S. 1544: Insurance Data Protection Act

The Insurance Data Protection Act is a legislative proposal that aims to alter how the federal government interacts with insurance companies regarding their data. The bill specifically focuses on limiting the ability of federal financial regulators, such as the Federal Insurance Office and the Office of Financial Research, to collect data directly from insurance companies. Here are the key components of the bill:

1. Prohibition on Data Collection

The bill prohibits the Federal Insurance Office and other financial regulators from collecting nonpublicly available data directly from insurance companies. This means any type of data that is not publicly accessible cannot be obtained by these federal agencies without going through specific procedures.

2. Coordination Before Data Collection

Before any data collection from an insurance company, a financial regulator is required to coordinate with relevant federal and state regulatory agencies to check if the data is already available from those sources. If the data is accessible in a timely manner from other regulators, it must be obtained from those sources instead of directly from the insurance companies.

3. Limitations on Subpoenas

The bill places limitations on the authority of the Office of Financial Research regarding subpoenas for data from insurance companies. It specifies that insurance companies, as defined in the proposal, cannot be subjected to subpoenas under certain sections of the Financial Stability Act of 2010.

4. Confidentiality Protections

The legislation includes provisions to protect confidentiality. Any data shared by an insurance company with a financial regulator will not lose its confidentiality or any legal privileges associated with that data. Additionally, existing confidentiality agreements related to that data will still apply even after it has been shared with a regulator.

5. Information Sharing with State Regulators

Data collected by federal financial regulators may be shared with state insurance regulators, but this will be done through formal information-sharing agreements that adhere to federal laws and maintain data confidentiality protections.

6. Technical Amendments

The bill also includes technical amendments to existing laws, such as the Dodd-Frank Act, to accommodate the changes it proposes regarding the treatment of data from insurance companies.

7. Legislative Process

The bill was introduced in the Senate and has been referred to the Committee on Banking, Housing, and Urban Affairs for further consideration.

Relevant Companies

- AIG (American International Group, Inc.): May be impacted due to the restrictions on data collection and its administrative processes regarding data sharing with regulators.

- PRU (Prudential Financial, Inc.): Affects their interactions with financial regulators, potentially impacting their compliance and reporting obligations.

- MET (MetLife, Inc.): Similar to AIG and Prudential, changes to data privacy could alter their regulatory compliance practices.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

12 bill sponsors

-

TrackKatie Boyd Britt

Sponsor

-

TrackJim Banks

Co-Sponsor

-

TrackKevin Cramer

Co-Sponsor

-

TrackMike Crapo

Co-Sponsor

-

TrackBill Hagerty

Co-Sponsor

-

TrackJohn Kennedy

Co-Sponsor

-

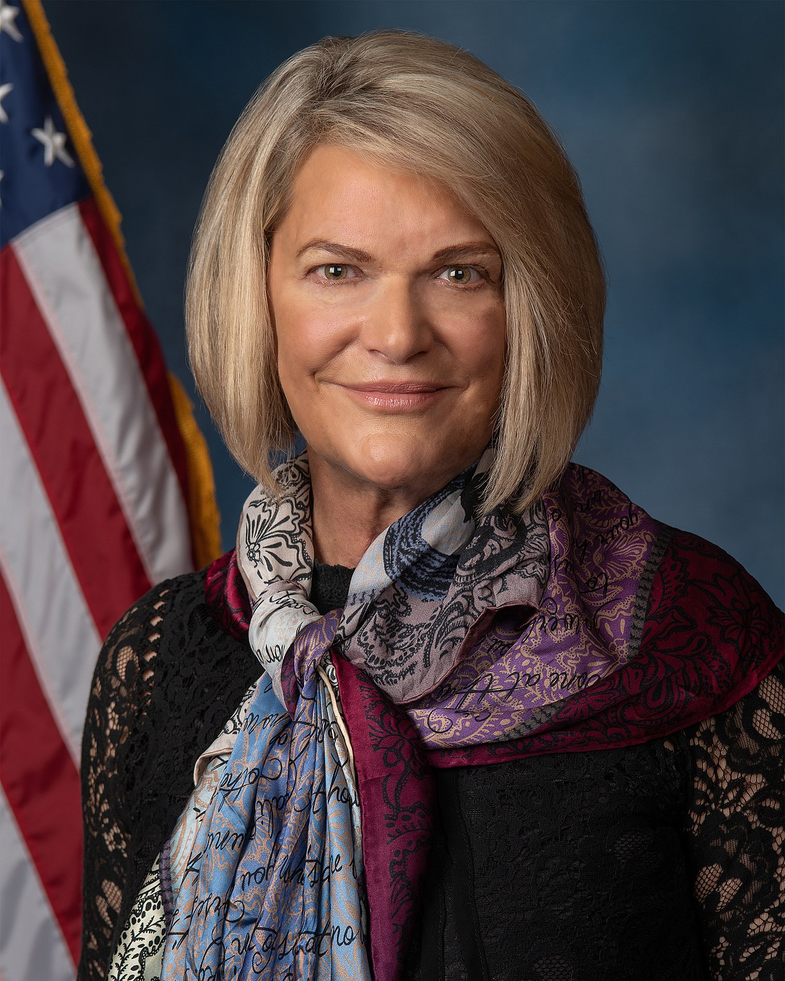

TrackCynthia M. Lummis

Co-Sponsor

-

TrackBernie Moreno

Co-Sponsor

-

TrackPete Ricketts

Co-Sponsor

-

TrackMike Rounds

Co-Sponsor

-

TrackTim Scott

Co-Sponsor

-

TrackThom Tillis

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 30, 2025 | Introduced in Senate |

| Apr. 30, 2025 | Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.