S. 1243: Paying a Fair Share Act of 2025

The "Paying a Fair Share Act of 2025" aims to establish a new tax for high-income earners to ensure they contribute a fair amount to federal taxes. Here are the key elements of the bill:

High-Income Taxpayer Definition

The bill defines a "high-income taxpayer" as an individual with an adjusted gross income (AGI) exceeding $1,000,000 for a taxable year. For married individuals filing separately, the threshold is set at $500,000. The income threshold will be adjusted for inflation starting from the year 2026.

Fair Share Tax Implementation

The bill introduces a phase-in tax specifically for high-income taxpayers, which is in addition to any other federal taxes they owe. The tax will be calculated based on the excess income over $1,000,000, using a specific formula:

- The tax is determined by multiplying a certain amount by a fraction.

- The numerator of this fraction is the excess of the taxpayer's AGI over $1,000,000.

- The denominator is always $1,000,000.

Tentative Fair Share Tax

The tentative fair share tax is set at 30% of the amount exceeding the AGI of $1,000,000, after considering a modified charitable contribution deduction for the year. If an individual does not itemize deductions, their modified charitable contribution deduction is zero.

Exemption for Existing Tax Liabilities

The final amount of the fair share tax will be reduced by existing tax liabilities, including:

- Regular tax liability, excluding any liability from the fair share tax.

- Tax imposed under the alternative minimum tax (AMT).

- Payroll taxes for the taxable year.

Special Provisions for Estates and Trusts

For estates and trusts, adjusted gross income will be calculated according to specific rules outlined in the related tax code.

Clerical Amendments

The bill updates the Internal Revenue Code to include the newly defined "Fair Share Tax on High-Income Taxpayers." This is primarily a formal update to accommodate the new provisions introduced by the bill.

Effective Date

The provisions of this bill are set to apply to taxable years beginning after December 31, 2024.

Sense of the Senate

The bill expresses the Senate's view that comprehensive tax reform should be pursued. This includes eliminating unnecessary tax loopholes and ensuring that wealthy individuals pay a fairer amount. The act is viewed as an initial step towards broader tax reform and is expected to reduce the federal deficit significantly.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

