H.R. 995: No Tax Breaks for Outsourcing Act

The "No Tax Breaks for Outsourcing Act" seeks to amend the Internal Revenue Code with the goal of eliminating tax benefits that multinational corporations currently receive for outsourcing jobs and investments overseas. The legislation targets aspects of the tax system that allow these corporations to reduce their tax liability through various credits and deductions related to income generated outside of the United States.

Key Provisions

- Disallowed Tax Benefits: The bill disallows tax advantages for corporations that generate income from foreign investments and operations. This means that companies may no longer be able to claim certain deductions that significantly reduce their taxable income when they have operations or income outside the U.S.

- Foreign Tax Credits: The bill also focuses on revising the rules regarding foreign tax credits, which allow companies to reduce their U.S. tax burden based on taxes paid to foreign governments. Under this new legislation, the amount that can be credited for those payments may be limited.

- Treatment of Carryover Interest: The legislation includes provisions for how disallowed interest can be treated moving forward. Specifically, it states that any disallowed interest that a corporation cannot deduct will be considered part of a pre-change loss. This change is set to take effect for tax years beginning after December 31, 2024.

- Inverted Corporations: The bill aims to define the treatment of "inverted corporations" (those that were originally U.S.-based companies but then moved abroad to minimize tax obligations). Under the new provisions, if such corporations are primarily managed within the U.S., they will still be classified as domestic for tax purposes, subjecting them to U.S. taxation laws regardless of their incorporation status.

Objective and Implications

The overarching objective of this legislation is to ensure that U.S. corporations contribute fairly to the tax system by minimizing the loopholes that allow for significant tax advantages when outsourcing operations. The bill seeks to encourage corporations to maintain and grow their operations within the U.S., primarily by eliminating incentives to relocate or invest overseas.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

135 bill sponsors

-

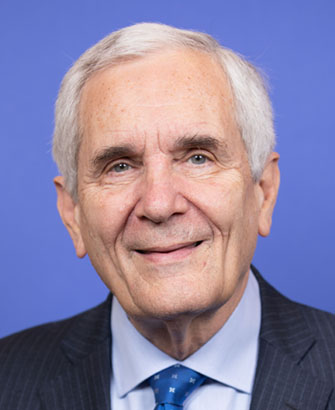

TrackLloyd Doggett

Sponsor

-

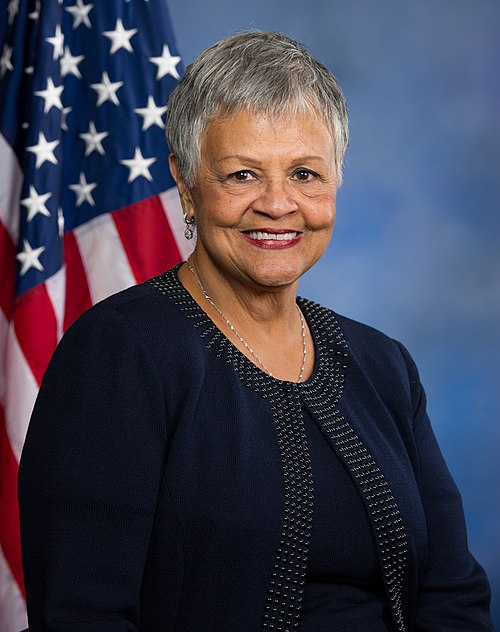

TrackAlma S. Adams

Co-Sponsor

-

TrackYassamin Ansari

Co-Sponsor

-

TrackBecca Balint

Co-Sponsor

-

TrackNanette Diaz Barragán

Co-Sponsor

-

TrackJoyce Beatty

Co-Sponsor

-

TrackWesley Bell

Co-Sponsor

-

TrackSanford D. Bishop, Jr.

Co-Sponsor

-

TrackSuzanne Bonamici

Co-Sponsor

-

TrackBrendan F. Boyle

Co-Sponsor

-

TrackShontel M. Brown

Co-Sponsor

-

TrackJulia Brownley

Co-Sponsor

-

TrackNikki Budzinski

Co-Sponsor

-

TrackAndré Carson

Co-Sponsor

-

TrackTroy A. Carter

Co-Sponsor

-

TrackGreg Casar

Co-Sponsor

-

TrackEd Case

Co-Sponsor

-

TrackJudy Chu

Co-Sponsor

-

TrackGilbert Ray Cisneros, Jr.

