H.R. 7183: Youth Financial Learning Act

The Youth Financial Learning Act aims to enhance financial literacy among secondary school students in the United States. Here’s a breakdown of the key components of the bill:

1. Overview

The bill is focused on improving the financial education given to students at both elementary and secondary school levels. It introduces grants to encourage state educational agencies to integrate financial literacy into their curricula.

2. Grants for Financial Literacy Education

The bill authorizes the Secretary of Education to provide competitive grants to state educational agencies. These grants are intended to:

- Enable schools to develop and implement financial literacy education programs.

- Support the planning and execution of financial education activities in schools.

The duration of these grants can be up to four years.

3. Application Process for Grants

State educational agencies must apply for these grants by providing a detailed application that includes:

- A plan for awarding subgrants to local educational agencies.

- A strategy to maintain the financial literacy initiatives after grant funds are exhausted.

- Evidence of consultation with stakeholders, including teachers, parents, and students, during the application process.

- A commitment to ensuring programs reach diverse geographic areas and student populations.

4. Allocation of Grant Funds

States receiving grants can allocate funds for various activities, which may include:

- Technical assistance and guidance for local agencies.

- Curriculum development focused on financial literacy.

- Evaluating the effectiveness of financial literacy programs.

Additionally, states must award the majority of grant funds as subgrants to local educational agencies. Priority will be given to local agencies that serve a larger number of schools that require financial literacy improvements.

5. Local Agency Use of Funds

Local educational agencies that receive subgrants must use the funds for:

- Implementing or expanding financial literacy programs within schools.

- Creating partnerships with community organizations for innovative financial literacy activities.

- Professional development programs for educators to incorporate financial education into their teaching.

6. Funding Requirements

States must provide matching funds from non-Federal sources, equating to 25% of the grant amount received. The funds provided under this act are meant to supplement existing state and federal funds, not replace them.

7. Appropriations

The bill authorizes the appropriation of necessary funds for the current fiscal year and the following four fiscal years to support the implementation of these financial literacy initiatives.

Relevant Companies

- GME - GameStop: Likely to be affected by partnerships with schools for educational programs around financial literacy, especially with regards to investing and personal finance.

- SLB - Schlumberger: Could be involved in community initiatives that educate students on the economics of industries, including energy and finance sectors.

- AXP - American Express: May provide resources or programs related to credit and financial management to students through partnerships with educational institutions.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

11 bill sponsors

-

TrackStephen F. Lynch

Sponsor

-

TrackBrendan F. Boyle

Co-Sponsor

-

TrackAndré Carson

Co-Sponsor

-

TrackEd Case

Co-Sponsor

-

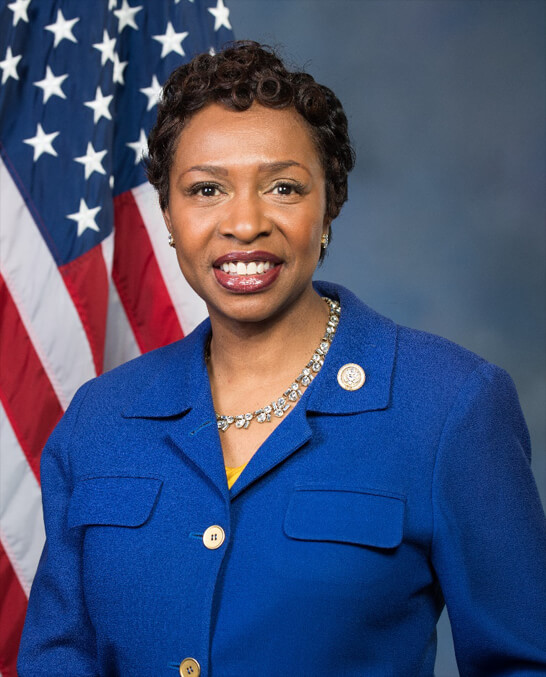

TrackYvette D. Clarke

Co-Sponsor

-

TrackDwight Evans

Co-Sponsor

-

TrackCleo Fields

Co-Sponsor

-

TrackHenry C. "Hank" Johnson, Jr.

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackMarilyn Strickland

Co-Sponsor

-

TrackDina Titus

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Jan. 21, 2026 | Introduced in House |

| Jan. 21, 2026 | Referred to the House Committee on Education and Workforce. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.