16 bill sponsors

-

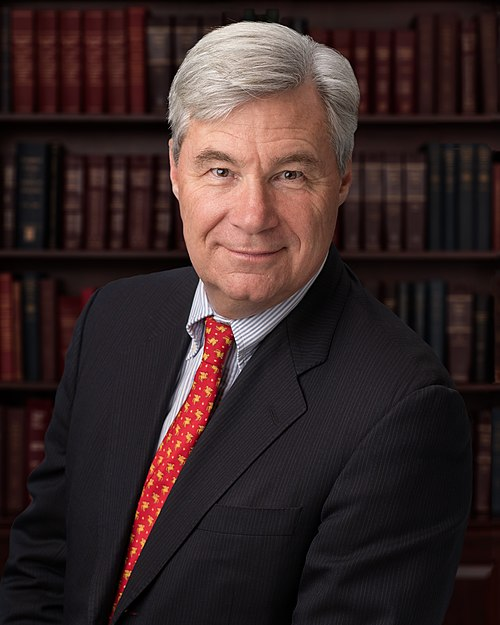

TrackSheldon Whitehouse

Sponsor

-

TrackTammy Baldwin

Co-Sponsor

-

TrackRichard Blumenthal

Co-Sponsor

-

TrackCory A. Booker

Co-Sponsor

-

TrackRichard J. Durbin

Co-Sponsor

-

TrackMazie K. Hirono

Co-Sponsor

-

TrackAmy Klobuchar

Co-Sponsor

-

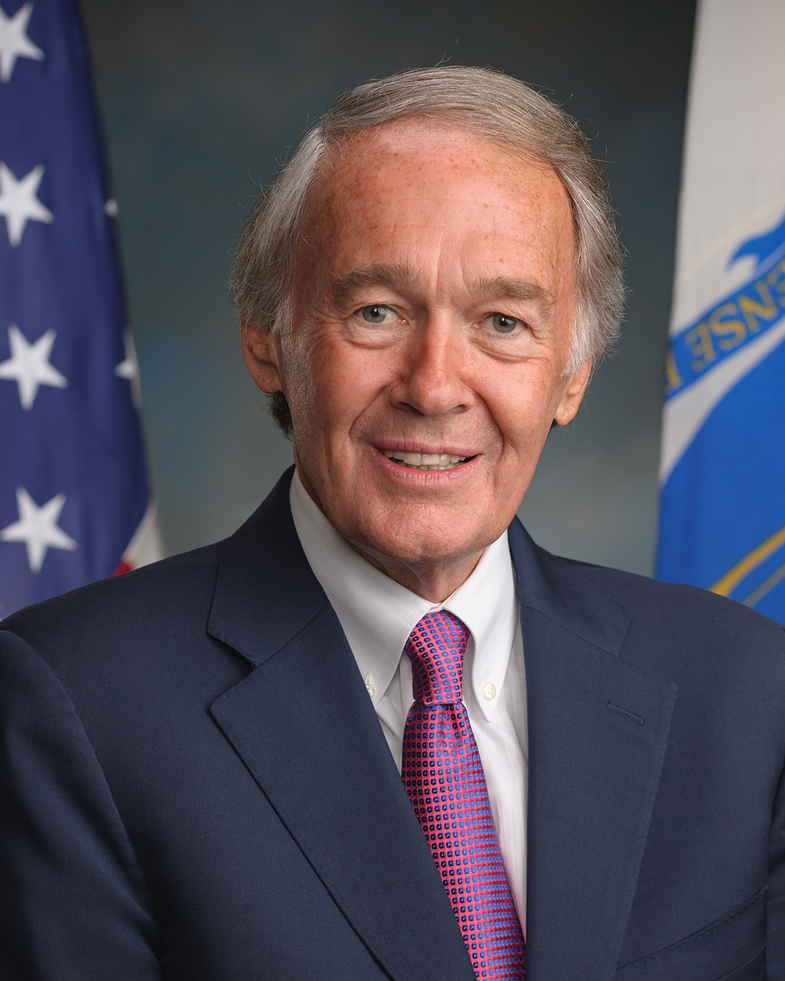

TrackEdward J. Markey

Co-Sponsor

-

TrackJeff Merkley

Co-Sponsor

-

TrackAlex Padilla

Co-Sponsor

-

TrackJack Reed

Co-Sponsor

