H.R. 6390: Make Housing Affordable and Defend Democracy Act

The "Make Housing Affordable and Defend Democracy Act" aims to address housing affordability and immigration enforcement funds by implementing several key measures. The bill proposes to rescind over $175 billion allocated for immigration enforcement, redirecting these resources to initiatives that promote affordable housing. One of the primary elements of the bill is the introduction of tax credits specifically designed to assist first-time homebuyers, making it easier for them to enter the housing market.

Conversion of Non-Residential Buildings

The bill facilitates the transformation of eligible commercial properties into affordable housing units. This process, termed "qualified conversion," will have specific expenditure thresholds that buildings must meet to qualify. The legislation sets guidelines to ensure that the converted properties meet the standards for affordable housing.

Criteria for Affordable Housing

In establishing affordable units, the bill outlines the criteria that must be satisfied to ensure these housing options are accessible to low-income families. This includes the specification of what constitutes an affordable unit and how tax credits can assist those in need.

Funding and Outreach

In addition to tax credits, the bill includes provisions for funding outreach programs. These outreach efforts are intended to help inform potential renters and buyers of the programs available to support them in finding affordable housing solutions.

Support for Low-Income Households

The legislation also aims to provide advance renter tax credits for low-income households, providing them with financial relief as they navigate the housing market. This measure is designed to enhance affordability and support families who may otherwise struggle to secure stable housing.

Overall Objective

Overall, the act seeks to create a more accessible housing environment, providing financial tools for buyers and renters while reallocating significant funds from immigration enforcement towards essential housing solutions.

Relevant Companies

- PHM - PulteGroup, Inc.: This company could be affected as potential changes in the housing market may influence demand for new homes in response to the incentives for first-time homebuyers.

- DHI - D.R. Horton, Inc.: As one of the largest homebuilders in the U.S., D.R. Horton may see impacts from tax credits assisting first-time homebuyers and potential changes in housing inventory.

- KBH - KB Home: This homebuilder may be impacted similarly to others as the bill could create an overall increase in the demand for affordable housing.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

