S. 1393: American Family Act

The "American Family Act" aims to enhance financial support for families with children through a refundable child tax credit. Here are the key components of the bill:

Child Tax Credit Structure

The bill introduces a monthly advance payment system for eligible taxpayers, significantly changing how families receive financial assistance for their children. The details of the child tax credit are as follows:

- Families will receive $300 each month for every child over the age of 6.

- For children under the age of 6, the monthly payment will be $360.

- The credit will be subject to income thresholds, meaning it will phase out for higher-income families based on modified adjusted gross income.

Eligibility and Payment Processing

The bill includes provisions to establish how to determine eligibility for these child tax credits. This involves:

- Identifying a reference month for assessing eligibility and aligning it with the taxable year.

- Establishing methods for claiming the credits, ensuring a clear process for families to access funds.

- Addressing any competing claims that may arise over eligibility or payment amounts.

- Defining rules for the distribution of payments, including requirements for electronic transfers to make the process more efficient.

- Setting notification requirements to inform families about their eligibility and payment status.

Implementation of Monthly Payments

The advancement of the child tax credit to a monthly payment model is designed to provide families with immediate financial relief. This system aims to ease the financial burden on families with children by allowing them to receive support directly and on a regular basis rather than waiting until the tax season to claim a larger sum.

Income Considerations

The bill's structure ensures that the benefits are targeted towards families that need them most by introducing income thresholds. As families’ income rises above certain limits, the amount they receive from the child tax credit will gradually decrease, helping to allocate resources efficiently.

Administrative Aspects

The legislation outlines specific administrative details to facilitate the efficient processing of these payments. This includes criteria for maintaining records, ensuring timely disbursements, and resolving disputes related to eligibility or payment amounts to minimize confusion and maximize reach.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

45 bill sponsors

-

TrackMichael F. Bennet

Sponsor

-

TrackAngela Alsobrooks

Co-Sponsor

-

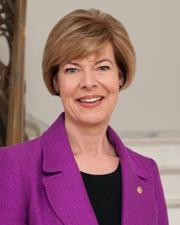

TrackTammy Baldwin

Co-Sponsor

-

TrackRichard Blumenthal

Co-Sponsor

-

TrackLisa Blunt Rochester

Co-Sponsor

-

TrackCory A. Booker

Co-Sponsor

-

TrackMaria Cantwell

Co-Sponsor

-

TrackChristopher A. Coons

Co-Sponsor

-

TrackCatherine Cortez Masto

Co-Sponsor

-

TrackTammy Duckworth

Co-Sponsor

-

TrackRichard J. Durbin

Co-Sponsor

-

TrackJohn Fetterman

Co-Sponsor

-

TrackRuben Gallego

Co-Sponsor

-

TrackKirsten E. Gillibrand

Co-Sponsor

-

TrackMargaret Wood Hassan

Co-Sponsor

-

TrackMartin Heinrich

Co-Sponsor

-

TrackMazie K. Hirono

Co-Sponsor

-

TrackTim Kaine

Co-Sponsor

-

TrackMark Kelly

Co-Sponsor

-

TrackAndy Kim

Co-Sponsor

-

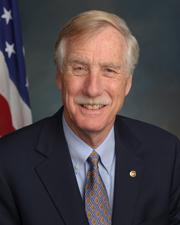

TrackAngus S. King Jr.

Co-Sponsor

-

TrackAmy Klobuchar

Co-Sponsor

-

TrackBen Ray Lujan

Co-Sponsor

-

TrackEdward J. Markey

Co-Sponsor

-

TrackJeff Merkley

Co-Sponsor

-

TrackChristopher Murphy

Co-Sponsor

-

TrackPatty Murray

Co-Sponsor

-

TrackAlex Padilla

Co-Sponsor

-

TrackGary C. Peters

Co-Sponsor

-

TrackJack Reed

Co-Sponsor

-

TrackJacky Rosen

Co-Sponsor

-

TrackBernard Sanders

Co-Sponsor

-

TrackBrian Schatz

Co-Sponsor

-

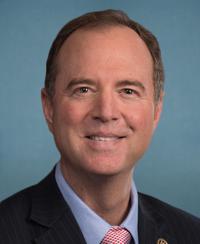

TrackAdam B. Schiff

Co-Sponsor

-

TrackCharles E. Schumer

Co-Sponsor

-

TrackJeanne Shaheen

Co-Sponsor

-

TrackElissa Slotkin

Co-Sponsor

-

TrackTina Smith

Co-Sponsor

-

TrackChris Van Hollen

Co-Sponsor

-

TrackMark R. Warner

Co-Sponsor

-

TrackRaphael G. Warnock

Co-Sponsor

-

TrackElizabeth Warren

Co-Sponsor

-

TrackPeter Welch

Co-Sponsor

-

TrackSheldon Whitehouse

Co-Sponsor

-

TrackRon Wyden

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 09, 2025 | Introduced in Senate |

| Apr. 09, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.