-

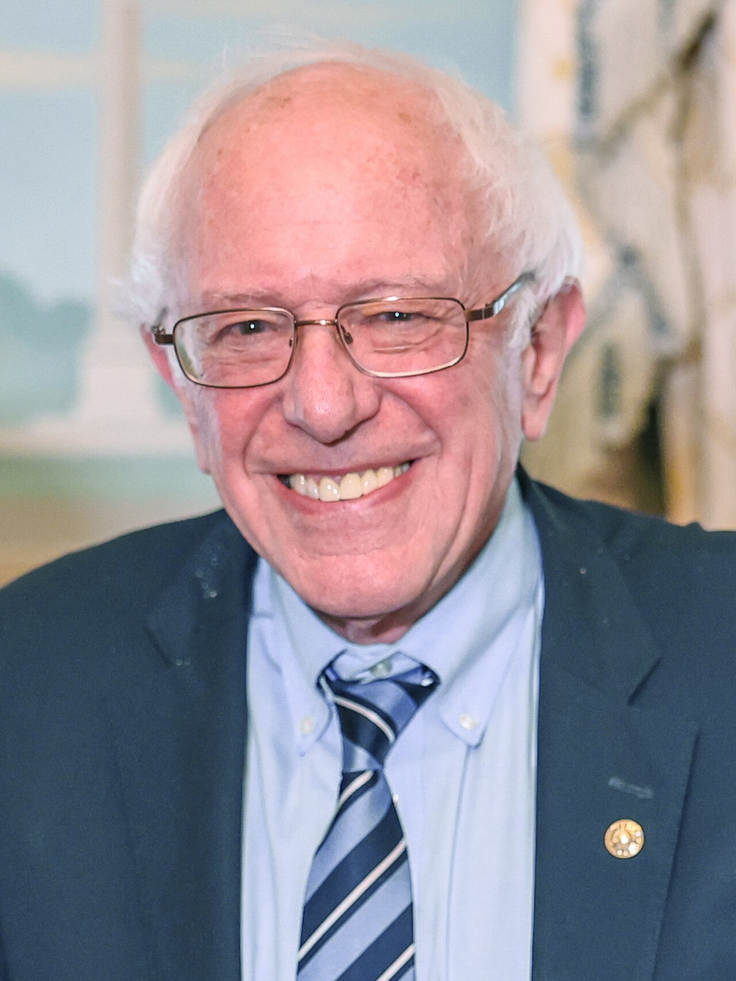

TrackBernard Sanders

Co-Sponsor

-

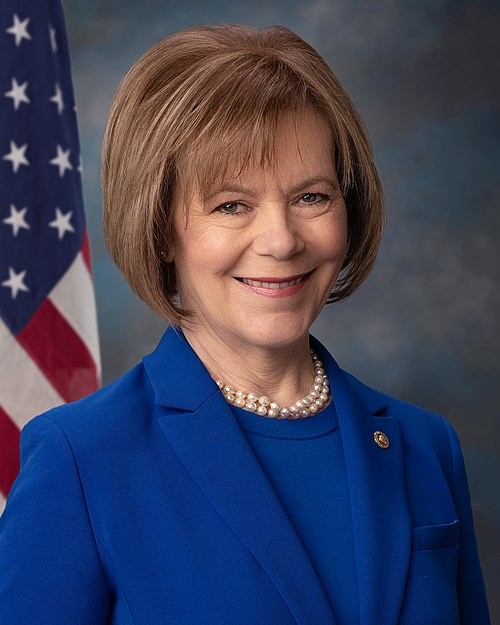

TrackTina Smith

Co-Sponsor

-

TrackChris Van Hollen

Co-Sponsor

-

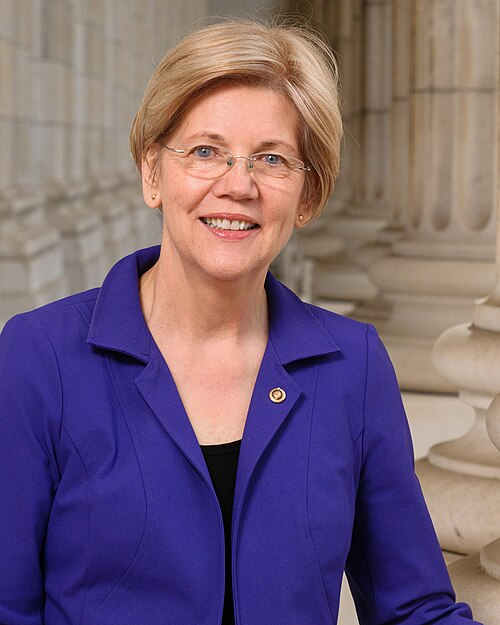

TrackElizabeth Warren

Co-Sponsor

-

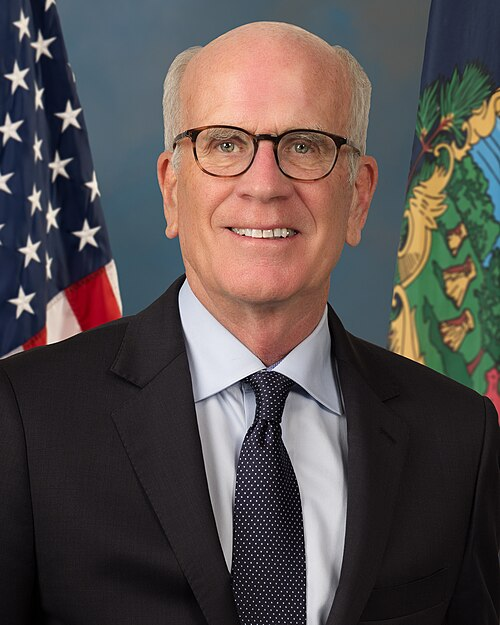

TrackPeter Welch

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 01, 2025 | Introduced in Senate |

| Apr. 01, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.