S. 1438: Disaster Related Extension of Deadlines Act

The proposed bill, titled the Disaster Related Extension of Deadlines Act, aims to amend the Internal Revenue Code to provide certain flexibility regarding tax deadlines in the event of disasters, significant fires, or acts of terrorism or military action. The main components of the bill are outlined below:

Extension of Tax Filing Deadlines

The bill seeks to modify Section 7508A of the Internal Revenue Code, which currently allows for the postponement of tax-related deadlines due to disasters. Specifically, it includes the following provisions:

- Extension of Time for Filing Returns: The amendment would mean that any period of time disregarded under this provision would be recognized as an extension when determining the deadline for filing tax returns. Thus, if a disaster leads to a postponement, taxpayers would not be penalized for late filing based on this extended timeline.

- Effective Date: These changes would be applicable to all claims filed after the enactment of this legislation.

Changes to Collection Notices

The bill also aims to revise Section 6303(b) to address the timing of tax collection notices. This includes:

- Postponement Consideration: The last date for tax payment will also take into account the periods disregarded under the disaster-related extensions. This means that if a taxpayer is affected by a disaster, the deadline for when they must pay taxes will reflect the additional time granted due to the affected situation.

- Effective Date: These amendments regarding collection notices would come into effect for notices issued after the bill’s enactment.

Rationale Behind the Bill

The rationale for these adjustments is to provide relief to taxpayers who are facing difficulties during or after a disaster. By extending deadlines for filing and payment, the bill aims to reduce the financial burden on individuals and businesses affected by such unforeseen events.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

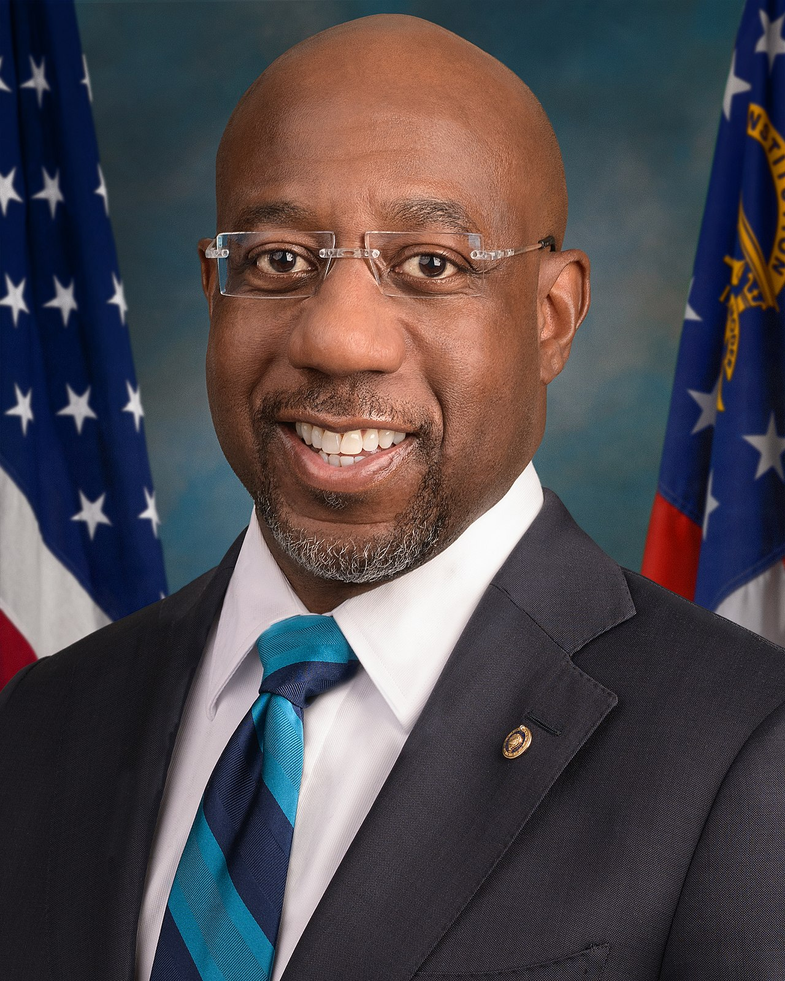

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 10, 2025 | Introduced in Senate |

| Apr. 10, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.