H.R. 7051: American Dream Act

The American Dream Act is a proposed piece of legislation aimed at modifying the tax treatment of capital gains from the sale of real estate for certain sellers. Specifically, the bill seeks to exclude from gross income any gains realized by individuals aged 65 and older when they sell their property to first-time homebuyers. Here’s a summary of the main components of the bill:

Key Provisions

- Age Requirement: The seller must be at least 65 years old at the time of the property sale.

- First-Time Homebuyer Requirement: The real estate must be sold to a first-time homebuyer, defined as an individual who, or whose spouse, has not owned a principal residence at any time before the sale.

- Price Limit: The sale price of the property must not exceed $500,000.

- Documentation: The closing documents must include a statement from the buyer affirming that they are a first-time homebuyer and the property will be their principal residence.

Exclusions from Taxable Income

Gain from the sale of real property that meets the above criteria would not be included in the seller's gross income for tax purposes. This exclusion would apply only to the sale of the property to qualifying first-time homebuyers as described.

Existing Laws Coordination

The new provision would work alongside existing tax laws but would not allow for the use of the typical exclusion under section 121 for sales to first-time homebuyers if the conditions of this new section are satisfied.

Termination of the Provision

The provisions of this bill would be effective for sales conducted after December 31, 2026, and will not apply to any sale occurring after December 31, 2031.

Clerical Amendment

The bill also proposes a clerical amendment for the table of sections in the Internal Revenue Code to include this new section regarding exclusions for sales by seniors to first-time homebuyers.

Effective Date

The provisions would apply to taxable years ending after December 31, 2026.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

12 bill sponsors

-

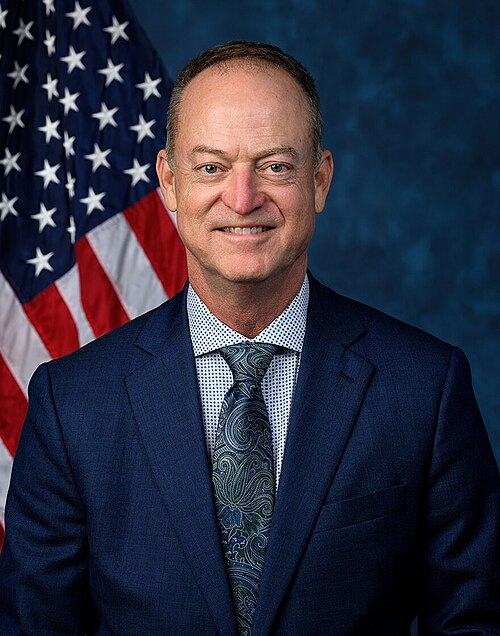

TrackJohn McGuire

Sponsor

-

TrackTom Barrett

Co-Sponsor

-

TrackKat Cammack

Co-Sponsor

-

TrackAbraham Hamadeh

Co-Sponsor

-

TrackJeff Hurd

Co-Sponsor

-

TrackRyan Mackenzie

Co-Sponsor

-

TrackMark Messmer

Co-Sponsor

-

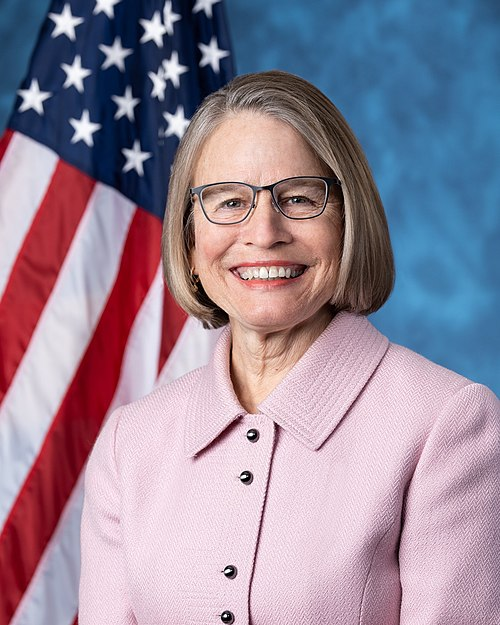

TrackMariannette Miller-Meeks

Co-Sponsor

-

TrackDerek Schmidt

Co-Sponsor

-

TrackJefferson Shreve

Co-Sponsor

-

TrackPete Stauber

Co-Sponsor

-

TrackMarlin A. Stutzman

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Jan. 14, 2026 | Introduced in House |

| Jan. 14, 2026 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.