can claim a deduction or another credit under different parts of the tax code for those same expenses, preventing individuals from receiving double benefits for one purchase.

Termination of Credit

The tax credit as proposed in this legislation will not be available for amounts paid or incurred after December 31, 2030, meaning it would be a temporary measure.

Effective Date

The provisions outlined in this bill will apply to taxable years commencing after December 31, 2025, providing some time for implementation after its introduction.

Relevant Companies

None found.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

13 bill sponsors

-

TrackJohn Boozman

Sponsor

-

TrackSusan M. Collins

Co-Sponsor

-

TrackKevin Cramer

Co-Sponsor

-

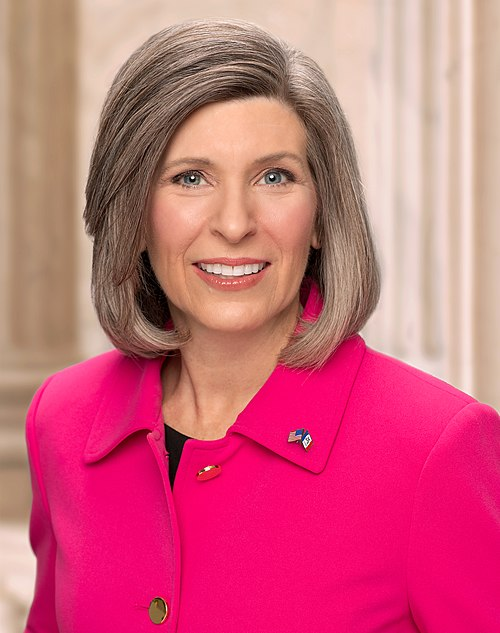

TrackJoni Ernst

Co-Sponsor

-

TrackMazie K. Hirono

Co-Sponsor

-

TrackMark Kelly

Co-Sponsor

-

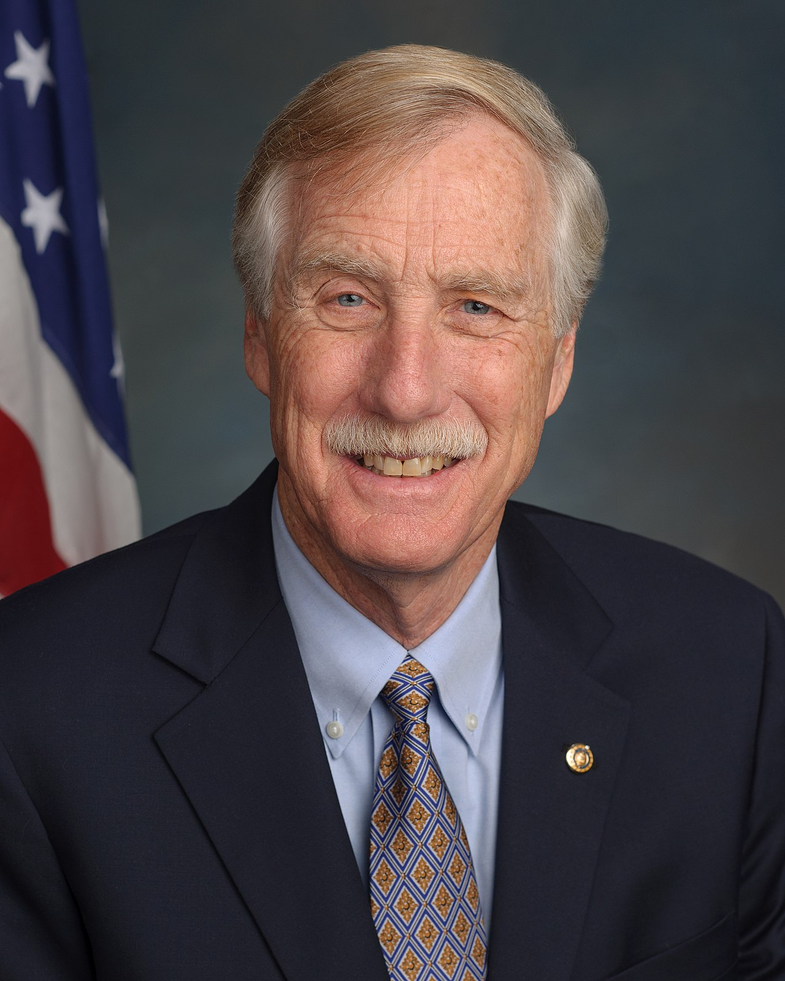

TrackAngus S. King Jr.

Co-Sponsor

-

TrackAmy Klobuchar

Co-Sponsor

-

TrackBen Ray Lujan

Co-Sponsor

-

TrackJeff Merkley

Co-Sponsor

-

TrackDan Sullivan

Co-Sponsor

-

TrackMark R. Warner

Co-Sponsor

-

TrackRon Wyden

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| May. 22, 2025 | Introduced in Senate |

| May. 22, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.