S. 1879: Ban Congressional Stock Trading Act

The Ban Congressional Stock Trading Act is legislation aimed at regulating the financial activities of Members of Congress and their immediate family members. The core provisions of the bill are as follows:

Purpose

The bill seeks to prevent conflicts of interest by prohibiting Members of Congress from trading stocks and certain financial assets while serving in office. It aims to ensure that lawmakers do not benefit financially from their legislative actions, which could affect their decision-making regarding policy and regulations.

Blind Trust Requirements

Under this act, Members of Congress, along with their spouses and dependent children, will be required to place specific assets, referred to as "covered investments," into "qualified blind trusts." A blind trust means the Member of Congress will not have knowledge of or control over the investments held in that trust. The key points include:

- Definition of Covered Investments: This includes investments in securities, commodities, futures, and comparable economic interests. However, diversified mutual funds and U.S. Treasury securities are exempt from this requirement.

- Action Timeline: Current lawmakers must certify and either divest or place their covered investments in a qualified blind trust within 120 days of the bill's enactment.

- New Members Compliance: Individuals becoming lawmakers after the bill's enactment must comply with these requirements within a similar 120-day timeframe after taking office.

Restrictions on Acquisitions

Members and their families will be prohibited from acquiring additional covered investments during their term in office. They will be required to divest or place any inherited covered investments into a qualified blind trust within 120 days of the inheritance.

Extensions and Compliance

If a Member of Congress cannot place an investment in a blind trust within the specified timeframe, they can request an extension. However, this extension cannot exceed 180 days in total. Compliance is monitored through certifications and reports to the supervising ethics office responsible for oversight of these matters.

Enforcement and Penalties

The supervising ethics offices will ensure adherence to these rules, imposing civil penalties on Members of Congress who fail to meet the divestment or compliance requirements. These penalties will be calculated based on the annual pay of the Member of Congress and can be assessed repeatedly until compliance is achieved.

Transparency Measures

The law mandates that all related documents, including certifications, trust agreements, and notices, be made publicly available through the supervising ethics offices. This is aimed at increasing transparency regarding the financial interests of lawmakers and to alleviate potential concerns about conflicts of interest.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

14 bill sponsors

-

TrackJon Ossoff

Sponsor

-

TrackAngela Alsobrooks

Co-Sponsor

-

TrackTammy Baldwin

Co-Sponsor

-

TrackMichael F. Bennet

Co-Sponsor

-

TrackTammy Duckworth

Co-Sponsor

-

TrackRuben Gallego

Co-Sponsor

-

TrackKirsten E. Gillibrand

Co-Sponsor

-

TrackJohn W. Hickenlooper

Co-Sponsor

-

TrackMark Kelly

Co-Sponsor

-

TrackAmy Klobuchar

Co-Sponsor

-

TrackBrian Schatz

Co-Sponsor

-

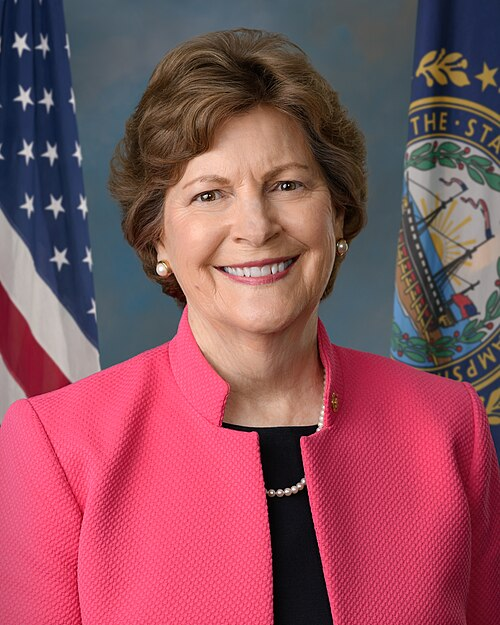

TrackJeanne Shaheen

Co-Sponsor

-

TrackElissa Slotkin

Co-Sponsor

-

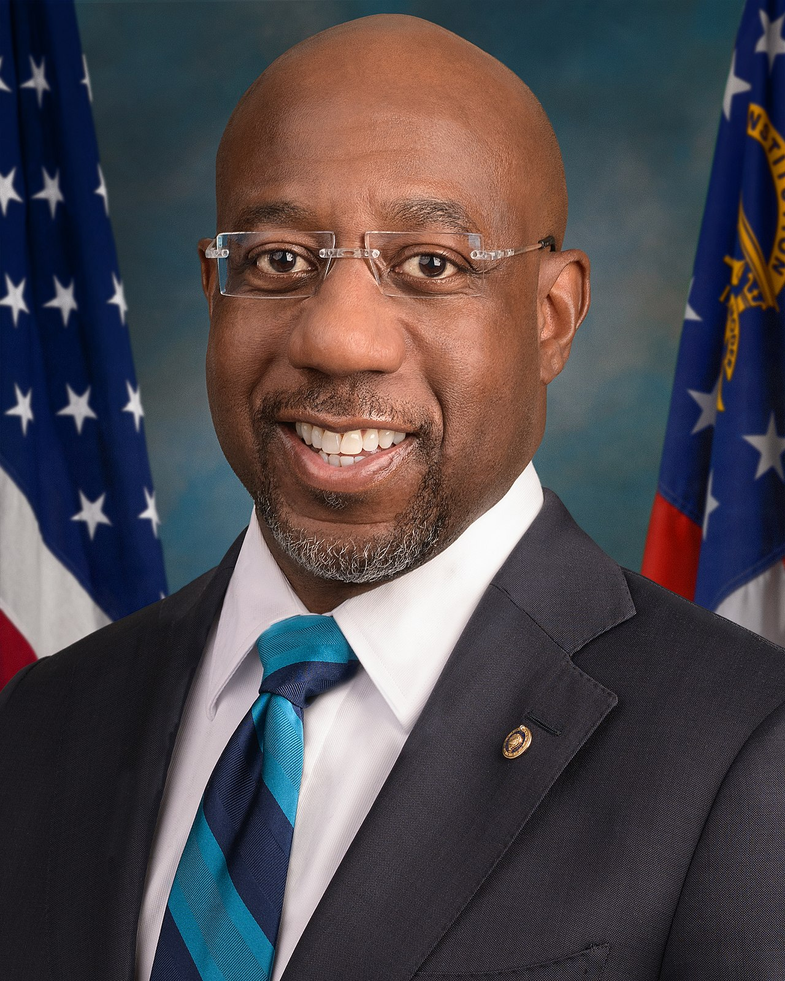

TrackRaphael G. Warnock

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| May. 22, 2025 | Introduced in Senate |

| May. 22, 2025 | Read twice and referred to the Committee on Homeland Security and Governmental Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.