S. 1688: Growing America’s Small Businesses and Manufacturing Act

This bill, titled the Growing America’s Small Businesses and Manufacturing Act

, aims to amend certain provisions of the Internal Revenue Code related to business deductions and depreciation for small businesses and manufacturers.

Key Provisions of the Bill

Permanently Extend Depreciation Allowances

The bill proposes a permanent extension of the rules that allow businesses to use depreciation, amortization, or depletion when calculating their limits on the deduction for business interest. Specifically, it removes previous time restrictions related to taxable years starting before January 1, 2022, thereby allowing businesses to benefit from these allowances without time limits.

Increased Limits on Expensing Business Assets

Another significant aspect of the bill is the increase in the limits for expensing certain business assets under the current law:

- Expensing Limit: The maximum amount a business can expense is raised from

$1,000,000

to$2,500,000

. - Phase-out Threshold: The limit at which the expensing begins to phase out is increased from

$2,500,000

to$4,000,000

.

These adjustments aim to provide small businesses with greater financial flexibility when they invest in new equipment and other depreciable assets.

Inflation Adjustments

The bill incorporates inflation adjustments for expensing limits. Specifically:

- The reference year for calculating inflation for depreciation limits has been updated from

2018

to2025

. - The year used for earlier thresholds is also updated, changing from

calendar year 2017

tocalendar year 2024

.

These adjustments help ensure that the expensing limits remain relevant and useful in light of economic changes over time.

Effective Date

The changes implemented by this bill will take effect for taxable years beginning after December 31, 2024.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

12 bill sponsors

-

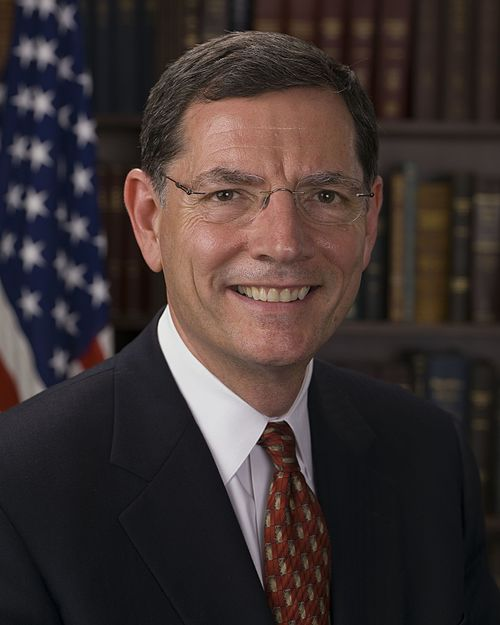

TrackJohn Barrasso

Sponsor

-

TrackMarsha Blackburn

Co-Sponsor

-

TrackKatie Boyd Britt

Co-Sponsor

-

TrackShelley Moore Capito

Co-Sponsor

-

TrackTed Cruz

Co-Sponsor

-

TrackSteve Daines

Co-Sponsor

-

TrackJohn Hoeven

Co-Sponsor

-

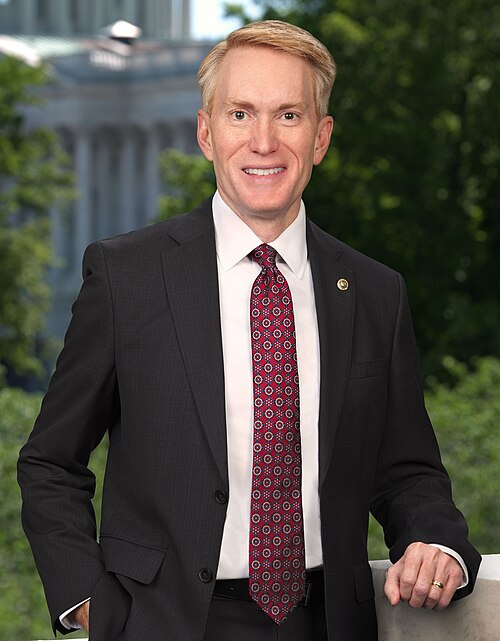

TrackJames Lankford

Co-Sponsor

-

TrackPete Ricketts

Co-Sponsor

-

TrackTim Sheehy

Co-Sponsor

-

TrackTommy Tuberville

Co-Sponsor

-

TrackTodd Young

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| May. 08, 2025 | Introduced in Senate |

| May. 08, 2025 | Read twice and referred to the Committee on Finance. (text: CR S2841) |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.