H.R. 6575: CommonGround for Affordable Health Care Act

The "CommonGround for Affordable Health Care Act" is designed to make healthcare more accessible and affordable through several key amendments to existing laws. The bill primarily focuses on two areas: premium tax credits and regulations governing pharmacy benefit managers (PBMs).

Premium Tax Credits

The bill extends premium tax credits to make health insurance more affordable for individuals and families. This extension aims to ensure that more people can afford to obtain health insurance coverage through the marketplaces established by the Affordable Care Act (ACA). The measure also includes enhanced provisions to deter fraud in healthcare enrollment, which involves penalties for agents and brokers participating in fraudulent activities.

Pharmacy Benefit Managers Regulations

The bill introduces new disclosure requirements for pharmacy benefit managers. These requirements include:

- Providing cost-sharing estimates for prescription drugs, allowing patients to better understand their financial responsibilities.

- Disclosing contracts with drug manufacturers, promoting transparency regarding pricing agreements.

- Establishing audit rights to ensure compliance and accountability among PBMs.

Additionally, the bill promotes compliance certifications for PBMs, ensuring they meet certain standards. It also allows for expedited consideration of reforms related to premium tax credits, streamlining the process for making necessary updates in the future.

Enforcement and Compliance

By emphasizing the importance of honesty in healthcare and insurance enrollment, the legislation seeks to bolster trust in the system. The defined penalties for fraud aim to protect consumers and ensure that individuals are treated fairly when seeking coverage.

Goals of the Bill

The overarching goals of the "CommonGround for Affordable Health Care Act" are to:

- Enhance access to affordable health insurance by extending premium tax credits.

- Increase transparency in the prescription drug market through required disclosures from pharmacy benefit managers.

- Reduce fraudulent activities in healthcare enrollment by imposing penalties for misconduct.

Impact on Healthcare System

Overall, the bill seeks to improve the healthcare system by ensuring affordability, transparency, and integrity. By addressing these key components, the "CommonGround for Affordable Health Care Act" aims to create a more equitable health insurance landscape for Americans.

Relevant Companies

- UNH - UnitedHealth Group Incorporated: As a large health insurance provider, UnitedHealth could be impacted by changes in premium tax credits which may influence enrollment levels and their customer base.

- ANTM - Anthem, Inc.: As a major insurer, Anthem may be affected by the extended premium tax credits, potentially leading to changes in their enrollment figures and premium revenue.

- CVS - CVS Health Corporation: CVS, which operates in both insurance and pharmacy benefits management, could see significant impacts from mandated disclosures and compliance requirements for pharmacy benefit managers.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

