S. 1371: S-Corporation Additional Participation Act of 2025

The S-Corporation Additional Participation Act of 2025 proposes changes to the Internal Revenue Code that would increase the maximum number of shareholders allowed in S corporations from 100 to 250. S corporations are a specific type of corporation in the United States that pass income, losses, deductions, and credits directly to their shareholders for federal tax purposes. By raising the limit on shareholders, the bill aims to allow more individuals to invest in S corporations, thereby potentially fostering growth and investment in smaller businesses.

Key Provisions

- Increase in Shareholder Limit: The current limit of 100 shareholders for S corporations would be increased to 250. This change could enable larger groups of people to collaborate in ownership of an S corporation, which may enhance capital raising opportunities.

- Effective Date: The increase in the shareholder limit would apply to taxable years beginning after December 31, 2025. This means that any changes resulting from the bill would not take effect until after this date.

Impact on S Corporations

Increasing the shareholder limit could potentially benefit the following areas:- Investment Opportunities: More investors could lead to greater capital for S corporations, which may facilitate expansion, innovation, and operational growth.

- Business Structures: Businesses that choose to structure themselves as S corporations may have more flexibility in attracting diverse capital sources.

- Tax Structure:** Since S corporations would remain pass-through entities for tax purposes, the increase in shareholders might enhance the appeal of this structure for more businesses.

Conclusion

By enabling a greater number of shareholders, the S-Corporation Additional Participation Act of 2025 seeks to adapt the legal framework governing S corporations to current market conditions, potentially promoting business growth and investment.Relevant Companies

None found.

This is an AI-generated summary of the bill text. There may be mistakes.

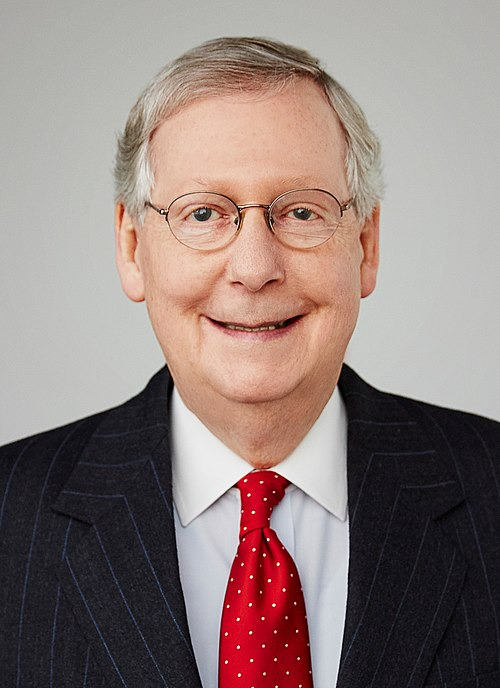

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 09, 2025 | Introduced in Senate |

| Apr. 09, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.