Co-Sponsor

-

TrackYvette D. Clarke

Co-Sponsor

-

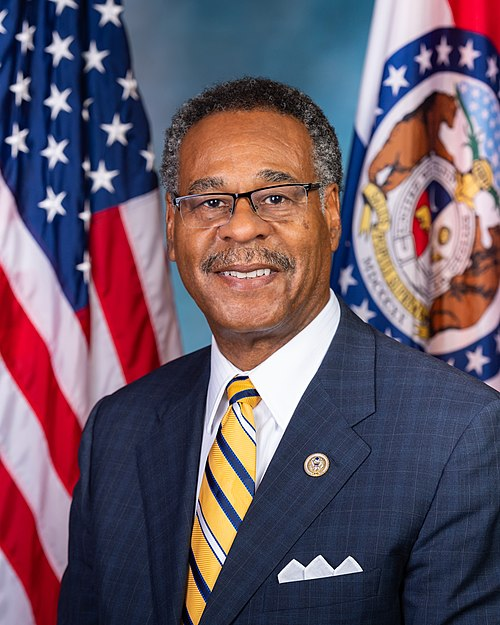

TrackEmanuel Cleaver

Co-Sponsor

-

TrackSteve Cohen

Co-Sponsor

-

TrackHerbert Conaway

Co-Sponsor

-

TrackJoe Courtney

Co-Sponsor

-

TrackJasmine Crockett

Co-Sponsor

-

TrackJason Crow

Co-Sponsor

-

TrackDonald G. Davis

Co-Sponsor

-

TrackDanny K. Davis

Co-Sponsor

-

TrackRosa L. DeLauro

Co-Sponsor

-

TrackMark DeSaulnier

Co-Sponsor

-

TrackMadeleine Dean

Co-Sponsor

-

TrackSuzan K. DelBene

Co-Sponsor

-

TrackChristopher R. Deluzio

Co-Sponsor

-

TrackMaxine Dexter

Co-Sponsor

-

TrackDebbie Dingell

Co-Sponsor

-

TrackVeronica Escobar

Co-Sponsor

-

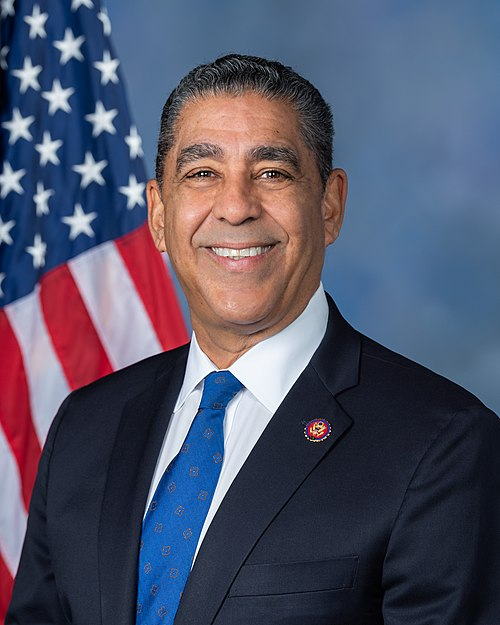

TrackAdriano Espaillat

Co-Sponsor

-

TrackDwight Evans

Co-Sponsor

-

TrackBill Foster

Co-Sponsor

-

TrackValerie P. Foushee

Co-Sponsor

-

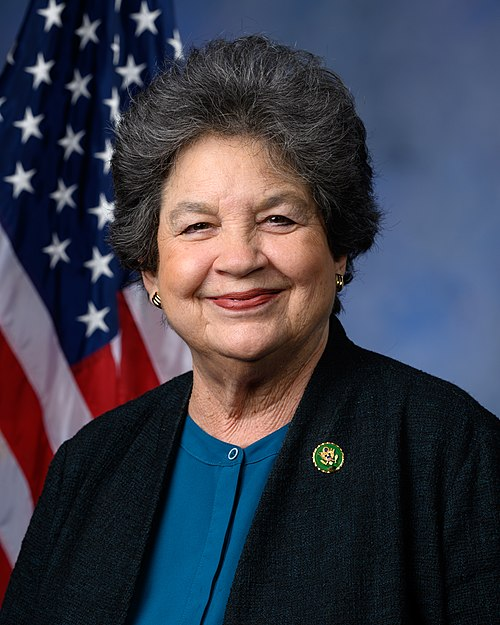

TrackLois Frankel

Co-Sponsor

-

TrackMaxwell Frost

Co-Sponsor

-

TrackJohn Garamendi

Co-Sponsor

-

TrackSylvia R. Garcia

Co-Sponsor

-

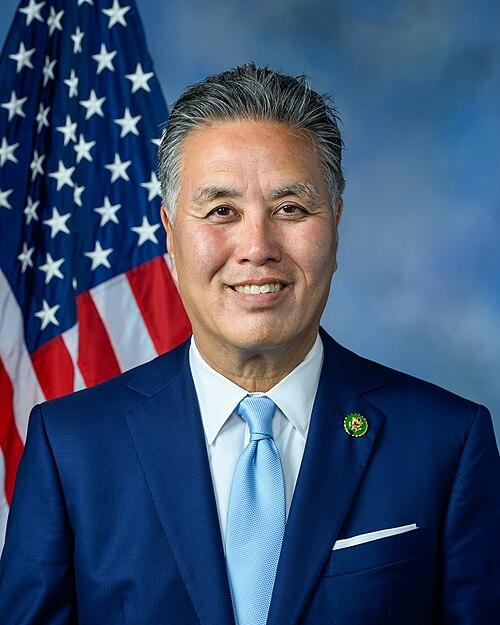

TrackRobert Garcia

Co-Sponsor

-

TrackJesús G. "Chuy" García

Co-Sponsor

-

TrackJared F. Golden

Co-Sponsor

-

TrackDaniel S. Goldman

Co-Sponsor

-

TrackJimmy Gomez

Co-Sponsor

-

TrackAl Green

Co-Sponsor

-

TrackRaúl M. Grijalva

Co-Sponsor

-

TrackJosh Harder

Co-Sponsor

-

TrackJahana Hayes

Co-Sponsor

