H.R. 7041: Earmark Elimination Act of 2026

This bill, known as the Earmark Elimination Act of 2026, seeks to prohibit the House of Representatives from considering any legislation that includes an earmark, limited tax benefit, or limited tariff benefit. An earmark is defined as a provision or report language included mainly at the request of a member of Congress that allocates a specific amount of discretionary spending to a contract, grant, or other expenditure for a specific entity or location, outside of formula-driven or competitive processes.

Key Provisions of the Bill

- Prohibition on Consideration: The bill states that any bill, joint resolution, amendment, or conference report that includes earmarks or limited benefits cannot be considered by the House of Representatives.

- Point of Order: If a point of order is raised claiming that a congressional earmark or benefit exists in a piece of legislation, and if this point of order is upheld, the earmark or benefit will be removed from that legislative measure.

- Special Procedures for Conference Reports: If a point of order against a conference report is sustained, the report will be treated as rejected. The House would then have to decide how to proceed with the remaining disagreements. There are specific motions that will take precedence under these circumstances.

- Determining Earmarks: If there is uncertainty about whether a provision qualifies as an earmark or limited benefit, the Chair of the House will pose the question to the House, which will be decided without debate.

- Amendment to House Rules: The bill proposes to amend the House Rules by removing a specific clause regarding earmarks.

Definitions

- Congressional Earmark: A provision or language in legislation that is mainly requested by a member of Congress, providing funding or spending authority to a specific entity or aimed at a specific locality outside standard competitive processes.

- Limited Tax Benefit: A tax provision that favors 10 or fewer beneficiaries, or provides specific tax relief based on non-uniform eligibility criteria.

- Limited Tariff Benefit: A provision that modifies the tariff schedule in a way that benefits 10 or fewer entities.

Projected Impact

This bill aims to increase fiscal transparency and accountability by eliminating the ability to insert earmarks or limited benefits into legislation, which some view as a way to secure targeted funding for specific interests within their constituencies. By doing this, it seeks to standardize the process of allocating federal funds and limit the potential for perceived corruption or favoritism in federal spending.

Relevant Companies

None found.This is an AI-generated summary of the bill text. There may be mistakes.

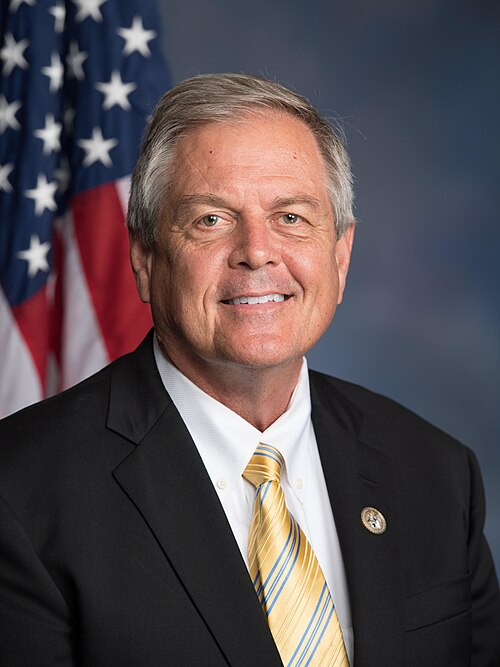

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jan. 13, 2026 | Introduced in House |

| Jan. 13, 2026 | Referred to the House Committee on Rules. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.