39 bill sponsors

-

TrackJennifer Kiggans

Sponsor

-

TrackDon Bacon

Co-Sponsor

-

TrackRobert Bresnahan

Co-Sponsor

-

TrackEd Case

Co-Sponsor

-

TrackJuan Ciscomani

Co-Sponsor

-

TrackJim Costa

Co-Sponsor

-

TrackHenry Cuellar

Co-Sponsor

-

TrackDonald G. Davis

Co-Sponsor

-

TrackMonica De La Cruz

Co-Sponsor

-

TrackShomari Figures

Co-Sponsor

-

TrackBrian K. Fitzpatrick

Co-Sponsor

-

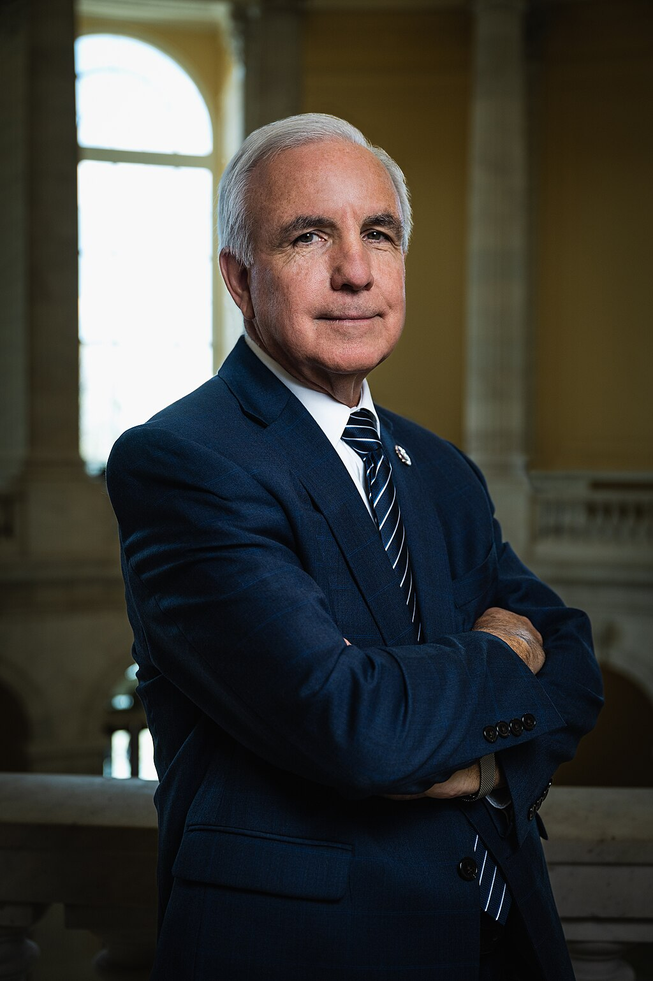

TrackCarlos A. Gimenez

Co-Sponsor

-

TrackJared F. Golden

Co-Sponsor

-

TrackVicente Gonzalez

Co-Sponsor

-

TrackMaggie Goodlander

Co-Sponsor

-

TrackJosh Gottheimer

Co-Sponsor

-

TrackAdam Gray

Co-Sponsor

-

TrackJeff Hurd

Co-Sponsor

-

TrackThomas H. Kean, Jr.

Co-Sponsor

-

TrackKevin Kiley

Co-Sponsor

-

TrackNick LaLota

Co-Sponsor

-

TrackGreg Landsman

Co-Sponsor

-

TrackMichael Lawler

Co-Sponsor

-

TrackSusie Lee

Co-Sponsor

-

TrackSam Liccardo

Co-Sponsor

-

TrackRyan Mackenzie

Co-Sponsor

-

TrackJared Moskowitz

Co-Sponsor

-

TrackJimmy Panetta

Co-Sponsor

-

TrackChris Pappas

Co-Sponsor

-

TrackMarie Gluesenkamp Perez

Co-Sponsor

-

TrackScott H. Peters

Co-Sponsor

-

TrackJosh Riley

Co-Sponsor

-

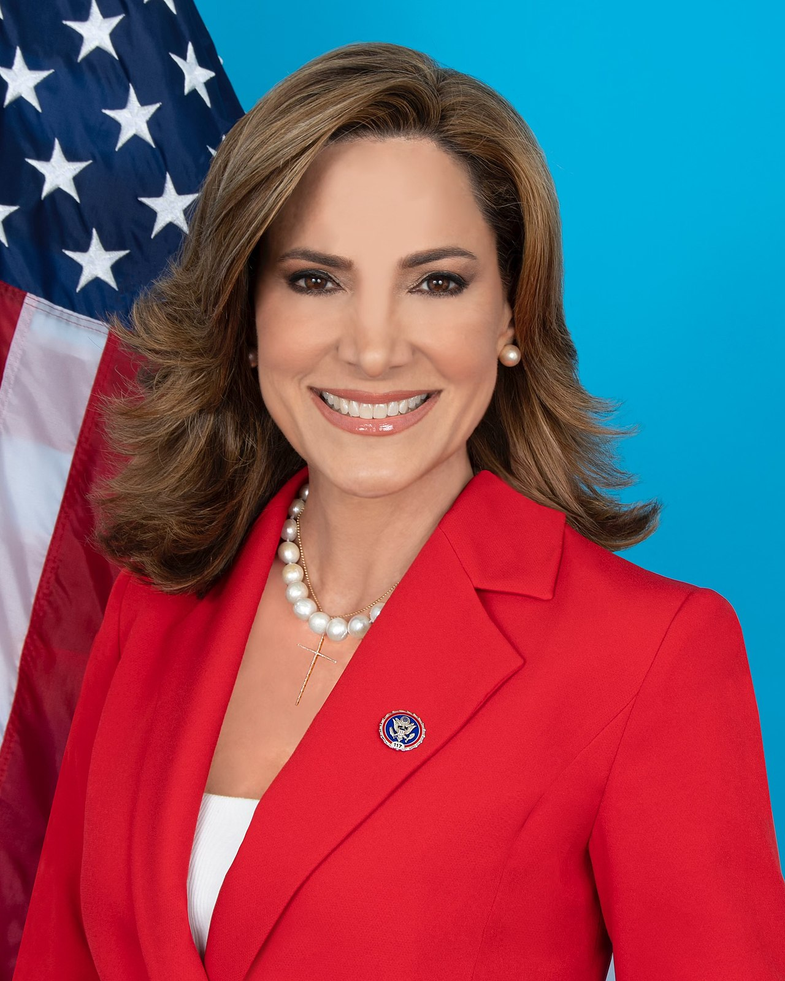

TrackMaria Elvira Salazar

Co-Sponsor

-

TrackHillary J. Scholten

Co-Sponsor

-

TrackDarren Soto

Co-Sponsor

-

TrackThomas R. Suozzi

Co-Sponsor

-

TrackDavid G. Valadao

Co-Sponsor

-

TrackJefferson Van Drew

Co-Sponsor

-

TrackFrederica S. Wilson

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Dec. 10, 2025 | Introduced in House |

| Dec. 10, 2025 | Referred to the Committee on Energy and Commerce, and in addition to the Committees on Ways and Means, and Rules, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

1 company lobbying