S. 1222: Financial Freedom Act of 2025

This bill, titled the Financial Freedom Act of 2025, seeks to modify regulations that govern how pension plans manage investments related to individual retirement accounts (IRAs). Specifically, the bill focuses on the authority of the Secretary of Labor in relation to the types of investments that can be made available to participants and beneficiaries who have control over their accounts.

Key Provisions of the Bill

- The bill authorizes participants and beneficiaries of pension plans that permit them to control their own accounts to have a broader choice of investment options.

- The Secretary of Labor would be prohibited from imposing restrictions or regulations that limit the types of investments available through self-directed brokerage windows. This means that investment firms and plan fiduciaries must provide a wide range of investment alternatives for participants to choose from.

- Fiduciaries managing these plans would not be required to select or avoid particular investment types, as long as they allow individuals the opportunity to decide how to invest their assets within the predetermined range of options.

- Any existing regulations that require specific investment selections to be favored or disfavored would need to be assessed based purely on the risk-return characteristics of the investments, making the decision-making more flexible for the participants.

Broader Implications

The bill aims to enhance the autonomy of individuals over their retirement savings by ensuring that they have access to a diverse array of investment choices. It addresses the need for flexibility in investment strategies in response to market dynamics, potentially allowing for better performance of retirement accounts based on individual risk preferences and financial goals.

As a further technical aspect, if a fiduciary decides to offer a self-directed brokerage window, the Secretary cannot override the range of investment options available, ensuring that participants can invest in a manner that aligns with their preferences without undue regulatory hindrance.

Relevant Companies

- BLK (BlackRock, Inc.) - As a leading investment management firm, BlackRock could see changes in how it structures investment options within retirement plans.

- VFINX (Vanguard 500 Index Fund) - As a large provider of mutual funds and retirement accounts, Vanguard may need to adjust the range of investment alternatives they offer in response to this legislation.

- SCHB (Schwab U.S. Broad Market ETF) - As a provider of ETFs, Schwab may experience impacts related to the availability of investment choices in self-directed accounts.

This is an AI-generated summary of the bill text. There may be mistakes.

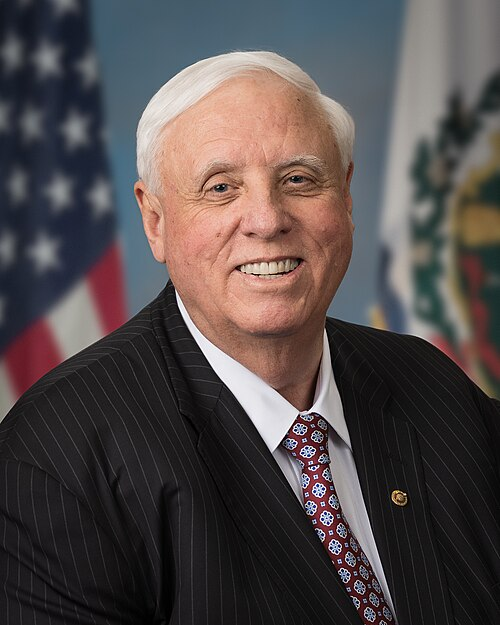

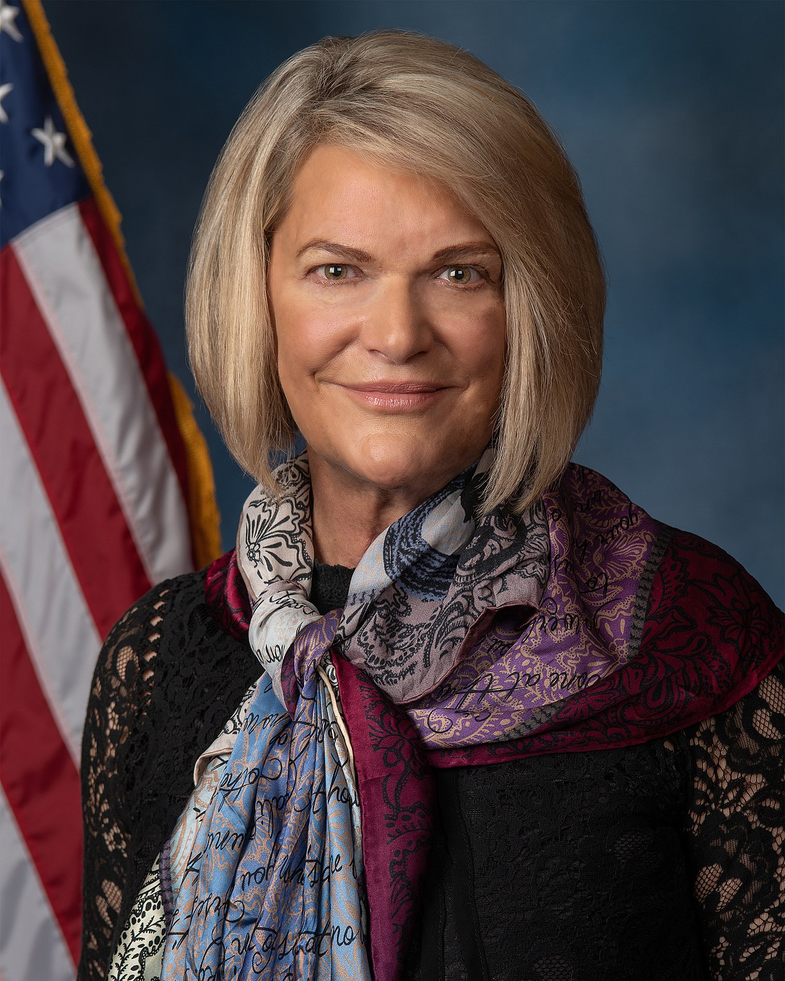

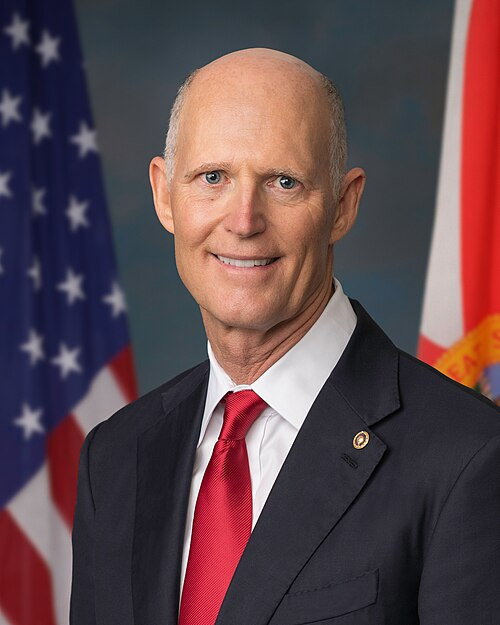

Sponsors

4 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 01, 2025 | Introduced in Senate |

| Apr. 01, 2025 | Read twice and referred to the Committee on Health, Education, Labor, and Pensions. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.