H.R. 6495: Taxpayer Notification and Privacy Act

This bill, titled the Taxpayer Notification and Privacy Act

, aims to amend existing rules regarding how the Internal Revenue Service (IRS) can communicate with third parties when seeking information about taxpayers. It introduces more specific guidelines for notifying taxpayers before the IRS reaches out to third parties, such as banks, employers, or other entities, to gather information related to a taxpayer's financial situation.

Key Provisions

- Notification Requirement: The IRS must provide a clear notification to the taxpayer detailing the specific information it intends to seek from third parties. This requirement applies when the IRS has not already requested this information from the taxpayer directly and when the taxpayer could reasonably provide it themselves.

- Response Time: Taxpayers are to be afforded a reasonable opportunity to respond to the IRS's request. The bill mandates that taxpayers must be given at least 45 days to reply, or more if they request additional time and can show valid reasons for needing it.

- Exceptions to Notification: There are exceptions to these notification and response requirements. For instance, if the information sought pertains to the collection of a tax liability, or if the IRS determines the information is necessary regardless of whether the taxpayer could provide it, the IRS is not bound to follow the above notification procedures.

- Effective Date: The changes stipulated by this bill would take effect 12 months after it is signed into law.

The intent behind this legislation is to enhance taxpayer privacy and ensure that taxpayers are adequately informed before their personal information is sought from external sources. It aims to offer taxpayers more control and opportunity to address inquiries regarding their financial circumstances directly with the IRS.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

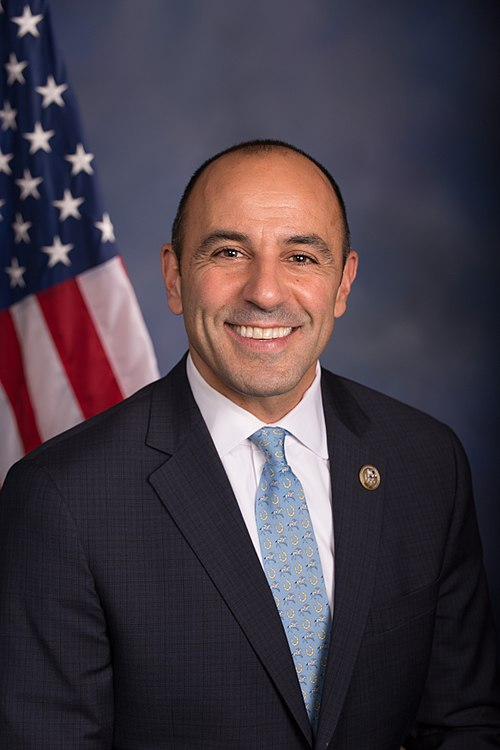

Sponsors

2 bill sponsors

Actions

6 actions

| Date | Action |

|---|---|

| Jan. 07, 2026 | Placed on the Union Calendar, Calendar No. 372. |

| Jan. 07, 2026 | Reported (Amended) by the Committee on Ways and Means. H. Rept. 119-427. |

| Dec. 10, 2025 | Committee Consideration and Mark-up Session Held |

| Dec. 10, 2025 | Ordered to be Reported in the Nature of a Substitute (Amended) by the Yeas and Nays: 41 - 0. |

| Dec. 05, 2025 | Introduced in House |

| Dec. 05, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.