S. 1831: Auto Reenroll Act of 2025

The Auto Reenroll Act of 2025 aims to amend the Internal Revenue Code of 1986 and the Employee Retirement Income Security Act of 1974 to implement periodic automatic reenrollment under certain retirement savings plans, specifically qualified automatic contribution arrangements and eligible automatic contribution arrangements. Here’s a breakdown of the main features of the bill:

1. Automatic Reenrollment Provisions

The bill allows for periodic automatic reenrollment of employees into retirement savings plans after they choose not to contribute. Specifically, employees can opt to stop contributions for a period of up to three years, after which they will automatically be reenrolled unless they explicitly choose to opt out again.

2. Changes to Qualified Automatic Contribution Arrangements

- The amendment modifies existing rules to ensure that a qualified automatic contribution arrangement continues to meet requirements even if an employee stops contributions for a duration between one and three years.

- Once this period ends, the employee is presumed to wish to continue contributing at a certain percentage unless they take action to opt-out once more.

3. Adjustments for Current Employees

The legislation changes the participation rules for employees, stating that they will need to actively participate in the arrangement unless they choose otherwise. Furthermore, those who previously opted out of the plan will be treated as participants under the new definitions provided in the bill.

4. Eligible Automatic Contribution Arrangements

Similar provisions will apply to eligible automatic contribution arrangements, allowing participants who had previously elected not to make contributions to be automatically rerouted back into contribution status after a specified time unless they choose to opt-out again.

5. Compliance Amendments

Conforming amendments will also be made to the Employee Retirement Income Security Act to align regulations regarding automatic contributions with the changes proposed in this legislation.

6. Effective Date

The changes made by this amendment will take effect for plan years starting after the enactment of the Act, meaning that the provisions will apply in the future rather than retroactively.

7. Clarifications on Interpretation

The legislation clarifies that the new rules will not affect the application of existing law for prior plan years. It expressly states that the changes regarding automatic reenrollment do not imply retroactive effects on previous elections made under older rules.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

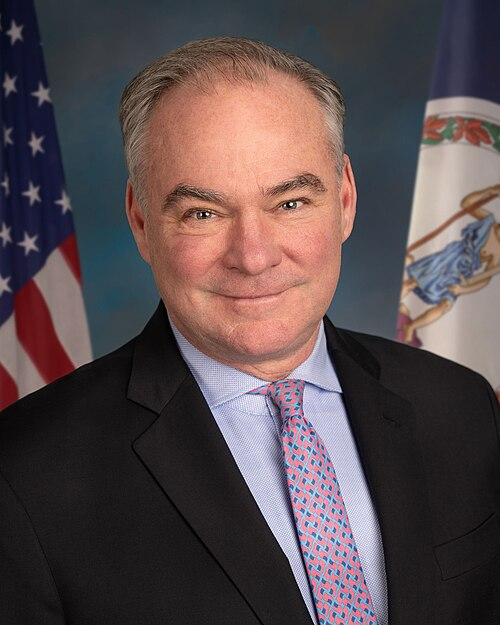

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| May. 21, 2025 | Introduced in Senate |

| May. 21, 2025 | Read twice and referred to the Committee on Health, Education, Labor, and Pensions. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.