S. 1649: Sporting Goods Excise Tax Modernization Act

This bill, known as the Sporting Goods Excise Tax Modernization Act, proposes changes to how certain sales of sporting goods are taxed under the Internal Revenue Code. The key provisions of the bill are as follows:

Marketplace Providers as Importers

One of the main changes introduced by the bill is that it treats certain marketplace providers—businesses that facilitate online sales of goods—as importers for the purposes of the excise tax on certain sporting goods. Specifically:

- When a taxable sporting good is sold through a specified marketplace, the marketplace provider will be considered both the importer and seller of that good.

- A "specified marketplace sale" occurs if the marketplace provider assists in the sale and the good is shipped into the U.S. from outside the country.

- The manufacturer of the good cannot be the same entity as the marketplace provider for this designation to apply.

Definition of Marketplace Provider

The bill defines a "marketplace provider" as a business that:

- Hosts or facilitates product listings or advertisements.

- Collects payments from purchasers and transmits some or all of that money to the seller.

Related Persons Consolidation

For tax purposes, related entities are treated as one entity when applying these new rules. This means that if companies are considered related, they must comply as a single marketplace provider in this context.

Taxable Sporting Goods

A "taxable sporting good article" refers to any product categorized under the current excise tax laws that apply to sporting goods.

Exceptions and Regulatory Authority

There is an exception included in the bill which states that if a tax would be imposed on someone other than the purchaser, then the marketplace provider does not receive the same tax treatment specified in this bill. Additionally:

- The Secretary of the Treasury is tasked with creating regulations necessary for implementing these amendments.

Effective Date

The amendments introduced by this bill would take effect for sales occurring during calendar quarters starting 60 days after the enactment of the legislation.

Considerations and Implications

The bill aims to modernize the tax code regarding the sale of sporting goods, recognizing the growing role of online marketplaces in facilitating these sales and their impact on tax compliance and collection.

Relevant Companies

- AMZN (Amazon.com, Inc.) - As a major online marketplace, Amazon may face new responsibilities for collecting excise taxes on sporting goods sold through its platform.

- EQIX (Equinix, Inc.) - Provides infrastructure services that could support the operations of marketplace providers impacted by this law.

- EBAY (eBay Inc.) - Similar to Amazon, eBay may need to comply with the new tax collecting requirements for sporting goods listed on its site.

This is an AI-generated summary of the bill text. There may be mistakes.

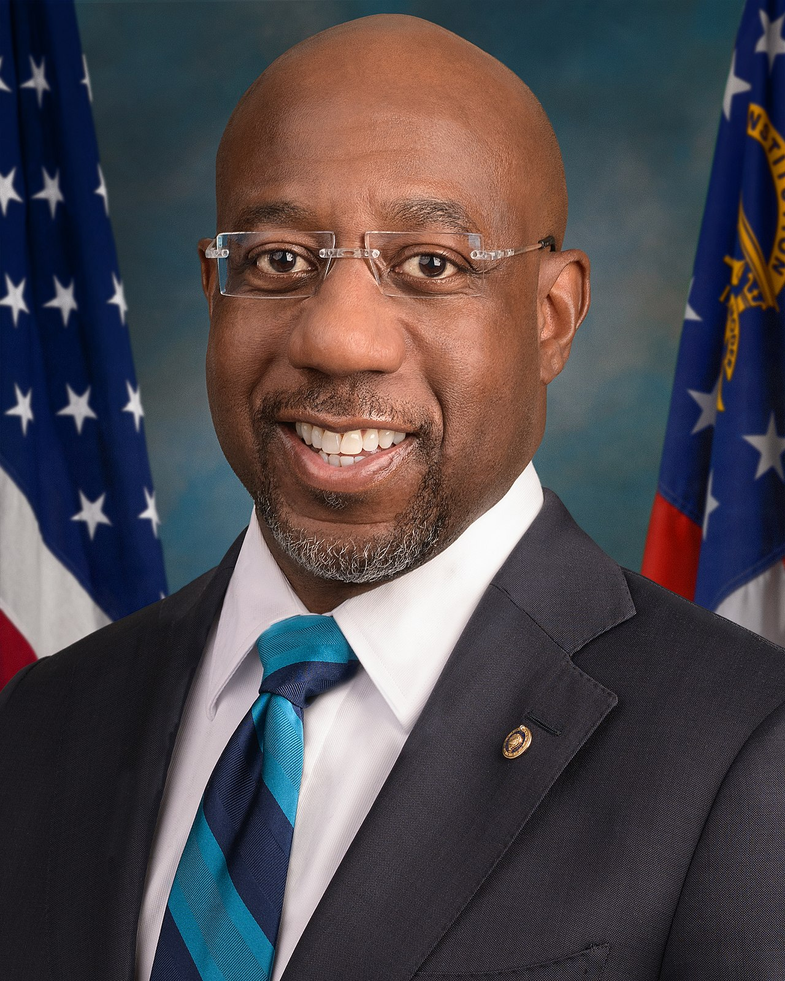

Sponsors

3 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| May. 07, 2025 | Introduced in Senate |

| May. 07, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.