H.R. 6455: Health Insurance Premium Fairness Act of 2025

This bill, known as the Health Insurance Premium Fairness Act of 2025, aims to change how certain healthcare insurance tax credits are calculated under the Internal Revenue Code. Specifically, it seeks to allow taxpayers to take into account the Medicare premiums paid by members of their household when determining their eligibility for health care insurance premiums tax credits.

Key Provisions

- Inclusion of Medicare Premiums: The bill proposes that taxpayers can reduce their calculated tax credit amount by the total Medicare premiums paid by household members during a specific coverage month. These Medicare premiums must not be reimbursed by other sources.

- Definition of Household Member: A "household member" is defined as anyone included in determining the family size of the taxpayer when calculating tax credits.

- Types of Medicare Premiums: The specified Medicare premiums include those paid for coverage under Medicare parts A, B, C, or D, as well as premiums for Medicare supplemental policies.

- Effective Date: The changes proposed by the bill would take effect for coverage months that begin after December 31, 2025.

The intention behind this bill is to provide additional financial relief to taxpayers who have family members with significant healthcare responsibilities, thus potentially making healthcare more affordable.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

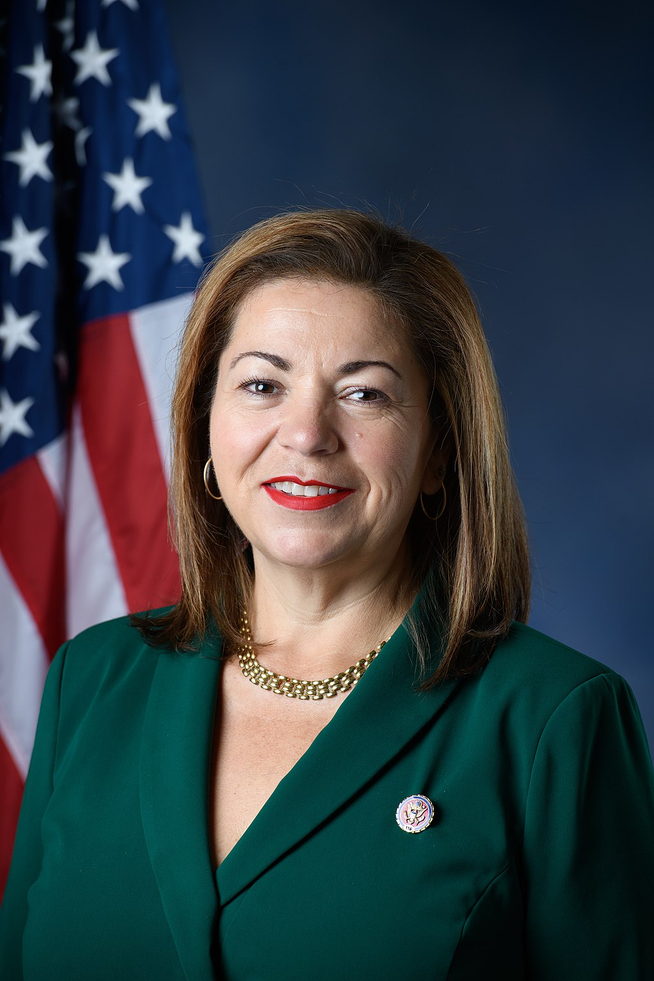

Sponsors

4 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Dec. 04, 2025 | Introduced in House |

| Dec. 04, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.