-

TrackSteven Horsford

Co-Sponsor

-

TrackVal T. Hoyle

Co-Sponsor

-

TrackJared Huffman

Co-Sponsor

-

TrackGlenn Ivey

Co-Sponsor

-

TrackJonathan L. Jackson

Co-Sponsor

-

TrackPramila Jayapal

Co-Sponsor

-

TrackHenry C. "Hank" Johnson, Jr.

Co-Sponsor

-

TrackMarcy Kaptur

Co-Sponsor

-

TrackRobin L. Kelly

Co-Sponsor

-

TrackTimothy M. Kennedy

Co-Sponsor

-

TrackRo Khanna

Co-Sponsor

-

TrackGreg Landsman

Co-Sponsor

-

TrackJohn B. Larson

Co-Sponsor

-

TrackSummer L. Lee

Co-Sponsor

-

TrackTeresa Leger Fernandez

Co-Sponsor

-

TrackMike Levin

Co-Sponsor

-

TrackTed Lieu

Co-Sponsor

-

TrackStephen F. Lynch

Co-Sponsor

-

TrackSeth Magaziner

Co-Sponsor

-

TrackLucy McBath

Co-Sponsor

-

TrackSarah McBride

Co-Sponsor

-

TrackApril McClain Delaney

Co-Sponsor

-

TrackBetty McCollum

Co-Sponsor

-

TrackKristen McDonald Rivet

Co-Sponsor

-

TrackMorgan McGarvey

Co-Sponsor

-

TrackJames P. McGovern

Co-Sponsor

-

TrackGregory W. Meeks

Co-Sponsor

-

TrackRobert Menendez

Co-Sponsor

-

TrackGrace Meng

Co-Sponsor

-

TrackKweisi Mfume

Co-Sponsor

-

TrackSeth Moulton

Co-Sponsor

-

TrackFrank J. Mrvan

Co-Sponsor

-

TrackJerrold Nadler

Co-Sponsor

-

TrackJoe Neguse

Co-Sponsor

-

TrackDonald Norcross

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackAlexandria Ocasio-Cortez

Co-Sponsor

-

TrackIlhan Omar

Co-Sponsor

-

TrackFrank Pallone, Jr.