73 bill sponsors

-

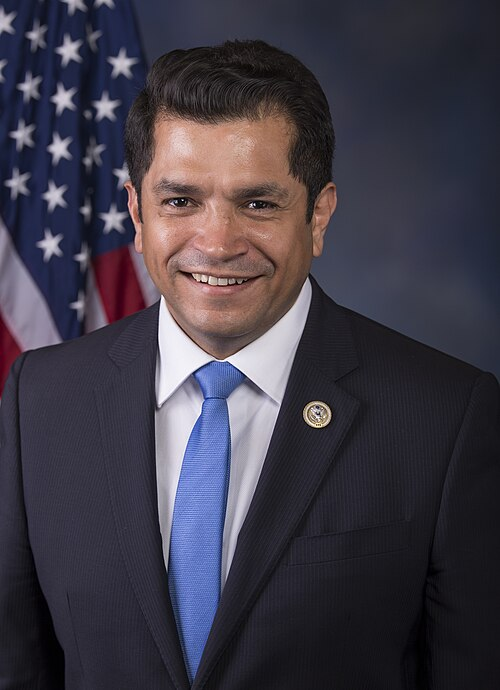

TrackJimmy Gomez

Sponsor

-

TrackYassamin Ansari

Co-Sponsor

-

TrackBecca Balint

Co-Sponsor

-

TrackNanette Diaz Barragán

Co-Sponsor

-

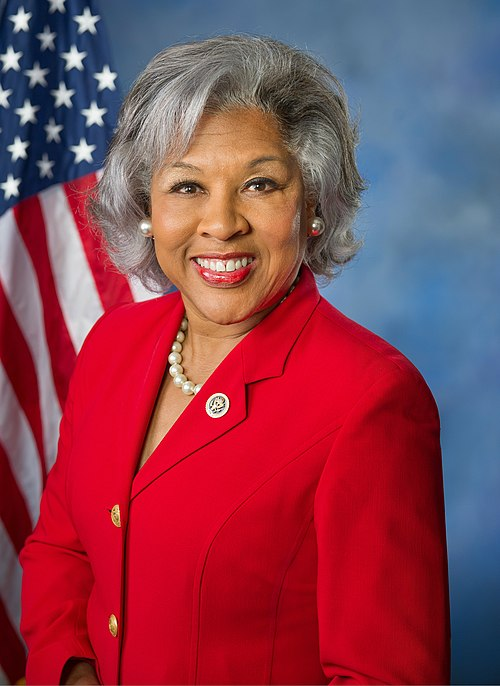

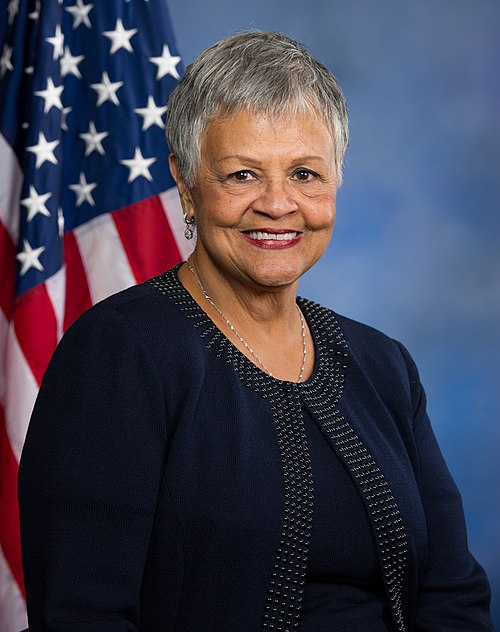

TrackJoyce Beatty

Co-Sponsor

-

TrackBrendan F. Boyle

Co-Sponsor

-

TrackJulia Brownley

Co-Sponsor

-

TrackSalud O. Carbajal

Co-Sponsor

-

TrackAndré Carson

Co-Sponsor

-

TrackTroy A. Carter

Co-Sponsor

-

TrackJudy Chu

Co-Sponsor

-

TrackGilbert Ray Cisneros, Jr.

Co-Sponsor

-

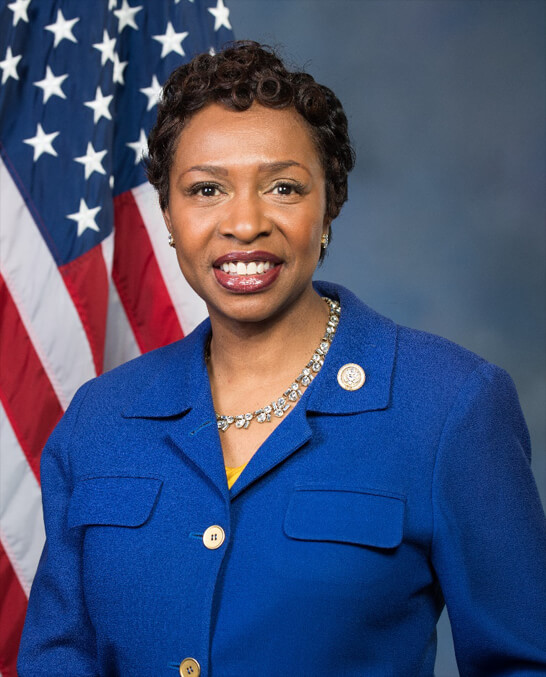

TrackYvette D. Clarke

Co-Sponsor

-

TrackSteve Cohen

Co-Sponsor

-

TrackDanny K. Davis

Co-Sponsor

-

TrackMadeleine Dean

Co-Sponsor

-

TrackChristopher R. Deluzio

Co-Sponsor

-

TrackMaxine Dexter

Co-Sponsor

-

TrackDwight Evans

Co-Sponsor

-

TrackValerie P. Foushee

Co-Sponsor

-

TrackMaxwell Frost

Co-Sponsor

-

TrackJohn Garamendi

Co-Sponsor

-

TrackSylvia R. Garcia

Co-Sponsor

-

TrackRobert Garcia

Co-Sponsor

-

TrackJesús G. "Chuy" García

Co-Sponsor

-

TrackDaniel S. Goldman

Co-Sponsor

-

TrackJonathan L. Jackson

Co-Sponsor

-

TrackSara Jacobs

Co-Sponsor

-

TrackPramila Jayapal

Co-Sponsor

-

TrackHenry C. "Hank" Johnson, Jr.

