S. 1610: Tax-Free Pell Grant Act

This bill, titled the Tax-Free Pell Grant Act, aims to amend the Internal Revenue Code to expand the exclusion of Pell Grants from gross income, making these financial aids more beneficial for students receiving them. Here are the key provisions of the bill:

1. Expansion of Pell Grant Exclusion

The bill will modify a specific section of the Internal Revenue Code concerning scholarships and fellowship grants. The changes will allow Pell Grants to be classified within a broader category of qualified tuition and related expenses. This means that Pell Grants, when used for these expenses, will not be counted as income for tax purposes. As a result:

- Pell Grant recipients will not have to report these funds as income on their federal tax returns.

- Students can possibly receive more financial aid without adverse tax implications.

2. No Adjustment under American Opportunity and Lifetime Learning Credits

The bill also specifies that Pell Grants will be excluded from adjustments concerning certain education tax credits. This change signifies that any financial aid received through Pell Grants will not affect eligibility for:

- American Opportunity Tax Credit

- Lifetime Learning Credit

This provision aims to ensure that students can benefit fully from both the Pell Grants and these educational tax credits without financial penalties.

3. Effective Date

The amendments proposed in this bill will take effect for taxable years beginning after December 31, 2025. Therefore, students who receive Pell Grants starting in the year 2026 will see the impacts of these changes in their federal income tax filing for that year and beyond.

Summary

In summary, the Tax-Free Pell Grant Act will enhance the treatment of Pell Grants in the tax code, allowing recipients to exclude these financial aids from their gross income, which could lead to improved financial outcomes for students and families utilizing these grants for education-related expenses.

Relevant Companies

None found.

This is an AI-generated summary of the bill text. There may be mistakes.

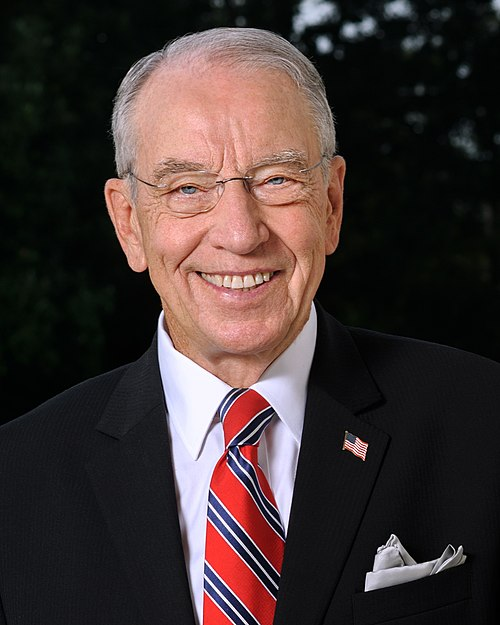

Sponsors

4 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| May. 06, 2025 | Introduced in Senate |

| May. 06, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.