H.R. 7230: Buying American Cotton Act of 2026

The Buying American Cotton Act of 2026 is a legislative proposal aimed at promoting the consumption of domestically sourced cotton and products made from it. The key components of the bill are outlined below:

Domestic Cotton Consumption Credit

The bill establishes a tax credit called the "domestic cotton consumption credit." The purpose of this credit is twofold:

- To encourage consumers and businesses to purchase cotton that is grown in the United States and products made from such cotton.

- To create a documented tracing system to confirm the origins of the cotton through the supply chain.

How the Credit Works

The credit will be calculated based on three factors:

- The documented volume of qualified cotton in an eligible product sold during the taxable year.

- An applicable percentage established by the bill.

- The market price of cotton over a specified period.

Determining Eligibility

Qualifying Sales

A "qualifying sale" refers to the first sale of an eligible product to an unrelated person in the U.S. Sales made for consumption outside the U.S. do not qualify unless they relate to U.S. business activities.

Applicable Percentages

- If the cotton is processed within the U.S. or in a country with a U.S. free trade agreement, a percentage of 24% applies.

- If processed in a country without such an agreement, a lower percentage of 18% applies.

Definitions of Eligible Articles

An "eligible article" includes any product containing certified qualified cotton that is ready for retail sale to consumers. However, certain products may be excluded if they have components eligible for the credit.

Increased Credit for Specific Products

The bill provides additional credits for products made from qualified cotton yarn and fabric. The enhanced credit is 1.6 times for cotton yarn and 6.5 times for cotton fabric, incentivizing the production of these items within the U.S.

Reporting and Regulations

The Secretary of the Treasury will be responsible for creating regulations to enforce these provisions, including guidelines for tracing cotton through the supply chain and preventing the same cotton from being credited multiple times.

Effective Date

The provisions will take effect for sales of eligible products occurring after the law is enacted.

Impact on Taxation

The credits can be part of the general business credit, meaning businesses can apply these credits against their overall tax liabilities.

Relevant Companies

- HEB: This company engages in food and grocery retail and may benefit from increased demand for products made with American cotton.

- TGT: Target operates in the retail sector and may see changes in sourcing policies for products containing cotton.

- WMT: Walmart may adjust its supply chain to take advantage of the credits from products made with U.S. cotton.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

24 bill sponsors

-

TrackGregory F. Murphy

Sponsor

-

TrackAlma S. Adams

Co-Sponsor

-

TrackRick W. Allen

Co-Sponsor

-

TrackSanford D. Bishop, Jr.

Co-Sponsor

-

TrackShontel M. Brown

Co-Sponsor

-

TrackSalud O. Carbajal

Co-Sponsor

-

TrackMike Carey

Co-Sponsor

-

TrackJim Costa

Co-Sponsor

-

TrackEric A. "Rick" Crawford

Co-Sponsor

-

TrackDonald G. Davis

Co-Sponsor

-

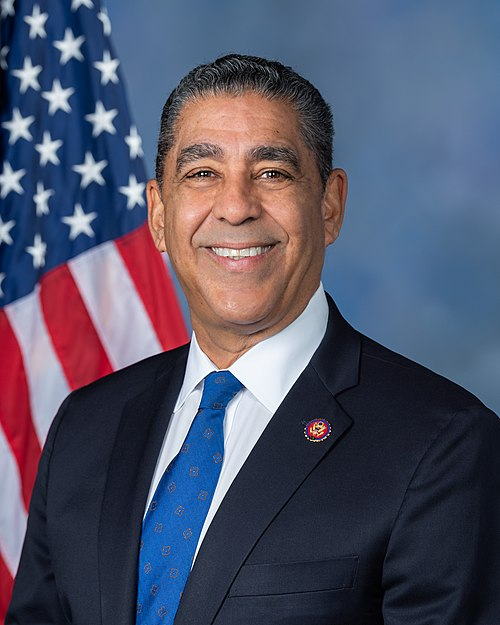

TrackAdriano Espaillat

Co-Sponsor

-

TrackShomari Figures

Co-Sponsor

-

TrackVicente Gonzalez

Co-Sponsor

-

TrackAdam Gray

Co-Sponsor

-

TrackRonny Jackson

Co-Sponsor

-

TrackDavid Kustoff

Co-Sponsor

-

TrackTracey Mann

Co-Sponsor

-

TrackBarry Moore

Co-Sponsor

-

TrackAugust Pfluger

Co-Sponsor

-

TrackDavid Rouzer

Co-Sponsor

-

TrackAustin Scott

Co-Sponsor

-

TrackDavid Scott

Co-Sponsor

-

TrackTerri A. Sewell

Co-Sponsor

-

TrackGlenn Thompson

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Jan. 22, 2026 | Introduced in House |

| Jan. 22, 2026 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.