Co-Sponsor

-

TrackMarie Gluesenkamp Perez

Co-Sponsor

-

TrackChellie Pingree

Co-Sponsor

-

TrackMark Pocan

Co-Sponsor

-

TrackAyanna Pressley

Co-Sponsor

-

TrackDelia C. Ramirez

Co-Sponsor

-

TrackJamie Raskin

Co-Sponsor

-

TrackJosh Riley

Co-Sponsor

-

TrackDeborah K. Ross

Co-Sponsor

-

TrackPatrick Ryan

Co-Sponsor

-

TrackAndrea Salinas

Co-Sponsor

-

TrackMary Gay Scanlon

Co-Sponsor

-

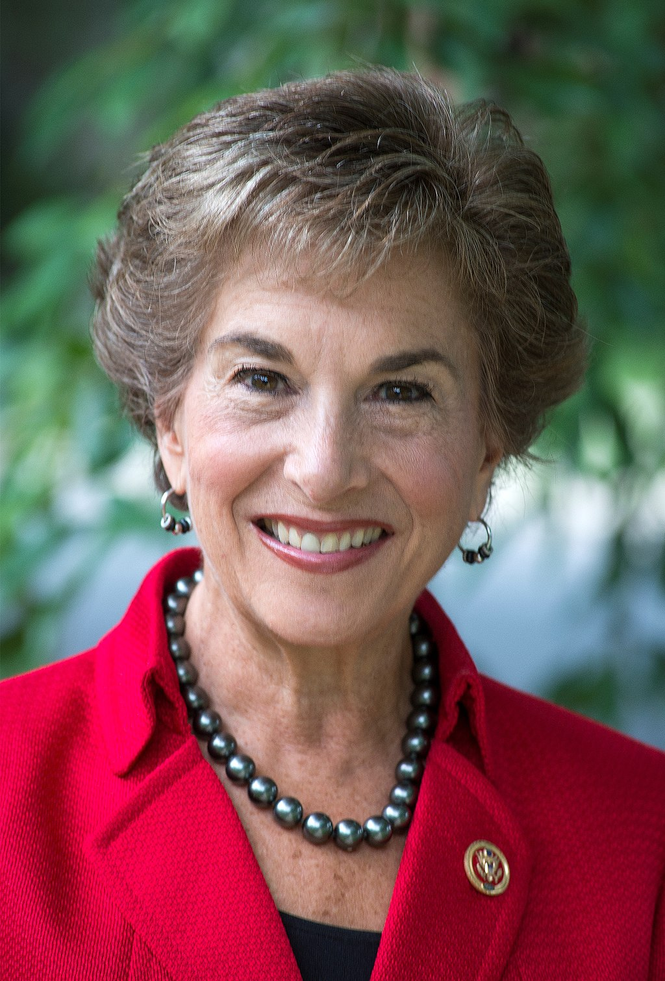

TrackJanice D. Schakowsky

Co-Sponsor

-

TrackKim Schrier

Co-Sponsor

-

TrackDavid Scott

Co-Sponsor

-

TrackBrad Sherman

Co-Sponsor

-

TrackLateefah Simon

Co-Sponsor

-

TrackAdam Smith

Co-Sponsor

-

TrackEric Sorensen

Co-Sponsor

-

TrackDarren Soto

Co-Sponsor

-

TrackMelanie A. Stansbury

Co-Sponsor

-

TrackHaley M. Stevens

Co-Sponsor

-

TrackThomas R. Suozzi

Co-Sponsor

-

TrackEmilia Strong Sykes

Co-Sponsor

-

TrackLinda T. Sánchez

Co-Sponsor

-

TrackMark Takano

