S. 1603: Preserving Rural Housing Investments Act

This bill, titled the Preserving Rural Housing Investments Act

, aims to clarify the tax-exempt status of certain entities related to government-sponsored enterprises (GSEs), specifically the Federal Home Loan Mortgage Corporation (Freddie Mac) and the Federal National Mortgage Association (Fannie Mae). The key changes proposed in this bill are as follows:

Modification of Tax-Exempt Entity Definition

The bill amends existing tax law to specify that, when determining tax-exempt entities under the Internal Revenue Code, the definition will explicitly exclude the United States and any of its agencies or instrumentalities when it comes to the Federal Home Loan Mortgage Corporation and the Federal National Mortgage Association. This means that these GSEs will not be classified as tax-exempt entities for certain transactions involving their stock, which could affect how income from these entities is taxed.

Effective Date

The changes outlined in the bill are set to apply to taxable years ending after July 30, 2008. Although this date may seem retroactive concerning the scope of the amendment, it establishes an official clarification for the future handling of tax exemptions related to these entities.

Intent and Implications

The intent behind this bill is to ensure that the tax treatment of specific financial transactions involving these GSEs is clear and consistent. By clarifying the status of these entities, the bill aims to protect rural housing investments and encourage stability within housing finance, particularly in relation to the functioning and funding of these government-sponsored enterprises in rural areas.

Relevant Companies

- FNMA - Federal National Mortgage Association (Fannie Mae): This company could be directly impacted as the bill clarifies tax implications for entities involving GSEs, which may affect its operations and financial transactions.

- FHLMC - Federal Home Loan Mortgage Corporation (Freddie Mac): Similar to Fannie Mae, this GSE will also be affected by the clarified tax rules, potentially influencing its financial structuring and investor interactions.

This is an AI-generated summary of the bill text. There may be mistakes.

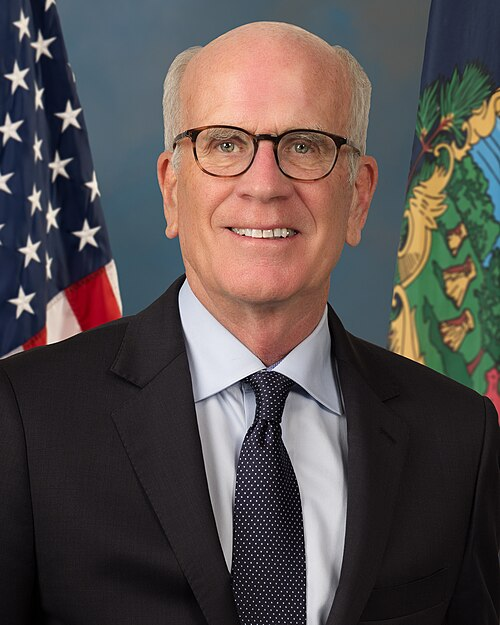

Sponsors

4 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| May. 06, 2025 | Introduced in Senate |

| May. 06, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.