H.R. 7185: Home Savings Act

This bill, known as the Home Savings Act, proposes amendments to the Internal Revenue Code to allow distributions from certain retirement plans to be used for down payments or closing costs when buying a principal residence without being counted as taxable income. Here are the key components of the bill:

Key Provisions

- Tax Exclusion for Retirement Plan Distributions: The bill allows individuals to withdraw money from defined contribution plans (like 401(k) plans), certain annuity plans, and individual retirement plans (IRAs) and use those funds for a down payment or closing costs associated with acquiring a principal residence. This means that the amount withdrawn will not be included in the individual’s gross income for tax purposes.

- Eligible Recipients: The funds can be used not only by the employee or individual making the withdrawal but also for an eligible relative, which includes their spouse, children, grandchildren, or ancestors.

- Gift Tax Treatment: If the employee transfers part of their distribution to an eligible relative for down payment or closing costs, that transfer won’t be classified as a gift for estate tax purposes.

- Defined Contribution Plans: The bill specifically amends Section 402 of the Internal Revenue Code to include this new provision on withdrawals for home purchase expenses.

- Annuity Plans: Similar rules apply to distributions from annuity plans under Section 403.

- Individual Retirement Plans: The provision also extends to distributions from individual retirement plans, amending Section 408.

- Termination Date: The tax exclusion for these distributions applies to withdrawals made until December 31, 2030. Withdrawals made in taxable years starting after this date will not qualify for the exclusion.

- Effective Date: The amendments will apply to distributions made during tax years beginning after December 31, 2025.

Impact on Retirement Savings

By permitting tax-free withdrawals for the purpose of purchasing a home, this bill aims to help first-time homebuyers and those looking to assist relatives with homebuying costs. This could make buying a home more accessible to individuals who might otherwise struggle with large upfront costs.

Administration and Compliance

The bill requires individuals to ensure that any withdrawals they make comply with the specific conditions outlined, such as the definition of an eligible relative and proper use of the funds for housing costs. Additionally, tax authorities will need to provide guidance on how these distributions should be reported.

Sunset Provision

The bill includes a sunset provision, meaning that its benefits will expire after the designated date, requiring further legislative action if continued tax relief is desired.

Relevant Companies

- LOW - Lowe's Companies, Inc.: As a major retailer in home improvement, Lowe's might see increased business as individuals access funds for home purchase through retirement accounts.

- HD - The Home Depot, Inc.: Similar to Lowe's, Home Depot could benefit from increased sales as more people invest in their own homes using funds made available through this legislation.

This is an AI-generated summary of the bill text. There may be mistakes.

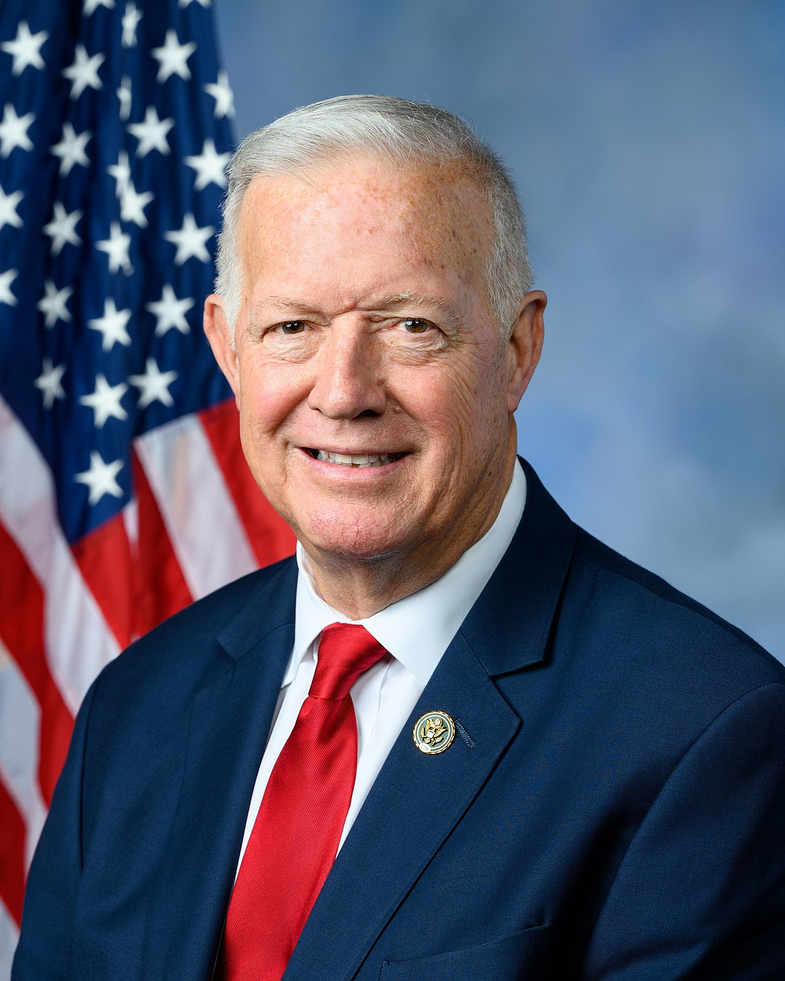

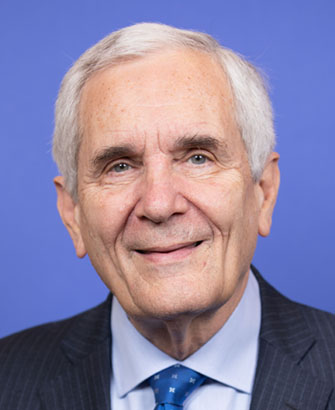

Sponsors

3 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jan. 21, 2026 | Introduced in House |

| Jan. 21, 2026 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.