S. 1111: To amend the Internal Revenue Code of 1986 to allow for payments to certain individuals who dye fuel, and for other purposes.

This bill proposes an amendment to the Internal Revenue Code of 1986, specifically aimed at individuals who deal with dyed diesel fuel and kerosene. Here are the main points:

Payment to Individuals Who Dye Fuel

The bill introduces a new section that allows payments to individuals who remove certain types of dyed diesel fuel or kerosene from a terminal. This payment is meant to reimburse them for specific fuel taxes they have already paid.

Eligibility Requirements

For individuals to qualify for these payments, they must meet specific criteria:

- They must prove to the Secretary of the Treasury that they have removed eligible indelibly dyed diesel fuel or kerosene.

- This fuel must have had taxes paid under a particular section of the tax code (section 4081) and must be exempt from taxation under another section (section 4082(a)).

Conforming Amendments

The bill also makes several amendments to existing tax code sections to include references to the new section regarding dyed fuel (section 6434). These changes ensure that the new provisions are incorporated into the current tax framework.

Effective Date

The changes and provisions established by this bill will come into effect 180 days after it is enacted. This means that individuals will need to wait for this period before they can begin receiving payments under the new provision.

Relevant Companies

None found.

This is an AI-generated summary of the bill text. There may be mistakes.

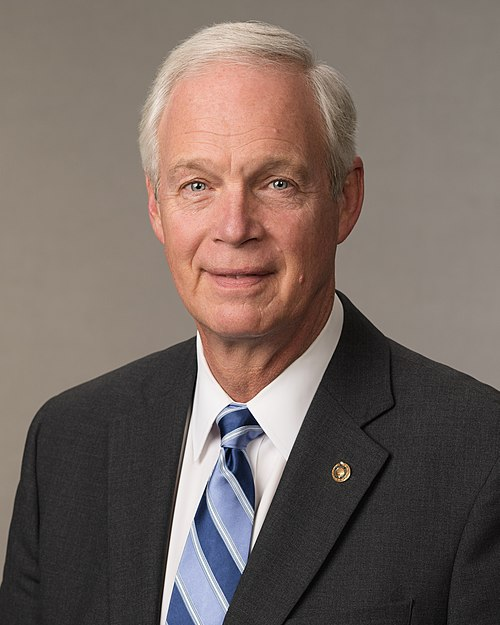

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Mar. 25, 2025 | Introduced in Senate |

| Mar. 25, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.