H.R. 6553: Tailoring and Indexing Enhanced Regulations Act of 2025

This bill, titled the Tailoring and Indexing Enhanced Regulations Act of 2025 (or TIER Act of 2025), proposes to adjust various financial regulatory thresholds to better reflect changes in the U.S. economy. The key points of the bill are outlined below:

Threshold Adjustments

The bill aims to increase specific financial asset thresholds used in various regulatory frameworks. The adjustments include:

- Federal Reserve Act:

- Increase the threshold from $100 billion to $150 billion in assessments.

- Change the range between $100 billion and $250 billion to between $150 billion and $370 billion.

- Bank Holding Company Act of 1956:

- Raise the threshold from $10 billion to $15 billion.

- Financial Stability Act of 2010:

- Increase multiple thresholds from $250 billion to $370 billion.

- Economic Growth, Regulatory Relief, and Consumer Protection Act:

- Change the threshold from $250 billion to $370 billion.

Periodic Adjustments

The bill mandates that these thresholds be periodically revised to account for future growth in the U.S. economy. Specifically:

- The thresholds will be recalculated every five years, starting April 1, 2031, based on the value of the U.S. gross domestic product (GDP).

- These revisions are to reflect increases in the GDP as published by the Department of Commerce, ensuring that the thresholds remain aligned with economic growth.

Review of Regulations

Additionally, the bill requires that regulatory agencies review and modify existing regulations that implement thresholds related to financial stability, ensuring they stay consistent with current economic conditions:

- The review will occur every five years and include various measures of financial companies.

- Any modifications made will be based on the same GDP growth calculations outlined in the periodic adjustments.

Implementation Timeline

Any adjustments made to the thresholds will take effect on January 1 of the year following the year in which the adjustment is calculated, allowing for a clear timeline for implementation.

Administrative Reporting

The regulatory bodies responsible for these thresholds (Board of Governors, Comptroller of the Currency, and others) will need to publish their findings and adjustments in the Federal Register on specific dates to maintain transparency.

Clerical Amendments

The bill also includes technical amendments to the Dodd-Frank Act to incorporate the references and sections regarding the new adjustment processes.

Relevant Companies

- JPM: JP Morgan Chase may be affected due to its substantial asset size and classification as a bank holding company. Changes in asset thresholds could influence regulatory compliance costs and operational strategies.

- BAC: Bank of America could see similar impacts as it may need to adjust its operations and compliance measures based on the updated thresholds.

- WFC: Wells Fargo may have to navigate new regulatory landscapes due to changes in financial thresholds affecting the scale of oversight and reporting requirements.

This is an AI-generated summary of the bill text. There may be mistakes.

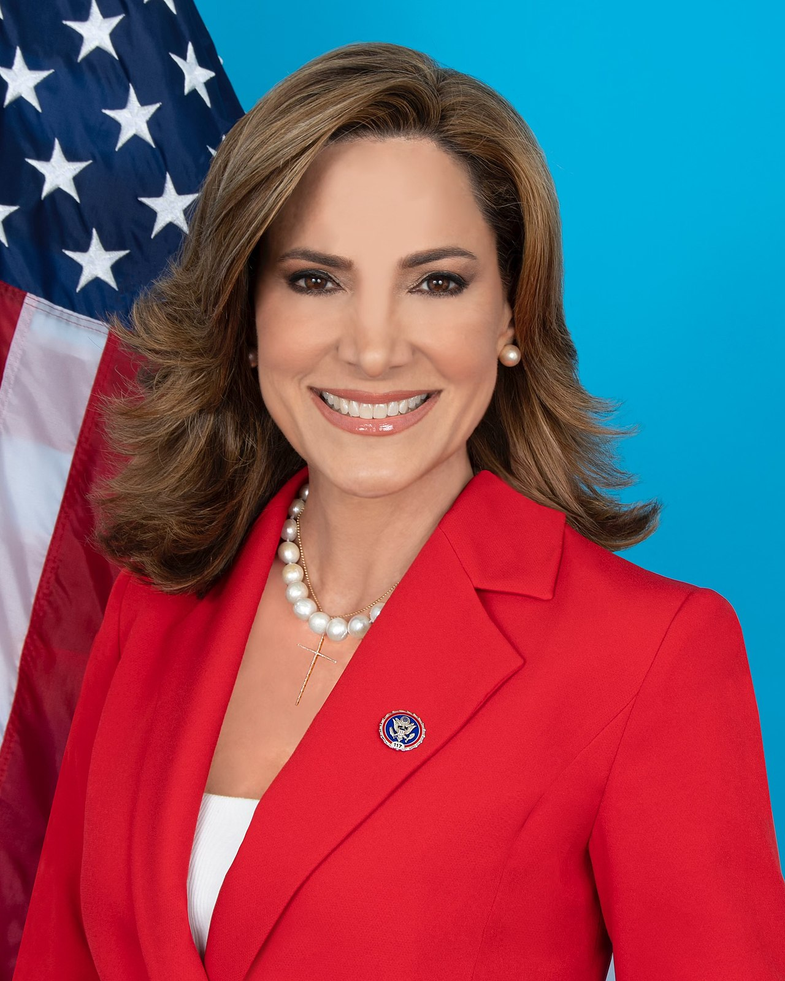

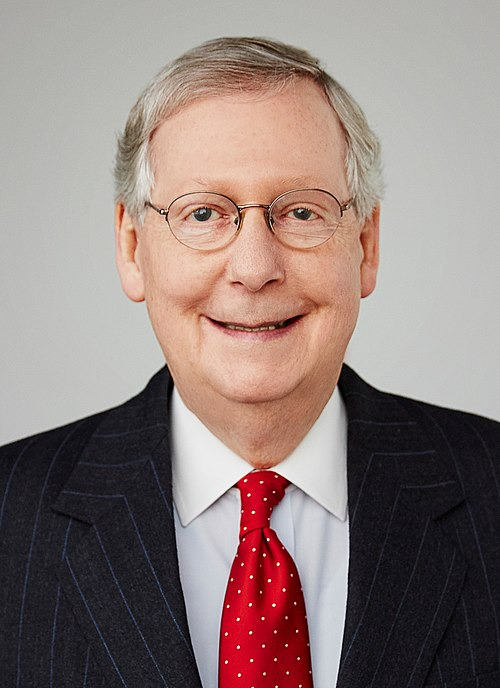

Sponsors

8 bill sponsors

Actions

5 actions

| Date | Action |

|---|---|

| Dec. 17, 2025 | Committee Consideration and Mark-up Session Held |

| Dec. 17, 2025 | Ordered to be Reported (Amended) by the Yeas and Nays: 33 - 19. |

| Dec. 16, 2025 | Committee Consideration and Mark-up Session Held |

| Dec. 10, 2025 | Introduced in House |

| Dec. 10, 2025 | Referred to the House Committee on Financial Services. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.