S. 1613: Tax Relief for New Businesses Act

The Tax Relief for New Businesses Act aims to modify certain provisions related to business expenses in the Internal Revenue Code to provide more financial flexibility for new businesses, specifically in terms of start-up and organizational expenditures.

Key Provisions

1. Consolidation of Deductions

The bill proposes to combine the deduction categories for start-up and organizational expenditures. Currently, these terms are handled separately. By consolidating them, the bill seeks to streamline the process for businesses when they claim deductions, allowing easier access to these financial benefits.

2. Definition of Organizational Expenditures

The legislation defines "organizational expenditures" as costs related to the creation of corporations or partnerships. Specifically, these are expenses that:

- Are incident to the creation of a corporation or partnership

- Are chargeable to the capital account

- Are amortizable over the lifespan of a limited-life corporation or partnership

3. Increased Deduction Limits

The act significantly raises the limits on how much new businesses can deduct for their qualifying expenditures:

- The limit for deductible start-up expenses will increase from $5,000 to $50,000

- The overall limit for total start-up and organizational expenditures will rise from $50,000 to $150,000

4. Changes to Net Operating Loss Rules

The bill includes adjustments to how net operating losses are treated for new businesses. New rules would allow taxpayers to handle start-up and organizational net operating losses separately from other types of losses. This includes allowing deductions that might previously have been limited to now be fully deductible against income.

5. Special Rules for Different Business Structures

There are specific provisions that apply differently to partnerships and S corporations. For these entities, the deduction rules and limits will be applied at the entity level rather than by individual partners or shareholders.

6. Effective Date

The changes outlined in the act will take effect for expenses that are paid or incurred during taxable years that begin after December 31, 2025.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

11 bill sponsors

-

TrackJacky Rosen

Sponsor

-

TrackAngela Alsobrooks

Co-Sponsor

-

TrackTammy Baldwin

Co-Sponsor

-

TrackRichard Blumenthal

Co-Sponsor

-

TrackChristopher A. Coons

Co-Sponsor

-

TrackRuben Gallego

Co-Sponsor

-

TrackMartin Heinrich

Co-Sponsor

-

TrackAmy Klobuchar

Co-Sponsor

-

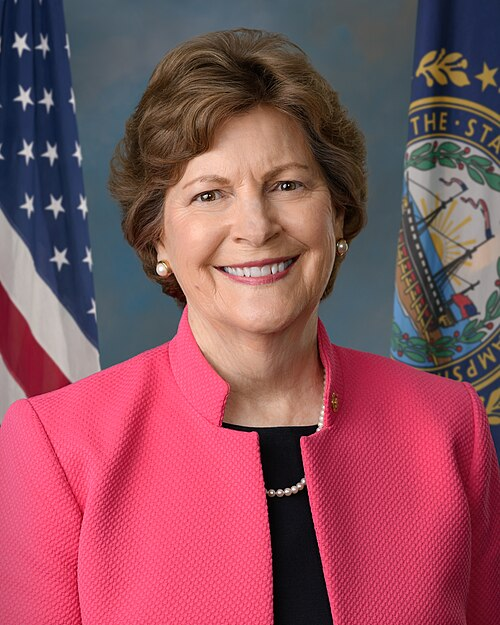

TrackJeanne Shaheen

Co-Sponsor

-

TrackElissa Slotkin

Co-Sponsor

-

TrackRon Wyden

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| May. 06, 2025 | Introduced in Senate |

| May. 06, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.