S. 1821: Tackling Predatory Litigation Funding Act

This bill, titled the Tackling Predatory Litigation Funding Act, aims to introduce a tax on income generated from litigation financing agreements involving third-party entities. Here is a detailed summary of the key points:

Purpose of the Bill

The bill seeks to amend the Internal Revenue Code to specifically tax income received by third parties that finance civil litigation.Key Provisions

- Tax Imposition: A tax will be levied on any qualified litigation proceeds that a third party (referred to as a "covered party") receives. The tax rate will consist of the highest rate of income tax for the applicable year plus an additional 3.8 percentage points.

- Coverage of Entities: The tax applies to multiple types of entities, including individuals, corporations, partnerships, or sovereign wealth funds that provide litigation financing but do not represent parties in the litigation as attorneys.

- Definition of Qualified Litigation Proceeds: This refers to any profits realized from a litigation financing agreement, which could include gains or net income derived from such agreements.

- Withholding Tax Requirements: Entities in control of civil action proceeds must withhold 50% of the applicable percentage tax from payments made to third parties under litigation financing agreements.

- Exclusions from Tax: Certain agreements, such as those involving less than $10,000 or specific types of loan repayments and reimbursements, are excluded from these taxation rules.

- Changes to Gross Income Definition: The bill proposes that certain litigation proceeds should not be included in gross income for tax purposes.

Implementation Timeline

The provisions outlined in the bill will take effect for taxable years beginning after December 31, 2025.Relevant Companies

None found.This is an AI-generated summary of the bill text. There may be mistakes.

Show More

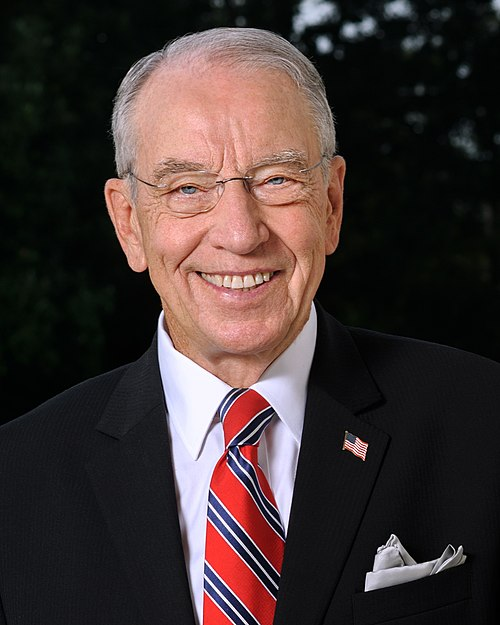

Sponsors

6 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| May. 20, 2025 | Introduced in Senate |

| May. 20, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.