S. 1416: Reduction of Excess Business Holding Accrual Act

The Reduction of Excess Business Holding Accrual Act is a proposed piece of legislation that aims to amend existing tax laws related to private foundations and their excess business holdings. Here’s a breakdown of the key components of the bill:

Objective

The primary objective of this bill is to revise the rules surrounding how private foundations are taxed on their investments in businesses structured as owner-operated entities, particularly those that are employee-owned.

Key Provision

The bill introduces a specific provision that states:

- If a business enterprise purchases voting stock that is not easily tradable, from an employee stock ownership plan (ESOP) in which its employees are participants, this stock will be considered as "outstanding" for tax purposes.

- This applies only to stock purchased on or after January 1, 2020, and the stock must be held as treasury stock or otherwise canceled or retired.

- The provision also has a cap; it only allows this treatment to the extent that it does not exceed 49% ownership in a business for the allowed holdings of private foundations.

- Additionally, this special consideration does not apply to stock purchases within the first 10 years of the establishment of the ESOP.

Implications

The changes proposed by this bill would impact how private foundations manage their investments in businesses owned, or partially owned, by their employees. The goal is to encourage foundations to invest in employee ownership without being taxed disproportionately on those investments, thereby promoting employee stock ownership models.

Effective Date

The provisions of the act, if passed, would take effect for taxable years that end after the bill is enacted.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

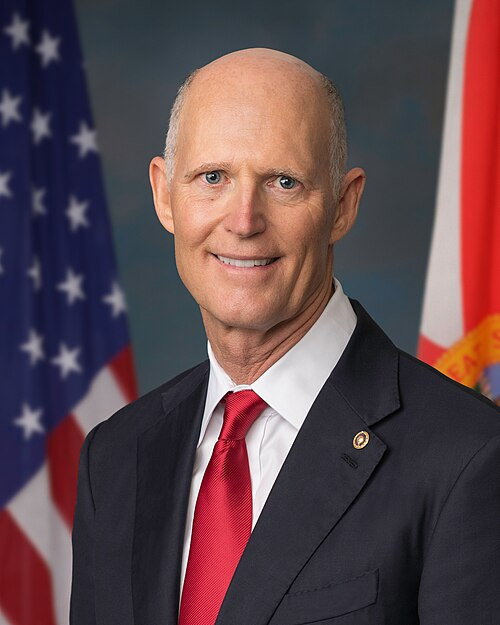

Sponsors

1 sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 10, 2025 | Introduced in Senate |

| Apr. 10, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.