Co-Sponsor

-

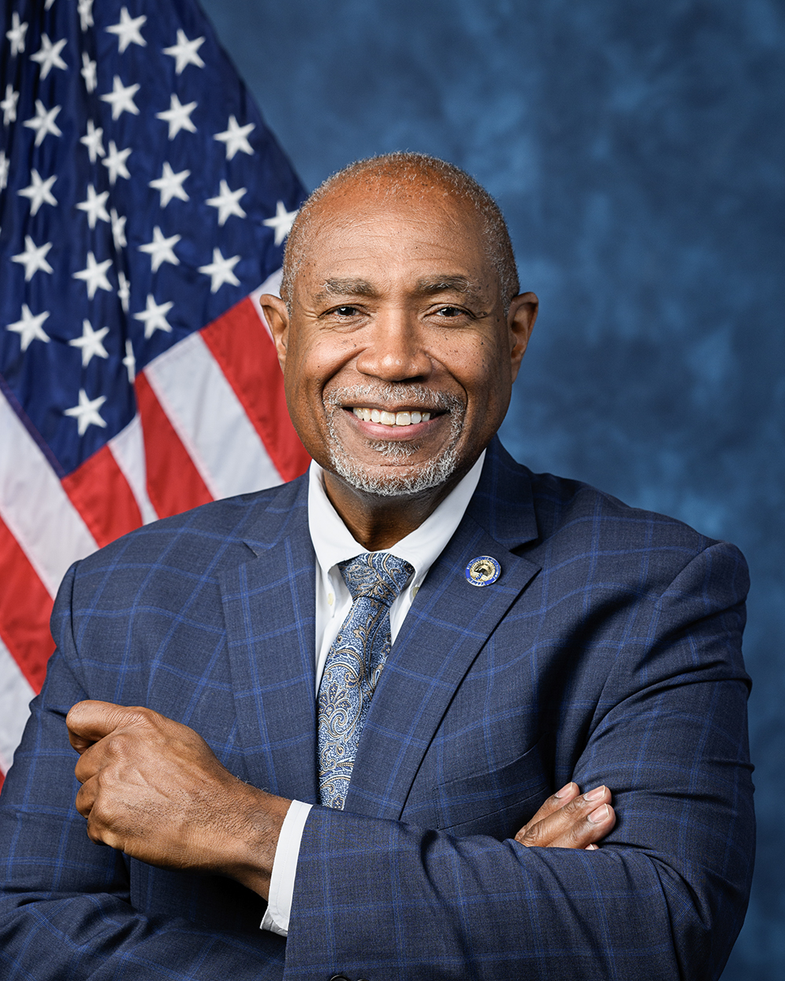

TrackShri Thanedar

Co-Sponsor

-

TrackBennie G. Thompson

Co-Sponsor

-

TrackDina Titus

Co-Sponsor

-

TrackRashida Tlaib

Co-Sponsor

-

TrackJill N. Tokuda

Co-Sponsor

-

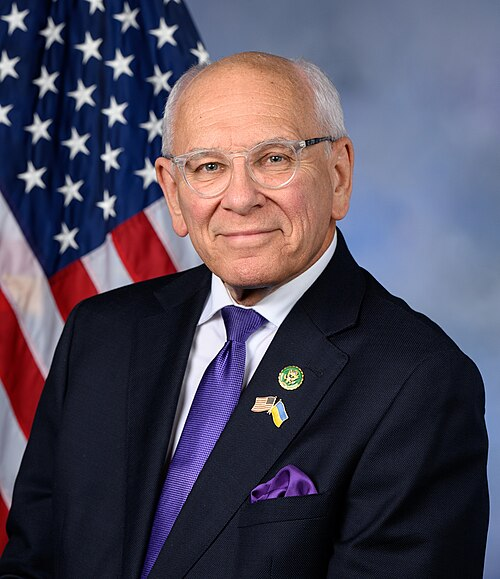

TrackPaul Tonko

Co-Sponsor

-

TrackRitchie Torres

Co-Sponsor

-

TrackNorma J. Torres

Co-Sponsor

-

TrackLori Trahan

Co-Sponsor

-

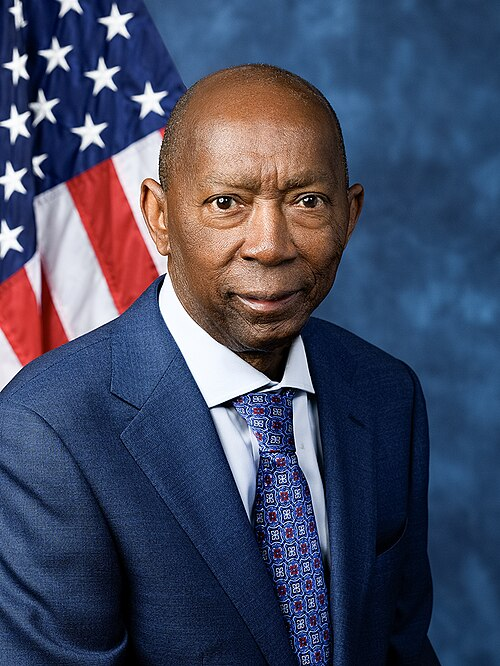

TrackSylvester Turner

Co-Sponsor

-

TrackJuan Vargas

Co-Sponsor

-

TrackNydia M. Velázquez

Co-Sponsor

-

TrackDebbie Wasserman Schultz

Co-Sponsor

-

TrackMaxine Waters

Co-Sponsor

-

TrackBonnie Watson Coleman

Co-Sponsor

-

TrackNikema Williams

Co-Sponsor

-

TrackFrederica S. Wilson

Co-Sponsor

-

Tracknan

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Feb. 05, 2025 | Introduced in House |

| Feb. 05, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.