Co-Sponsor

-

TrackSydney Kamlager-Dove

Co-Sponsor

-

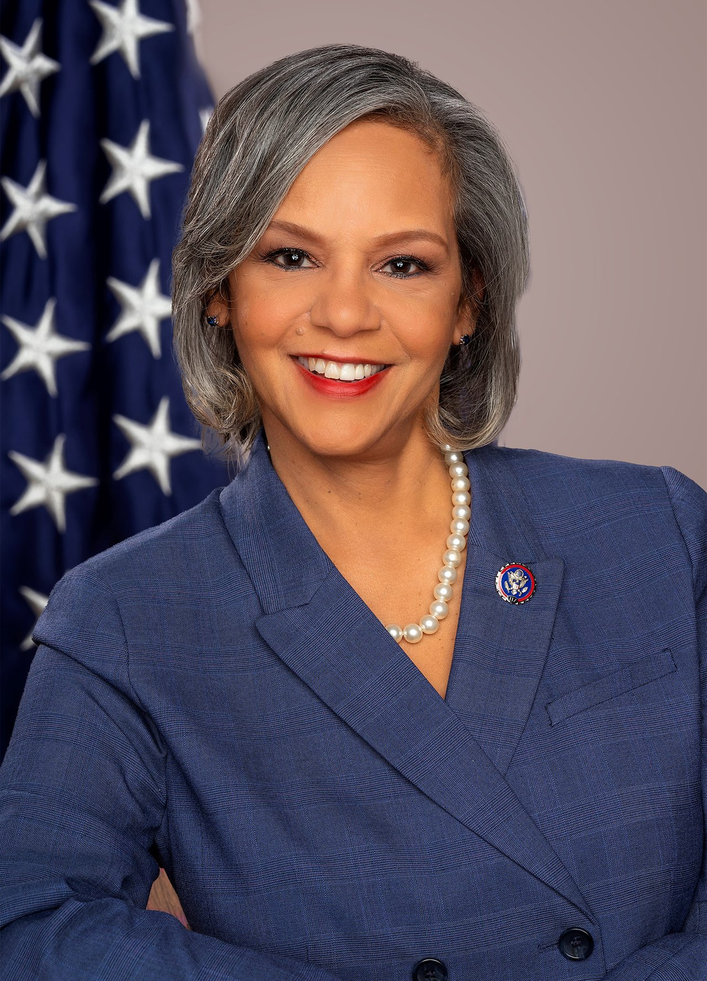

TrackRobin L. Kelly

Co-Sponsor

-

TrackRaja Krishnamoorthi

Co-Sponsor

-

TrackJohn B. Larson

Co-Sponsor

-

TrackGeorge Latimer

Co-Sponsor

-

TrackSummer L. Lee

Co-Sponsor

-

TrackTeresa Leger Fernandez

Co-Sponsor

-

TrackSam Liccardo

Co-Sponsor

-

TrackTed Lieu

Co-Sponsor

-

TrackDoris O. Matsui

Co-Sponsor

-

TrackApril McClain Delaney

Co-Sponsor

-

TrackJames P. McGovern

Co-Sponsor

-

TrackLaMonica McIver

Co-Sponsor

-

TrackRobert Menendez

Co-Sponsor

-

TrackKevin Mullin

Co-Sponsor

-

TrackJerrold Nadler

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackIlhan Omar

Co-Sponsor

-

TrackScott H. Peters

Co-Sponsor

-

TrackStacey E. Plaskett

Co-Sponsor

-

TrackMark Pocan

Co-Sponsor

-

TrackDelia C. Ramirez

Co-Sponsor

-

TrackEmily Randall

Co-Sponsor

-

TrackLuz Rivas

Co-Sponsor

-

TrackRaul Ruiz

Co-Sponsor

-

TrackAndrea Salinas

Co-Sponsor

-

TrackJanice D. Schakowsky

Co-Sponsor

-

TrackBrad Sherman

Co-Sponsor

-

TrackLateefah Simon

Co-Sponsor

-

TrackDarren Soto

Co-Sponsor

-

TrackMelanie A. Stansbury

Co-Sponsor

-

TrackSuhas Subramanyam

Co-Sponsor

-

TrackEric Swalwell

Co-Sponsor

-

TrackLinda T. Sánchez

Co-Sponsor

-

TrackShri Thanedar

Co-Sponsor

-

TrackMike Thompson

Co-Sponsor

-

TrackDina Titus

Co-Sponsor

-

TrackJill N. Tokuda

Co-Sponsor

-

TrackJuan Vargas

Co-Sponsor

-

TrackMarc A. Veasey

Co-Sponsor

-

TrackDebbie Wasserman Schultz

Co-Sponsor

-

TrackBonnie Watson Coleman

Co-Sponsor

-

TrackFrederica S. Wilson

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Dec. 03, 2025 | Introduced in House |

| Dec. 03, 2025 | Referred to the Committee on Ways and Means, and in addition to the Committees on Armed Services, Homeland Security, and the Judiciary, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.