S. 1223: Prohibiting Foreign Adversary Interference in Cryptocurrency Markets Act

This bill, titled the Prohibiting Foreign Adversary Interference in Cryptocurrency Markets Act, aims to amend the Commodity Exchange Act to restrict certain foreign entities from participating in U.S. digital commodity markets.

Key Provisions

- Definition of Terms: The bill defines several key terms, including:

- Covered entity: Entities organized or established in countries considered foreign adversaries, such as China, Cuba, Iran, North Korea, Russia, and Venezuela.

- Digital commodity: A fungible digital asset, including cryptocurrencies and virtual currencies, but excluding physical commodities, securities, and other specified items.

- Digital commodity platform: Any business engaged in activities related to digital commodities, including brokers, custodians, dealers, and trading facilities.

- Prohibition on Registration: The bill prohibits the registration of digital commodity platforms that are fully or partially owned by covered entities. This means that any platform associated with these foreign adversaries cannot operate legally in U.S. markets.

- Revocation of Registration: If a registered digital commodity platform is acquired by a covered entity, the bill mandates that the U.S. Commodity Futures Trading Commission (CFTC) revoke that platform's registration. This would enforce strict oversight and likely require platforms to monitor ownership structures to ensure compliance.

Impact on U.S. Digital Commodity Markets

The proposed legislation is intended to enhance the security and integrity of U.S. digital commodity markets by preventing potential interference or influence from these foreign adversaries. It emphasizes a cautious approach to foreign investment and participation in the digital commodity sector, potentially affecting how companies engage with overseas markets.

Compliance and Regulatory Oversight

The CFTC would be responsible for enforcing these provisions, which may involve increased scrutiny of registration applications and ongoing ownership disclosures from existing platforms. The bill creates a framework that emphasizes national security concerns regarding foreign influence in crucial financial sectors, particularly in emerging technologies like cryptocurrencies.

Relevant Companies

- COIN (Coinbase Global, Inc.): As a prominent cryptocurrency exchange, Coinbase could be affected if any of its platforms are found to have foreign adversary ownership.

- FTT (FTX Trading Ltd.): Depending on ownership structures and affiliations, FTX may face operational challenges if it has ties to any covered entities.

- BTC-USD (Bitcoin): Market dynamics surrounding Bitcoin and its exchanges could be impacted, particularly if exchanges have foreign adversary ties.

This is an AI-generated summary of the bill text. There may be mistakes.

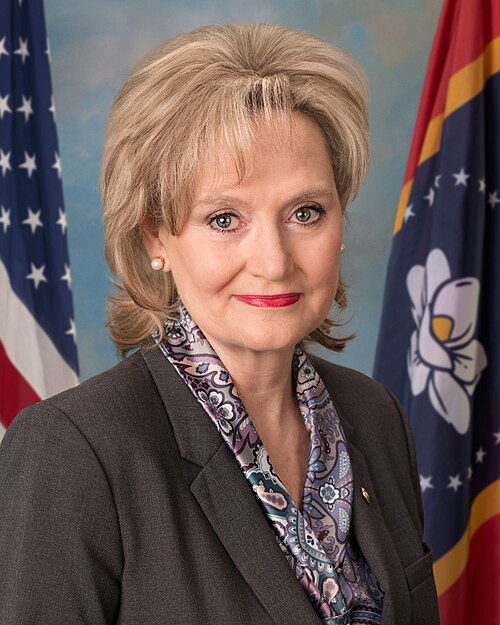

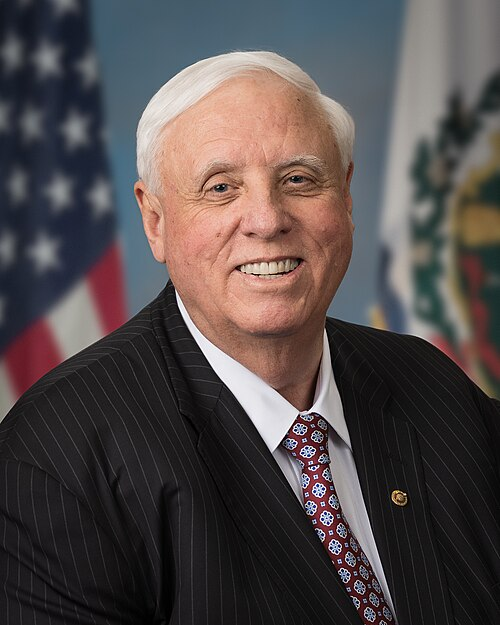

Sponsors

3 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 01, 2025 | Introduced in Senate |

| Apr. 01, 2025 | Read twice and referred to the Committee on Agriculture, Nutrition, and Forestry. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.